By MIA CPE Compliance Department

The year end is fast approaching. As such, this is the time of the year for professional accountants to tie up the loose ends of their compliance with Continuing Professional Education (CPE) requirements and be ready for the CPE compliance audit. As part of the Institute’s regulatory functions, the CPE compliance audit is conducted annually as a monitoring process to ensure members fulfil the CPE hours requirements as stipulated in the Institute’s By-Laws (On Professional Ethics, Conduct and Practice) (the By-Laws). This article will help members to understand what is required and how to meet the audit requirements if they are selected for CPE compliance audit. Even if members are not selected to take part in the audit, this will serve as guidance to fulfil the CPE obligations.

CPE Compliance Audit: Requirements and Regulation

CPE is pertinent in ensuring the competency level of professional accountants via lifelong learning. Through CPE, professional accountants are able to exercise the right technical skills in safeguarding the public interest and therein uphold the credibility of the profession.

The CPE compliance audit is an annual exercise performed by the Institute in monitoring members’ CPE compliance in line with the prescribed standards. As a member of the International Federation of Accountants (IFAC), the Institute need to ensure that members fulfil the CPE requirements as stipulated in the International Education Standards (IES) 7, Continuing Professional Development (Revised) issued by the IFAC which has been incorporated under Section B110 of the By-Laws.

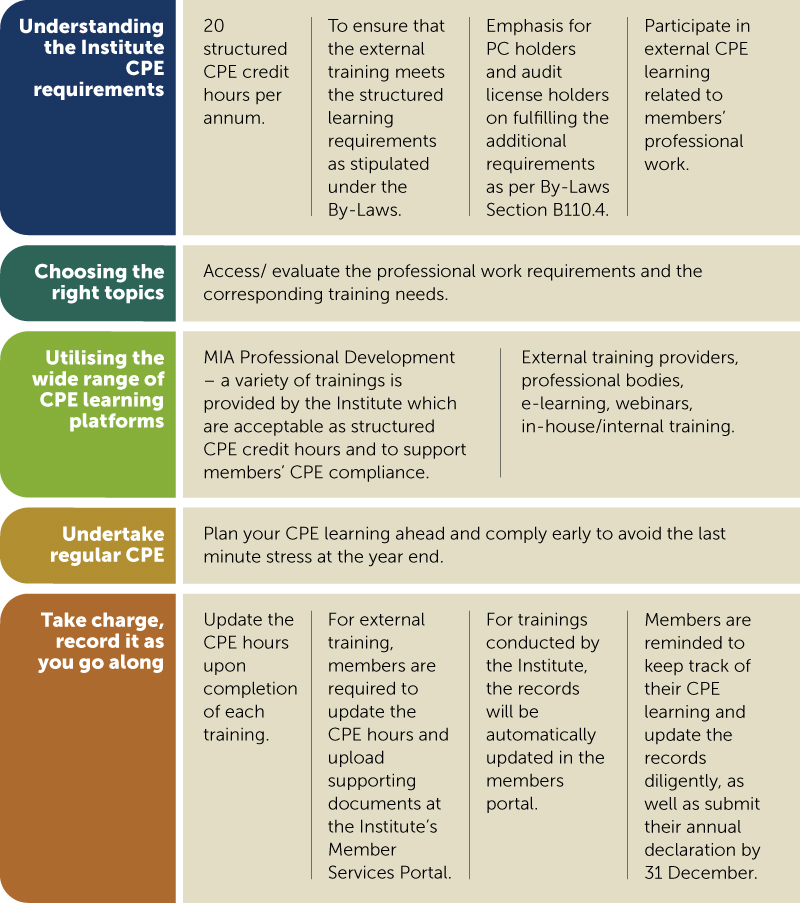

Under this section, members of the Institute are required to undertake and record relevant continuing professional education that develops and maintains professional competence to perform their professional role. To demonstrate compliance with the CPE, all members must participate in CPE learning related to members’ professional work and undertake a minimum of 20 structured CPE credit hours per annum. For Audit License (AL) renewal purposes, auditors must comply with a minimum of 10 out of 20 structured CPE hours to be completed by the members each year, which must be related to International Standards on Quality Control (ISQC1)¹, approved auditing standards, approved accounting standards and/or professional ethics.

