By MIA Small & Medium Practices Team

Many bank confirmation letters are sent to banks annually by auditors to request for confirmation of audit clients’ bank balances and arrangements. The conventional process of obtaining confirmations through mail is slow and time-consuming. Such delays could impact negatively the timing of the clearance of audited financial statements.

To facilitate the manual bank confirmation process, MIA has been working closely with The Association of Banks in Malaysia (ABM) since 2013 to maintain a list of contact details for commercial banks in Malaysia, to facilitate the sending of bank confirmation requests manually by auditors. This will enable auditors to send requests correctly to a central/branch address of a bank that matches each bank’s business model. Member firms are advised to refer to the updated list from MIA website before sending the manual bank confirmation requests. The turnaround time should be shortened by sending the bank confirmation requests to the right processing center or department or branch.

However, the aforementioned measure could not address all the challenges of getting bank confirmation replies. To effectively handle late confirmation replies due to mail delay or missing mail in transit, MIA championed the creation of an Industry-wide Electronic Bank Confirmation Platform (i.e. eConfirm.my) and launched the Platform in June 2020. After close to three years of implementation, eConfirm.my is currently used by 1,400 audit firms and 29 financial institutions in Malaysia.

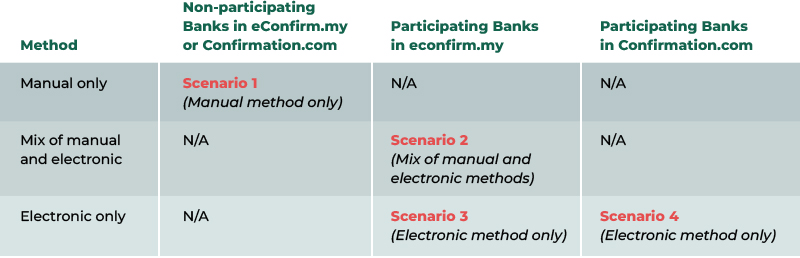

Four possible scenarios for sending of bank confirmation requests to financial institutions in Malaysia

There are currently four possible scenarios that auditors may encounter in sending confirmation requests:

Note: For the list of participating banks, please refer to here.

Scenario 1: Non-participating Banks (manual method only)

Even before the implementation of eConfirm.my, MIA has been working closely with the Association of Banks in Malaysia (ABM) since 2013 to maintain a list of updated contact details for commercial banks in Malaysia, to facilitate the sending of manual confirmations.

For sending of bank confirmation requests to non-participating banks, please refer to the list of contact details for 26 commercial banks in Malaysia (updated October 2022) before sending the hard copies of requests. To improve the turnaround time, bank confirmation requests should be sent to the right processing centre or department or branch, depending on the operations system (centralised or decentralised) of banks.

Scenario 2: Participating Banks (mix of manual and electronic method)

After the implementation of eConfirm.my, many participating banks are still accepting manual confirmation requests although they are onboarded with eConfirm.my. For online submission of requests, please send through eConfirm.my. For manual submission of requests, please refer to the contact list (last updated October 2022).

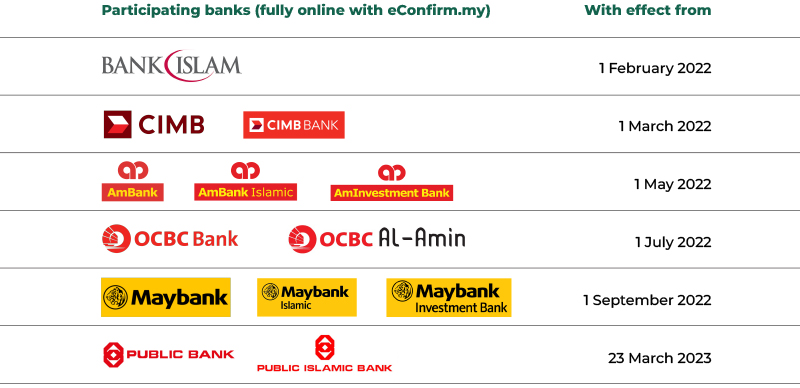

Scenario 3: Fully Online Participating Banks (Electronic method only with eConfirm.my)

Harnessing the Platform to reap its full benefits, the following banks have already fully migrated their bank confirmation process to eConfirm.my.

With these developments, manual bank confirmation requests submitted to the branches of the above banks will no longer be accepted for processing after the effective dates.

Scenario 4: American-based or Foreign-based Banks that are subscribed to Confirmation.com (Electronic method only with Confirmation.com)

Citibank, Standard Chartered Bank (SCB) and HSBC Bank in Malaysia have subscribed to Confirmation.com and now receive and respond to online requests through the Confirmation.com platform.

With the above, there is a 2-tier system for electronic bank confirmation in Malaysia. Auditors would need to subscribe to both systems in order to perform bank confirmation electronically for their audit clients.

To confirm accounts balances and other arrangements with American-based banks and some other foreign banks, the requests need to be submitted through Confirmation.com. To obtain confirmations from local banks and other foreign banks, the requests need to be submitted through eConfirm.my.

Feedback from Audit Firms and Financial Institutions

Since the launch of eConfirm.my on 26 June 2020, positive feedback has been received from participating audit firms and banks. Auditors are generally satisfied with the shorter turnaround time (TAT) and greater efficiency. The average TAT of the bank confirmation reply from the respondent banks is 7 days (the fastest TAT is 1 day).

The feedback from audit firms and banks after embracing eConfirm.my can be seen in the following articles in e-Accountants Today:

Embracing eConfirm.my: The Experience Thus Far

Embracing eConfirm.my: Feedback from Banks

If your firm has yet to participate in eConfirm.my, please register your firm using the registration form and email to [email protected]. Once registered, complimentary training will be provided to audit staff before your firm can start creating the firm’s and clients’ profile for submission of bank confirmation requests through the Platform.

With most audit firms already participating in eConfirm.my, the Institute is optimistic that other financial institutions would expedite their onboarding to the Platform and the Platform will gain the momentum needed to become an ‘industry-wide’ electronic bank confirmation platform.

For more information about eConfirm.my, please visit www.econfirm.my or MIA website.

Should you have further enquiries, please contact the Project Team at [email protected].