By MIA Practice Review Department

The concept of going concern is a fundamental assumption when it comes to preparing the financial statements of a company. Therefore, it is essential for an auditor to obtain sufficient appropriate audit evidence and conclude on the appropriateness of management’s use of the going concern basis of accounting in the financial statements.

The going concern assessments can require that a significant amount of time and judgement be devoted, particularly when significant estimates are applied. Hence, an auditor should consider engaging management and those charged with governance at an early stage as this would allow for more timely discussion and give the management adequate time to prepare its assessment and action plan to address any potential going concern issue. The auditor may also want to consider seeking assistance from an expert in obtaining sufficient appropriate audit evidence.

Common findings relating to Going Concern

Through the conduct of practice review, the MIA Practice Review Department (PRD) has identified going concern assessment as one of the areas many audit firms fail to grasp. Although many auditors attempt to perform the assessment as part of their mandatory audit procedures, there is still a lack of sufficient appropriate audit evidence obtained; this has become a common inspection finding following the review of the audit firms’ working papers.

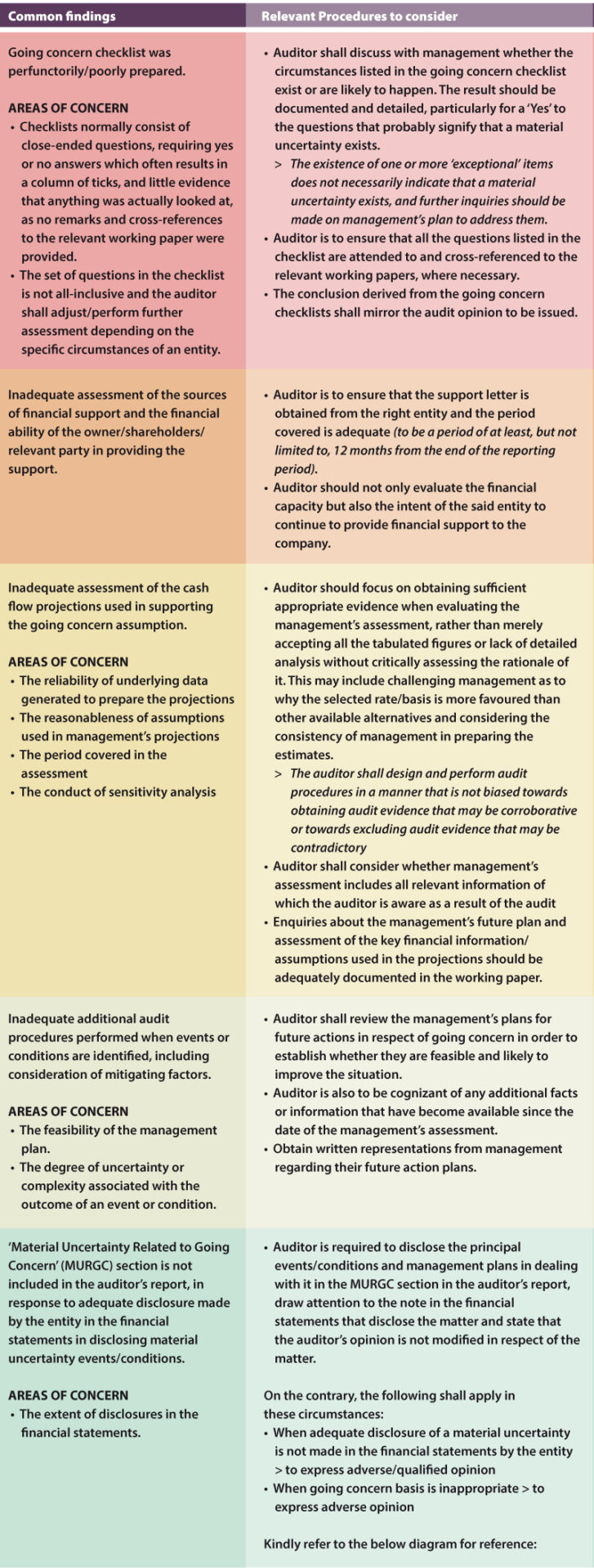

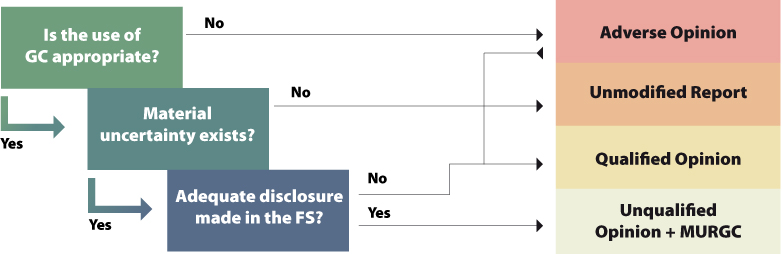

The audit deficiencies in going concern assessment and its relevant audit procedures that are expected to be performed by the audit firms are summarised in the table below:

Conclusion

In the aftermath of the Covid-19 pandemic, there is a rise in uncertainty pertaining to the economy, inflation, geopolitical instability, and future earnings that may directly affect business continuity. In this respect, PRD expects auditors to exercise due care and significant professional judgment when performing audit procedures over going concern assessments, in order to ensure that sufficient, appropriate audit evidence has been obtained and to conclude on the appropriateness of management’s use of the going concern basis of accounting in the preparation of the financial statements.

Lastly, we also wish to draw readers’ attention to the latest content from IAASB on this topic at https://www.ifac.org/system/files/publications/files/IAASB-Going-Concern-Frequently-Asked-Questions.pdf