By Ng Boon Hui and Kerk Su Ngee

Globally, mergers and acquisitions (M&A) continue to be highly sought-after corporate exercises. Despite the anticipation of a global recession, CEOs remain interested in deals, with 63% of them indicating that they will pursue a deal in the next 12 months, as highlighted in the EY 2023 CEO Outlook Survey.

A high-level study on public M&A transactions in Malaysia over the last six years reveals that most of the transactions have resulted in the recognition of goodwill. Goodwill, as explained in the Malaysian Financial Reporting Standards (MFRS) 138, is an asset representing the future economic benefits arising from other assets acquired, which may result from synergy with the identifiable assets acquired.

The study highlighted that approximately 40% of the transactions resulted in positive growth in market capitalisation after the M&A. However, various studies¹ show that 50% of the M&A transactions failed to achieve or realise the expected synergy. The Harvard Business Review² also reported that 70% to 90% of M&A fail during the post-merger integration phase.

While acquirers³ envisage synergies post-M&A, the market has revealed that the realisation of synergistic value is complex. To begin with, acquirers expect an immediate increase in their business value from the M&A exercise. More often than not, they also anticipate a synergy to emerge subsequent to the M&A exercise. According to the International Valuation Standard (IVS), synergistic value is defined as:

“The result of a combination of two or more assets or interests where the combined value is more than the sum of the separate values.”

Commonly identified synergies

Depending on the nature of the transaction and industry, the expected synergies may broadly be classified into two categories, namely, revenue synergies and operational synergies.

Revenue synergies

A key revenue synergy is the potential for cross-selling products to a wider customer base. This is observed in the acquisition of a premium Asian grocery store chain by a leading superapp company. Before the acquisition, the grocery store chain had a strong physical presence in the retail industry, while the leading superapp company had a competitive advantage in the ride-sharing digital space. The acquisition has since enabled the grocery store chain to reach out to a wider online customer base.

Cross-border M&A would also allow acquirers to quickly gain access into different geographical markets. For example, a European general insurance company is anticipating an improved global footprint via its recent acquisition of controlling stakes in various general and life insurance companies in Malaysia. With an enhanced global presence, the general insurance company is in a better position to meet the needs of their international clients and compete in the international market.

Operational synergies

Some M&As were led by operational synergies such as improved manufacturing efficiency, economies of scale, research and development collaboration, technology and platform sharing. For example, the merger of a regional car maker with a Chinese car manufacturer provided the regional car maker with advanced automotive technologies, a global supply chain network and advanced production techniques, resulting in reduced production costs, improved operational efficiency and enhanced product quality.With the sharing of expertise, resources and knowledge, this merger accelerated the development of new technologies and more innovative products supporting the car maker to remain competitive.

Another recent example is the merger of two leading regional telecommunication players. This merger aimed to leverage on combined economies of scale, productivity and efficiency gains to improve network operations. By sharing knowledge in the research and development of 5G, artificial intelligence (AI) and internet of things (IoT) technology, the merger paved the way significantly towards the growth of Malaysia’s digital ecosystem. With streamlined operations and processes as well as the post-merger plan to expand and enhance its network coverage to reach out to a larger customer base, increased growth in revenue and profitability are anticipated in the longer term.

Valuing synergies

Valuing synergies typically starts with understanding the business model of the entities involved in the M&A and their respective valuations on an “as-is” basis. The general valuation approaches include the income approach (discounted cash flow method), market approach (market multiples) and cost approach. The selection of the approach(es) to be adopted depends on various factors such as the characteristics of the target, availability of information and the nature of transactions. Generally, for income-generating entities, the income approach will be adopted as the primary approach and cross-checks will be performed using either the market approach or the cost approach, depending on the nature and characteristics of the target company’s business.

Next, a comprehensive understanding of the business model will lead to the identification of areas with potential synergistic opportunities. The synergistic opportunities identified will then be evaluated⁴ in terms of the benefits, achievability, time frame and cost to realize the synergies. With the quantification of the evaluated synergies and revenue-related synergies, estimates are required to be made on the additional revenue to be generated from the cross-selling of products and the gaining of access to different geographical markets over a reasonable period of time. For operational synergies, estimates are required to be made on the potential cost savings from the integration of operations over a reasonable period of time. For the valuation to be meaningful, these synergies have to impact the profit or loss and cash flows of the businesses. The expected gains or losses from the identified synergies are then estimated using the risk adjusted net present value approach.

It is pertinent to note that the valuation of synergies is critically exacting, and it should be carried out as realistically as possible. Three often overlooked areas are:

| Timing | Cost to counter de-synergies | Risk in the estimation of synergies |

| The execution of the plan to realise synergies may take time for their effect to take place. Moreover, the durability of synergies is evolving as competitors can imitate the new strategy or product(s) in the long-term. Hence, the valuation of synergies needs to avoid over-optimism in estimating the timings to realise the anticipated synergies | Estimate foreseeable costs such as severance pay to eliminate the duplication of roles, organisation and IT systems integration costs, and the potential cannibalisation of revenue. | As the process of estimating synergies is generally complex and judgmental, additional risk premiums will need to be considered in the estimation of the discount rate used in the net present value approach. |

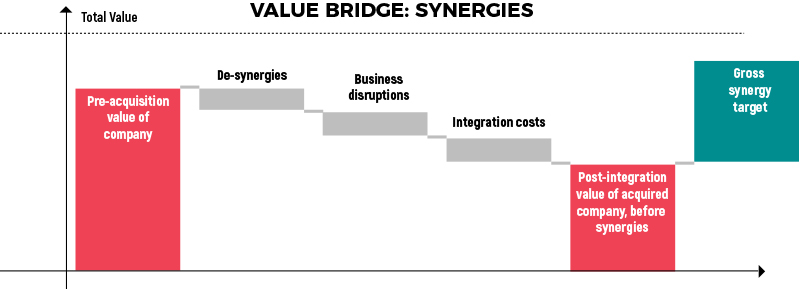

The chart below illustrates the total business value in the instance where all the synergies quantified can be realised to their full potential. The value bridge is broadly illustrated as follows:

In the process of evaluating the synergies, the key drivers will be identified and the impact of synergies will be estimated, allowing acquirers to monitor the performance of the key drivers and hold relevant stakeholders accountable after the M&A. This will increase the chances of the identified synergies being realised to their full potential.

Moving forward

In a rapidly evolving market landscape, we anticipate that the valuation of corporate synergies is going to be a key component in driving M&A deals, particularly in pricing considerations. It is integral for all interested parties to understand the implication of synergies and set realistic expectations on how much additional value the synergies can bring to the deal. With comprehensive evaluation and timely executions, synergies can be value-adding to the entities involved, and vice versa. One plus one is only greater than two, when the gross synergy target is more than the de-synergies and the costs of business disruptions and business integration.

¹ 2016 Innovative Space of Scientific Research Journals “Mergers And Acquisitions Failure Rates And Perspectives

On Why They Fail”

² Harvard Business Review June 2016, Roger L. Martin “M&A: The One Thing You Need to Get Right”

³ EY: Does your acquisition strategy nurture growth – or stifle it? EY Global, 2018

⁴ EY: Nine steps to setting up an M&A integration program, Lucas Hoebarth and Elizabeth Kaske, 2021

Note: The views reflected in this article are the views of the authors and do not necessarily reflect the views of the global EY organisation or its member firms.

Ng Boon Hui is a partner with Strategy and Transaction, Ernst & Young PLT and a member of the Valuation Committee of the Malaysian Institute of Accountants. Kerk Su Ngee is a partner with Strategy and Transaction, Ernst & Young PLT.