By MIA Professional Practices and Technical

Concerned by the perceived high level of stress among audit professionals in Malaysia, MIA took the initiative to conduct two surveys to provide insights into the quality control environment of the accounting and financial reporting function of reporting entities in Malaysia.

The management of a company is responsible for the preparation of its financial statements. The auditor is responsible for expressing a reasonable assurance opinion that the financial statements are free from material misstatement, whether due to fraud or error, and that they are fairly presented in accordance with the relevant accounting standards.

Nevertheless, according to a work stress survey conducted by MIA among audit staff in 2017, many audit clients in Malaysia fail to appreciate the different roles played by an external auditor and a financial statement preparer. Auditors frequently have to deal with delayed management accounts, poorly maintained accounting records and are expected to assist auditees in resolving their accounting issues. Consequently, auditors end up working in a stressful working environment with tight deadlines and this leads to staff burn-out and in the longer term, discourages talent from entering the auditing profession.

As an initial effort, the Public Practice Committee (PPC) and the Professional Accountants in Business Committee (PAIBC) collaborated in conducting two sets of surveys in 2020 in order to obtain data to assess the quality control over financial reporting by preparers of financial statements. The two surveys are “Survey for Preparers of Financial Statements” and “Survey for Auditors on Quality Control over Financial Reporting of Reporting Entities”.

Survey for Preparers of Financial Statements

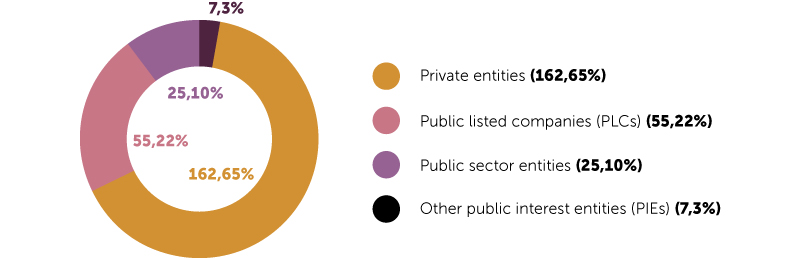

249 participants responded to the survey and the breakdown of the companies are as follows:

Below are some of the key findings and the interpretation of the data:

- Insufficient number of accounting and finance staff: Companies generally do not employ sufficient accounting and finance staff and these staff are not exclusively reserved for their accounting and finance role.

- Insufficient budget is allocated to accounting and finance staff’s training and development: As a consequence, accounting and finance staff are not updated with the latest developments and requirements.

- Quality control is an issue: There have been instances where prolonged weaknesses in internal control were not resolved for more than a year.

- Reasons for the audit adjustments: Lack of understanding of practical application of accounting standards, lack of experienced accounting staff, additional information surfaced during the audit and error in judgement by the accounting and finance staff.

- Accounting system issues: Apart from the human factor, accounting system issues contribute to the quality of the financial statements.

Survey for Auditors on Quality Control over Financial Reporting of Reporting Entities (on audit adjustments)

In total, 123 Audit Firms (AFs) (8% of total population) responded to the survey. However, only 6 out of 123 AFs audit PIEs.

Below are some of the key findings and the possible interpretations of the data:

- Audit adjustments indicate weaknesses in management’s financial reporting process: A significant number of audit firms either strongly agree or agree that the factual or misclassification adjustments indicate the need for management to improve their financial reporting processes and their internal quality control procedures.

- Auditors play a key role in ensuring higher financial reporting quality.

- Significant room for improvements: The quality of financial statements, as prepared by management, varies, and for some, there is significant room for improvements.

- Expectation gap exists between auditors and financial statement preparers in Malaysia, on the expected standard of quality of true and fair financial statements. The lack of competent finance staff is the main reason for the expectation gap.

- The imposition of certain quality control standards on the reporting entities will be useful in reducing work stress of audit staff: For example, by increasing the responsibility of directors and management of reporting entities to institute proper quality control mechanisms for financial reporting.

Next Steps

MIA believes that the findings of such surveys can highlight issues and challenges in the financial reporting value chain and identify the actions needed to improve the financial reporting ecosystem in Malaysia. However, the results of the two surveys should be taken with caution considering the overall low number of survey respondents and, in particular, the lack of participation from larger audit firms and public interest entities.

The PPC and PAIBC will discuss the need for conducting a second survey to obtain more responses from PIEs and auditors of PIEs to enable the analysis of more industry-representative data. We look forward to your active participation in such surveys in the future.