By the MIA CPE Compliance Department

Evolutionary changes are taking place throughout the accounting profession, with far-reaching impacts. Inevitable digital transformation, changes in financial ecosystems with continued globalisation of reporting and disclosure standards, new/ tightened regulations and the recent global pandemic pose major challenges for the accounting profession. Moreover, businesses are also seeking rapid transformation to evolve along with the changes.

As such, the important role of professional accountants in business positions the profession favourably to take the lead as the front-runner in this transformation. To gain and sustain the competitive advantage, professional accountants should uphold the responsibility for upskilling to future-proof their career and stay relevant. Hence, continuing professional education (CPE) fits into the picture and plays a major role in ensuring professional accountants stay abreast of the latest developments and continue to be at the forefront of evolution.

Importance of CPE & the Regulations

CPE is crucial to promote lifelong learning for the professional accountants in order to ensure they are able to meet stakeholder expectations, thereby safeguarding the public interest and upholding the credibility of the profession as not just the gatekeeper, but the leader in the numerous developments mentioned above.

As a member of the International Federation of Accountants (IFAC), the Institute needs to ensure that members fulfil the CPE requirements as stipulated in the International Education Standard (IES) 7, Continuing Professional Development (Revised) issued by the IFAC. This is specifically stated in Section B110 of the Institute’s By-Laws, which lay out the CPE requirements aligned with IES 7. Members of the Institute are required to undertake and record the relevant CPE that develops and maintains the necessary professional competence required to perform in their professional roles. Such a requirement contributes to the profession’s objective of providing high-quality services to meet the needs of the public (including both clients and employers) and thereby serves to strengthen public trust in the profession.

The Institute undertakes strict implementation and monitoring of the CPE requirements, which is spearheaded by the Institute’s CPE Compliance Department (CCD), to ensure professional accountants are compliant with the requirements of the Institute’s By-Laws. Professional accountants are required to participate in CPE learning related to their professional work and fulfil the CPE requirements annually. Any failure to maintain and improve professional competence is seen to be a violation of one of the fundamental principles of the profession and can lead to disciplinary action being taken against the member.

CPE as a Mandatory Requirement for Practising Certificate Holders and Audit License Holders

All members must undertake a minimum of 20 structured CPE credit hours each calendar year. For renewal as an approved company auditor, a minimum of 10 out of 20 structured CPE hours to be completed by the member each year must be related to International Standard on Quality Control (ISQC1) (to be replaced by International Standard on Quality Management (ISQM) 1 & 2 effective from 15 December 2022), approved auditing standards, approved accounting standards and/or professional ethics (By-Laws Section B110.4).

Audit License holders must demonstrate compliance with the CPE requirements in the two (2) preceding years of renewal while Practising Certificate (PC) holders must demonstrate compliance with CPE requirements for the year prior to PC renewal. For example, in regard to 2022 renewal, audit license holders will need to meet the CPE requirements for the years 2020 and 2021, while the CPE requirements for year 2021 will be reviewed for PC holders.

Observations from CPE Compliance Audit and Review

To ensure that members comply with the CPE requirements, CPE audit is conducted annually as a monitoring process in line with the prescribed standards. The audit serves to determine that members comply with the minimum hours required. In addition, CCD also performs an annual review on the CPE status of PC holders and audit license holders, as part of the assessment prior to the renewal of PC and/or audit license. The assessment includes determining that the member meets the minimum CPE hours required as well as verifying that the courses or trainings attended are relevant to their professional responsibility and supported with the relevant evidence.

Where there is no reasonable basis, audit license holders who flout the requirements will not obtain the Institute’s support in their applications for audit license renewal to the Accountant General (AG). As for PC holders, their PC will not be renewed and/or cancelled by the Institute.

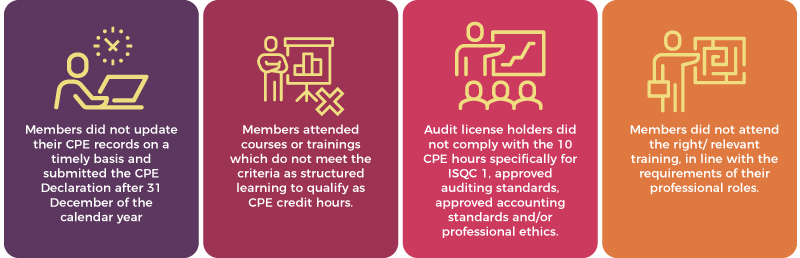

Based on the observation from the CPE Compliance Audits and CPE Compliance Reviews conducted by the CCD, common factors which contributed to the non-compliance are:

As a step-up effort, CCD sent regular email blast reminders to PC holders and audit license holders to remind members to comply with the CPE requirements and to update the CPE records with the Institute by the stipulated deadline of 31 December annually. To facilitate and ease the CPE hours submission, members can submit their CPE hours and related documents online through the MIA Members Portal at any time throughout the year. Members are required to upload the related certificates for verification and submit an annual declaration of complying with the CPE requirements.

In the recent 2020/2021 review, the Institute had cancelled twenty one (21) PCs as a result of failing to comply with the 2020 CPE requirements. In year 2019, twenty (20) PCs were cancelled by the Institute due to non-compliance with CPE requirements. Further, three (3) audit license holders did not obtain the Institute’s support in the application for renewal of audit license with the AG.

CPE Compliance efforts to create awareness and enhance compliance

CCD continues to monitor members’ compliance with the CPE obligation annually. Professional accountants are reminded that complying with the CPE requirements is crucial to be resilient and competent in the accountancy fraternity. It is the responsibility of every member, especially those in public practice, to ensure compliance with the CPE requirements in order to be knowledgeable and to remain relevant in the industry. In a world where change is the new constant, CPE is the guiding roadmap in ensuring the profession is able to rise to the challenges and be a game changer, thus future-proofing the accountancy profession and establishing its future relevance.