What RIs (Reporting Institutions) need to know about STRs

By Azizah Mohd Ghani

Reporting Institutions (RI) are MIA members who hold valid practising certificates issued pursuant to Rule 9 of the Malaysian Institute of Accountants (Membership and Council) Rules 2001 and member firms that under the AMLA, are subject to Part IV Reporting Obligations of the Act, when they carry out any of the gazetted activities (GAs) as follows:

- buying and selling of immovable property;

- managing of client’s money, securities or other property;

- managing of accounts including savings and securities accounts;

- organising of contributions for the creation, operation or management of companies; or

- creating, operating or managing of legal entities or arrangements and buying and selling of business entities

Accountants who only provide audit services which do not fall within any of the five GAs are not RIs under the AMLA. Bank Negara Malaysia (BNM) is currently in the midst of conducting a review to map out the services provided by accountants with the GAs and will communicate the outcome to the accountancy sector.

To enhance governance and compliance, RIs are required to raise suspicious transaction reports (STRs) under AMLA. Read more on STRs below.

1. What is a Suspicious Transaction Report?

A Suspicious Transaction Report (STR) is a document that RIs need to submit promptly to the Financial Intelligence and Enforcement Department (FIED) of BNM whenever there is any suspicion or reasonable grounds for suspicion that a client/prospective client (customer) is involved in any transactions/attempted transactions and/or engaged in any activity in Money Laundering (ML), Terrorism Financing (TF) or other serious crimes. STRs typically provide law enforcement agencies with valuable information and intelligence such as the identity of the parties involved in the transaction, the amount of money involved, the nature of the transaction, and any other relevant details of potential crime activities.

Submitting an STR does not necessarily mean that a transaction or activity is illegal or that any wrongdoing has occurred. It is simply a way for RIs to alert the authorities to transactions and/or activities that may warrant further investigation.

2. When to submit an STR?

RIs are required to submit an STR promptly whenever there is suspicion or reasons to suspect that the transaction (including attempted or proposed), regardless of the amount and/or activity engaged in:

- Appears unusual or does not fit the clients’ business profile;

- Has no clear economic purpose;

- Appears illegal or tainted with illegality;

- Involves proceeds from an unlawful activity; or

- Indicates that the customer is involved in Money Laundering / Terrorism Financing (ML/TF).

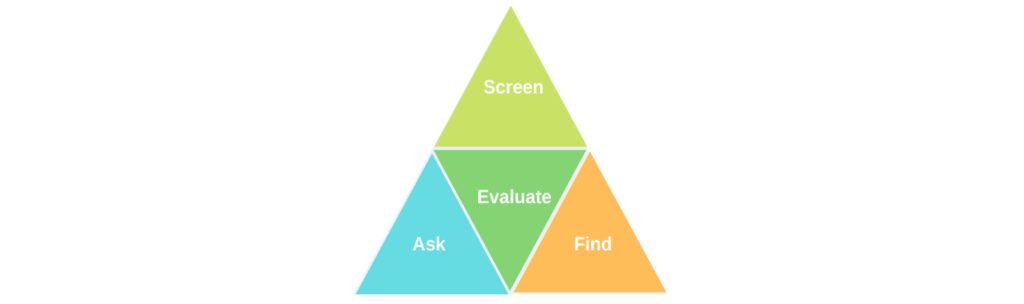

3. How do you recognise suspicious transactions?

Source: iv INFOGRAPHIC SUSPICIOUS TRANSACTION REPORTS.pdf (bnm.gov.my)

- Screen the client account

- RIs need to know the client’s personal particulars such as identification, nationality, contact details, occupation, nature of business, source of funds and income (when the client’s risk rating is higher) and their purpose of transactions or services engaged by performing Customer Due Diligence (CDD).

- RIs can only effectively control and reduce their Money Laundering/ Terrorism Financing (ML/TF) risk if the RIs have an understanding of the normal and reasonable activity of their clients, so that they have the means of identifying transactions and activities which fall outside their clients’ regular pattern or activity.

