By MIA Surveillance and Enforcement

1.0 Establishment of Practice Review Programme (PRP)

- As a member of the International Federation of Accountants (IFAC), it is incumbent upon the Malaysian Institute of Accountants (MIA) to implement the PRP for its member firms. The PRP forms the substance of the Statements of Membership Obligations (SMOs), particularly SMO 1 – Quality Assurance.

- As stated in Section B250: Quality Assurance and Practice Review of the By-Laws of MIA, MIA has established its PRP pursuant to the Council’s Statement on Practice Review issued on 15 November 2002 together with its supporting appendices which are set out in Appendix VI to these By-Laws. It assesses the standards and procedures of members’ audit practice to ensure compliance with applicable professional standards, legal and regulatory requirements.

The professional standards which are required to be observed and applied include:

- all standards and statements of professional conduct and ethics in the form of the Institute’s By-Laws issued from time to time; and

- all approved standards whether issued by the Council or otherwise, and all guidelines, statements and/or circulars of best practices issued or prescribed by the Council and/or the Institute from time to time.

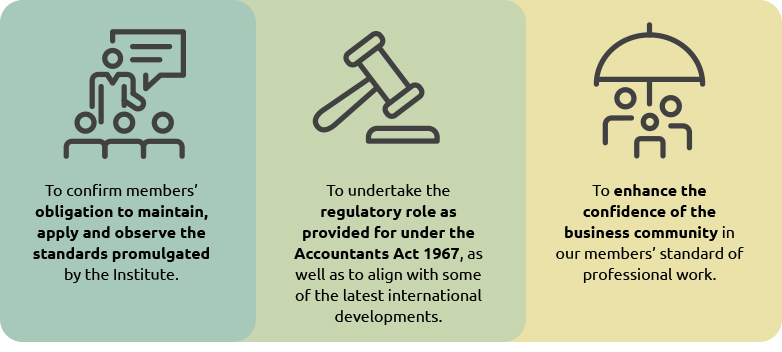

2.0 Objectives of PRP

The objectives of PRP are three-pronged:

3.0 Practice Review Framework

The Practice Review (PR) Framework serves as the foundation for the surveillance activities conducted by the PRD. The framework outlines the approach used for selecting audit firms to be reviewed, as well as the scope of the reviews and the types of ratings used to evaluate the firms.

Our framework involves identification and analysis of internal and external factors that influence how auditors fulfil their responsibility. It is thus imperative for audit firms to undertake an in-depth analysis of their firms to identify root causes that may result in deterioration of audit quality. Practice review considers Root Cause Analysis (RCA) to be part of a continuous audit quality improvement process, which includes other elements, namely remediation, monitoring and measurement.

- MIA uses a risk-based approach for selection of audit firms for practice review, which has been streamlined under the Revised Practice Review Framework, to select firms based on a risk profiling system using information extracted from the Annual Return submitted by Audit Firms. The cycle ratio for PR on firms is once within a period of 6 years unless there are referrals from other Regulatory bodies or Committees of the Institute.

- Audit firms may also be selected for review based on referrals from other Regulatory bodies in Malaysia or other Committees of the Institute.

- The identity of the audit firm is kept confidential at all times from all parties who are not directly involved in the practice review of the firm, including the Practice Review Committee (PRC) and staff of the Institute.

- Firm-level Inspections – Practice Review inspects the audit firm’s system of quality control (firm-level inspections) to ensure that they are in compliance with the requirements of ISQM 1.

- Engagement Inspections – Practice Review’s approach in performing inspections of individual engagements comprises detailed engagement inspections of audit firms to assess whether the audit work is conducted in compliance with relevant professional standards. For practical reasons, not all partners of an audit firm that have been selected for practice review will be reviewed individually with regards to the current audit engagement files.

- However, in most circumstances, the sample of files selected for practice review should be reflective of the firms’ overall operations and size.

- At the conclusion of the practice review, the reviewer is required to table a report to the PRC.

- Before the deliberation of the report, the reviewer will delete any reference to the audit firm’s identity to preserve confidentiality.

- The PRC shall determine a rating for the report in the following manner, taking into consideration the practice review report and the audit firm’s comments.

- Where it is determined that no or minimal weaknesses were observed.