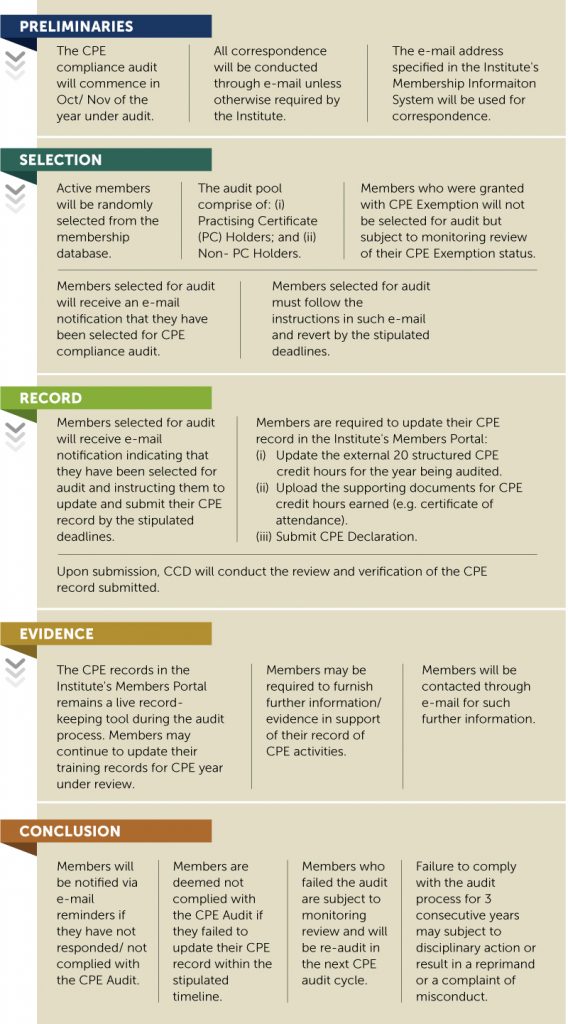

CPE Compliance Audit Process

To carry out the Institute’s regulatory function, the CPE Compliance Department (CCD) under the Surveillance and Enforcement Division has been tasked to monitor and review members’ CPE compliance. The CPE compliance audit process is set out below.

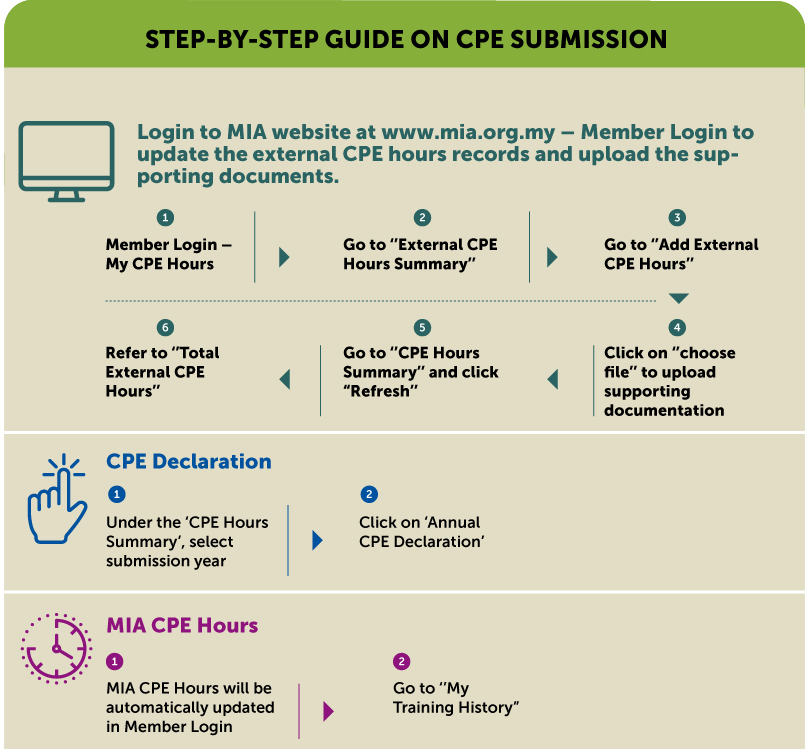

Tips for Members: CPE Compliance Audit Process is Simple

Members may take some simple steps now to make sure that they are prepared for the CPE compliance audit. If members are prepared, the whole audit process can be simple and straightforward. The following also serves as a guidance to fulfil the CPE obligation for those who are not involved in audit.

Findings: CPE Compliance Audit

The following are some of the common observations contributing towards non-compliance based on the past CPE compliance audit conducted by CCD:

- Members did not update the CPE hours’ records on a timely basis and submitted the CPE Declaration after 31 December of the calendar year.

- Courses/trainings which do not meet the criteria as structured learning to qualify as CPE credit hours.

- For AL holders: Non-compliance with the 10 CPE hours specifically for ISQC 11, approved auditing standards, approved accounting standards and/or professional ethics.

- Members did not choose the right training and attended training that is not acceptable as audit renewal CPE hours.

As an additional effort to support members, CCD sent regular e-mail reminders to remind members to comply with the CPE requirements and update the CPE records with the Institute by 31 December annually.

Members may reach out to CCD which is entrusted to spearhead, monitor and support members with the annual CPE compliance audit and other CPE compliance related matters. Members may send their enquiries via the CPE Enquiries (MIA Member Services Portal) or email to [email protected].

Get Ready – Be Prepared

It is essential for members to understand the purpose of CPE and it is members’ obligation to comply with the CPE requirements annually. Members are encouraged to plan ahead and take charge, as part of the responsibilities of being professional accountants. In the ever-changing landscape of the accountancy profession, it is vital for members to stay relevant, resilient and take proactive measures to be prepared for the challenges ahead.

¹ To be replaced by International Standard on Quality Management (ISQM) 1 and 2, effective from 15 December 2022.