- Ask the client appropriate questions.

- Only upon knowing the clients’ businesses will the RIs be able to ask the appropriate questions.

- Raise questions on those transactions and/or activities, in particular, that involve new clients, a new line of business, transactions that do not make any economic sense, and payment received/paid which appears unusual.

- Find out the client’s record/review known information

- Ask appropriate questions to the clients.

- If the clients hesitate or are unwilling to co-operate, that is the first sign that should trigger raising an STR.

- Evaluate information gathered and consider submitting an STR

- Employees of RIs should raise any suspicions formed on clients to the Compliance Officer (CO)

- Upon evaluation of established suspicion, the CO of an RI must submit an STR latest by the next working day from the date of establishing the suspicion.

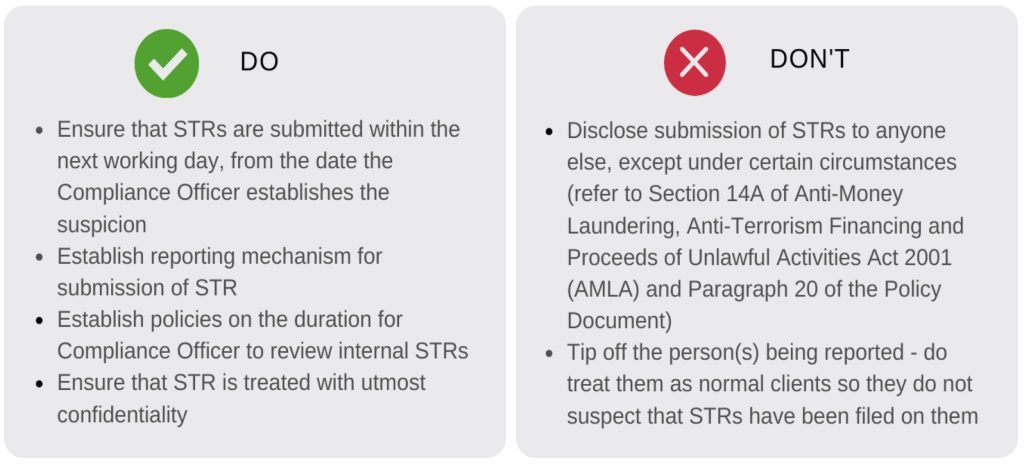

- RIs must not disclose to the clients or any other third party that an STR has been made, i.e., there should be no tipping off. However, certain exemptions to the tipping off offences are provided under Section 14A (3) of the AMLA.

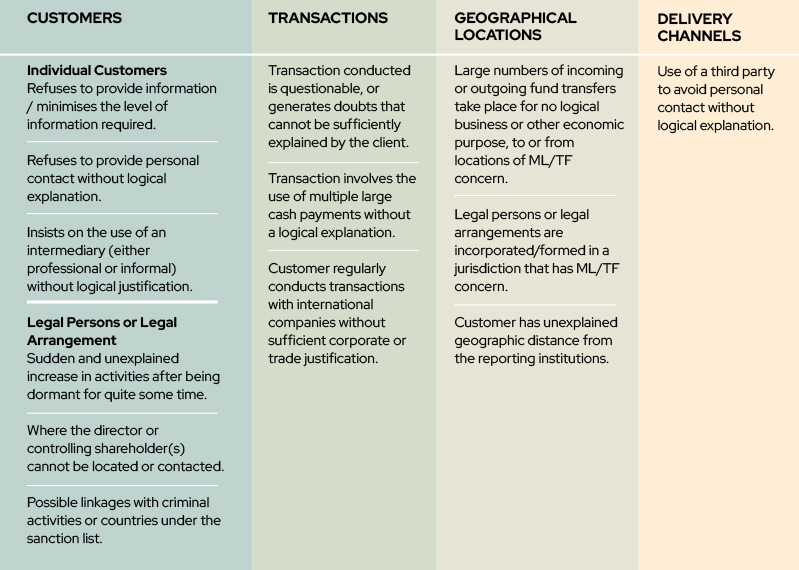

RIs are required to establish a list of red flags relevant to their business or service to facilitate the detection of suspicious transactions. Examples of red flags are as provided in the AML/CFT DNFBP Policy Document (Please refer to Appendix 15 – Examples of Red Flags).