- The audit firm has adequately complied with applicable professional standards, legal and regulatory requirements in the performance of its work.

Type 1 signifies a comfortable pass and no further action is required.

- Where it is determined that the audit firm has some significant weaknesses which were not pervasive.

- Weaknesses are noted in some engagements but not in others in complying with applicable professional standards, legal and regulatory requirements in carrying out the work in certain areas of the engagements reviewed.

Type 2 requires a written assurance and commitment from audit firms that they will implement remedial action and improvement to address the noted weaknesses in their compliance with applicable professional standards, legal and regulatory requirements.

- Where it is determined that the audit firm has some significant weaknesses which were pervasive in complying with applicable professional standards, legal and regulatory requirements.

- The work performed and evidence obtained thereon were inadequate and/or inappropriate and the basis needed to form the opinions expressed on those engagements was not adequately supported.

Type 3 requires audit firms to prepare a remedial action plan (RAP). Subsequently, the audit firms will be subject to monitoring reviews on the implementation of the approved RAP within a specific time period, as prescribed in the MIA By-Laws.

- A situation where an audit firm has committed an offence or a breach against the laws and regulations of the country and MIA’s regulations or the basis needed to form the opinions expressed on the engagement reviewed was not supported for reasons as stipulated in the MIA By-Laws.

Type 4 will result in a complaint being lodged with the Registrar for the purpose of investigation.

Note:- Since the last PR framework was reviewed and implemented in July 2017, a subsequent review of the framework is due every 5 years. The Council had on 29May 2023 approved the proposed review of the PR framework which would come into effect on 1 January 2024. This new framework will allocate a 24-month timeline between the first review and the subsequent review for firms to put up their annual remedial action plan and engagement of peer review before being subjected to a subsequent review.

4.0 Comparison between MIA as a statutory body vs other professional accounting bodies (e.g: ACCA, CPA Australia, AICPA-CIMA)

Members are advised not to be confused by comparing MIA with other professional accounting bodies (e.g ACCA, CPA Australia, and AICPA-CIMA). MIA is not a membership body per se like any other professional bodies. Our primary mandate is to regulate and develop the profession as per the Accountants Act 1967.

MIA is the national accountancy body and a statutory body that operates under the purview of the Ministry of Finance through the Accountant General’s Department. MIA is the only accountancy body empowered by law to regulate the accountancy profession in Malaysia, thus making MIA membership mandatory for those holding themselves out or practising as an accountant in the country.

Thus, MIA is distinct compared to other professional accounting bodies, and each serves different objectives and purposes. While MIA also develops and supports its members, the regulatory function of MIA to monitor and regulate the practice of the accountancy profession is to ensure performance quality consistent with global standards and best practices and ultimately enhance the participation of the profession in serving the national economy and public interest. Professional bodies, on the other hand, exist to serve the interest of its members. While they may take on an oversight role of the profession, only MIA has the legislative authority to govern the profession.

We wish to reiterate that in Malaysia, there are only three regulators that can regulate the audit profession, which are MIA, AOB and SSM. AOB is responsible for conducting quality assurance reviews of audit firms that are registered with AOB and audit PIEs under Part IIIA of the Securities Commission Act 1993 (SCA 1993). Although AOB is entrusted to regulate auditors of public interest entities (PIEs), MIA is still empowered to carry out a practice review on any audit firm (be it an AOB-registered firm) when the need arises. SSM too, through its Corporate Accounts Monitoring Section, is primarily responsible for registration of audit firms, monitoring of changes in audit firms and approved company auditors, and monitoring the resignation and removal of auditors.

In other countries, the national regulatory authority that is similar to MIA is the Financial Reporting Council (FRC) in UK, Accounting and Corporate Regulatory Authority (ACRA) in Singapore, Australian Securities and Investments Commission (ASIC) in Australia, the Indonesian Institute of Public Accountants in Indonesia, the Saudi Organisation for Chartered and Professional Accountants (SOCPA) in the Kingdom of Saudi Arabia and the Institute of Chartered Accountants India.

Any sanctions taken against any partners of firms will only be published after the final determination of the case at the Disciplinary Committee/ Disciplinary Appeal Board (DC/DAB) or the courts if there is an appeal.