By MIA Professional Practices and Technical

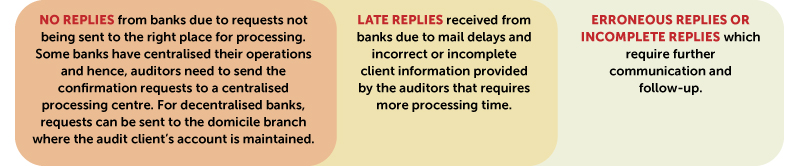

Numerous confirmation letters are sent to banks at least on an annual basis by auditors to request for information on their clients’ bank balances and arrangements. Historically, these confirmation requests have been mostly a manual process. This conventional method of obtaining confirmation is not only time-consuming but also susceptible to the following:

To facilitate the sending of manual confirmations, MIA has been working closely with The Association of Banks in Malaysia (ABM) since 2013 to maintain a list of updated contact details for commercial banks in Malaysia. Nevertheless, this arrangement could not fully address the delays in obtaining bank confirmation replies.

As a proactive measure to handle this problem, MIA championed the development of an Industry-wide Electronic Bank Confirmation Platform (i.e. eConfirm.my) and launched it in June 2020. After nearly 2 years since its inception, eConfirm.my is being used by over 900 audit firms and 26 financial institutions in Malaysia, including major banks such as Maybank, CIMB Bank, RHB Bank, Hong Leong Bank, OCBC Bank and Alliance Bank.

Previously, an article entitled Embracing eConfirm.my: The Experience Thus Far published in April 2021 showcased the feedback by audit firms on their use of eConfirm.my. As a follow on to that article, this article now highlights the experiences of participating banks pertaining to the eConfirm.my as follows:

Greater Efficiency and Effectiveness

The turnaround time for replying confirmations has significantly improved. Presently, the fastest turnaround time is 2 days (shortest) and the average turnaround time is 11 days.

In order to participate in eConfirm.my, almost all participating banks have taken the opportunity to rationalise, restructure and centralise their bank confirmation processes. Previously, several bank officers of various units/departments in a bank had to attend to all confirmation requests sent to the respective bank branches and facilities centres, aside from performing their daily routine tasks. Now, with this secure online platform, many participating banks have centralised the bank confirmation process across the bank. With these changes, a few designated bank staff have been assigned to handle all confirmation requests within a bank. This has improved the overall workflow for most participating banks.

Bank Islam and AmBank have been using eConfirm.my since 1 April 2021 and 1 December 2020 respectively. With the greater efficiency experienced, these banks decided to migrate fully to eConfirm.my for all their bank confirmation requests commencing 1 February 2022 and 1 May 2022 respectively. CIMB Bank has gone fully online for their bank confirmations effective 1 March 2022. With these developments, manual bank confirmation requests will eventually be a thing of the past.

Better Security and Lower Risk of Fraud

Each confirmation request sent to a bank must be associated with an engagement partner in eConfirm.my. During the registration process, the audit partner’s details must match with the audit firm’s details as recorded in MIA’s member firm database. This requirement ensures the authenticity of the audit partner’s identity, and that the private and confidential information of bank customers are sent only to the intended user through the platform.

eConfirm.my also features an end-to-end encryption technology, a key factor that ensures top level security and protection for the bank customers’ sensitive information and data. In addition, the platform has also undergone System and Organisation Controls (SOC) 2 and SOC 3 assurance work that covers data integrity, platform security, privacy and confidentiality.

To view the latest SOC reports, please log on to https://econfirm.my/soc-report/

While having these commendable experiences, the participating banks also faced some challenges during the implementation phase of eConfirm.my. One of the most common issues was the duplicate requests received from auditors as many auditors submitted multiple requests for the same confirmation through the platform. In addition, some audit firms sent manual and online confirmation requests concurrently. These duplications resulted in additional work for the respondent banks as they needed to identify those duplications in order not to double charge the bank customers. These duplications have reduced significantly after several notices were issued by the platform to the auditors and continuous training was rendered to the participating audit firms.

With the remarkable feedback and aforementioned developments, MIA is optimistic that other financial institutions would expedite their onboarding to the platform. The platform has certainly gained the momentum needed in moving towards attaining its aspiration of becoming an ‘industry-wide’ electronic bank confirmation platform.