Source: iv INFOGRAPHIC SUSPICIOUS TRANSACTION REPORTS.pdf (bnm.gov.my)

Infrastructure Required to Support the Detection and Reporting of STRs

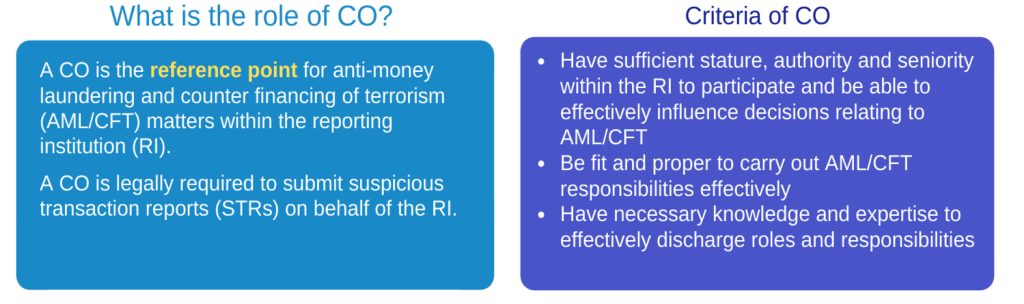

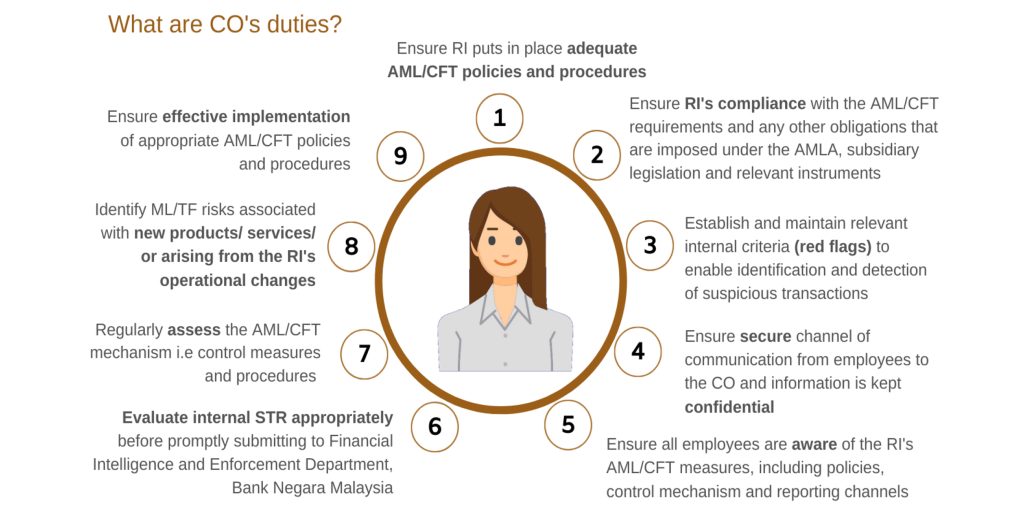

- Appoint an AML/CFT CO

- Appoint a CO regardless of the firm size. An RI may appoint any individual with management responsibilities within the RI to be the CO. However, the person appointed must satisfy the criteria provided under paragraph 11.5 of the AML/CFT Policy Document. Also, the CO must be in a position to have the sole discretion and independence to evaluate and report STRs.

- Notify BNM on the appointment of CO within 10 working days, in writing/email to: [email protected] or through the CO Nomination Form (preferred method). BNM will then assign a CO Number for administrative purposes and for all correspondence with BNM.

Source: BNM AML/CFT Policy Document – Appendix 11

- Establish a Reporting Mechanism

- RIs are required to ensure that there are policies and procedures in place and ensure the CO is responsible for channelling STRs received from the employees to be properly reviewed with a sufficient timeline. The policies and procedures must also cover the circumstances when the timeframe can be exceeded, where necessary.

- Upon receiving any STRs, the CO must evaluate the grounds for suspicion. Once the suspicion is confirmed, the CO must promptly submit the STR. In the case where the CO decides that there are no reasonable grounds for suspicion, the CO must document and file the decision, supported by the relevant documents. The CO is to maintain a complete file whether or not the STR was submitted.

- The CO must ensure that the STR is submitted within the next working day, from the date the CO establishes the suspicion.

- RIs need to ensure utmost care is taken upon submission to ensure that such reports are treated with the highest level of confidentiality. The CO has the sole discretion and independence to report suspicious transactions.

- RIs must also ensure that the suspicious transaction reporting mechanism is operated in a secure environment to maintain confidentiality and preserve secrecy.

- The RIs must provide additional information and documentation as may be requested by the BNM and must respond promptly to any further enquiries about any report received under section 14 of the AMLA.

- There is no threshold for STR as it can be raised based on suspicion.

- All files with regards to STR should be kept for 6 years in a form admissible as evidence in court under the Evidence Act 1950.

- Establish a Red Flags list

- RIs are required to establish internal criteria (“red flags”) to detect suspicious transactions.

- RIs must consider submitting an STR when any of its customer’s transactions or attempted transactions fits the reporting institution’s description of “red flags”.

- Reporting institutions may refer to Part E of the policy document for examples of transactions that may constitute triggers or any other examples that may be issued by the competent authority, regulatory bodies, Self-Regulating Bodies (SRB) and international organisations for the purpose of reporting suspicious transactions.

- Among the general Red Flags are as below:

Note: the list above is non-exhaustive

- Sector Specific Red Flags for Accountants as provided below*:

- Receive large sums of capital funding quickly following incorporation or formation, which is spent or transferred elsewhere in a short period of time without commercial justification.

- Received money through split transfers without logical explanation.

- Transactions aborted after funds are received, then deposited funds were sent to a third party and personal contact avoided without logical explanation.

- Clients having a history or tendency of changing accountants frequently without logical explanation.

- Creation of fictitious employees under payroll list.

STR Forms for Accountants

STR forms for accountants can be obtained via Appendix 5 (iii) of AML/CFT and TFS for DNFNPs and NBFIs or this link.

What makes a quality STR?

The following information must be included in the STR:

- Information on the account holder or client or beneficial owner of the transaction or activity;

- Information on the person conducting the transaction and/or engaged in the activity;

- Details of the transaction or /and activity, such as the type of products or services, the amount involved and review period;

- A description of the suspicious transaction or its circumstances.

- Suspected offence; and

- Any other relevant information that may assist the FIED, BNM in identifying potential offences and individuals or entities involved.

How to submit STRs?

Completed STR forms must be submitted to the FIED, BNM through any of the following channels:

- E-mail to [email protected]

- Mail to:

Director

Financial Intelligence & Enforcement Department

Bank Negara Malaysia

Jalan Dato’ Onn

50480 (Kuala Lumpur)

(To be opened by addressee only) - Financial Intelligence System (FINS) (where applicable)

The importance of STR submission for RIs

STR submission is important for RIs as protection from being abused. It is imperative that RIs protect their staff and firm from being abused to facilitate criminal activities and assist the law enforcement agencies in disrupting financial crime. In addition, submitting STRs and having a proper mechanism in place for STR reporting, will assist RIs in demonstrating that sufficient compliance measures are in place in instance of investigations by law enforcement agencies. Non-compliance with the obligation to report STR to BNM can entail a fine of up RM1 million under the AMLA 2001.

For further information on STR and other AML/CFT compliance requirements, please refer to the BNM’s AML/CFT website: https://amlcft.bnm.gov.my/

Azizah Mohd Ghani is the Head of Professional Accountants in Business (PAIB) and Valuation Department of the MIA.

More information on RIs is available at: https://www.at-mia.my/2022/05/20/obligations-by-reporting-institutions-under-amla/