By MIA Small and Medium Practices Department, Professional Practices & Technical Division

Among its efforts to future-proof the profession, MIA pioneered an Electronic Bank Confirmation platform widely known as eConfirm.my for the entire auditing industry in June 2020. Over a three-year implementation journey, eConfirm.my has seen a remarkable adoption rate. Presently, over 97% of audit firms and 30 financial institutions in Malaysia are actively harnessing the capabilities of this platform, streamlining and enhancing their banking confirmation processes.

For a comprehensive list of participating banks, please refer to here.

Useful tips for submitting bank confirmation requests through eConfirm.my

To optimise cost-efficiency in using eConfirm.my, auditors should familiarise themselves with how the participating banks handle their bank confirmation requests after receiving their online requests.

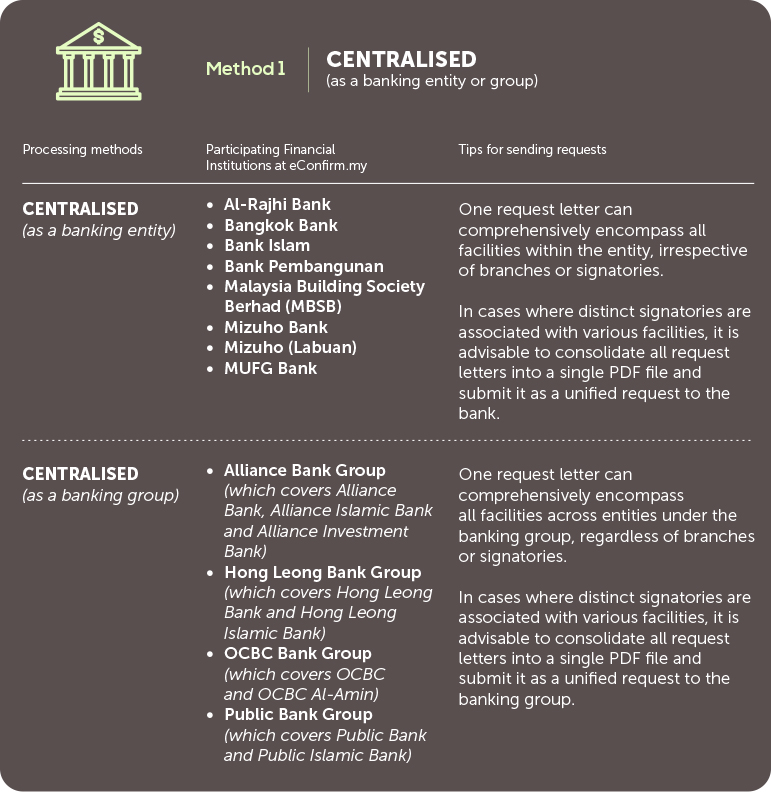

Presently, participating banks employ three distinct processing methods when responding to online bank confirmation requests:

Under this method, the banking entity or banking group has streamlined their processing by consolidating it under a single roof.

As a result, the auditor only needs to submit one confirmation request for all accounts/facilities held by the auditee with the responding Bank, even if they are spread across various branches and managed by different signatories.

If the auditee’s facilities have multiple signatories, it is advisable to merge all the request letters into a single PDF file and submit a solitary request to the responding bank. This streamlined approach will only incur a single platform usage fee of RM15.

Nevertheless, in the case of banks that have centralised their processing as a banking group, it remains crucial to direct the request letter to the appropriate bank entity.

Example 1: Centralised as a banking entity

An auditee holds multiple facilities across various branches of Bank Islam throughout the country.

In such a case, the auditor only needs to create a single request letter to cover all the facilities maintained with Bank Islam, regardless of the branches or signatories involved.

Example 2: Centralised as a banking group

An auditee maintains a current account with Alliance Islamic Bank and a loan account with Alliance Bank.

The first crucial step is to accurately address the request letter to the specific entities within the banking group, i.e. Alliance Bank and Alliance Islamic Bank.

In instances where the authorised signature(s) for the facilities in both banks are the same, we recommend addressing the request letter to both entities within the same request for the sake of efficiency.

However, if there happens to be different authorised signatures for the respective facilities, it is prudent to merge the separate request letters (one for Alliance Bank and one for Alliance Islamic Bank) into a single PDF file and submit as a single request. This consolidated approach ensures a more streamlined and cost-effective submission of auditor’s requests.

Under this method, the request letter should be directed to separate centres based on the financial products and the entity that will respond.

It is recommended to send the request letter to all relevant centres to ensure comprehensive coverage and completeness. If the auditee has no linked facilities at a specific centre, that particular centre will appropriately reject the request, and this rejection will not result in any bank charges or platform usage fee.

Example 3: Centralised by entity and financial products

An auditee has multiple facilities maintained with RHB Bank.

It is recommended to send the request letter(s) to all relevant centres (borrowing, non-borrowing, hire purchase, asset management and treasury) under RHB Bank to ensure comprehensive coverage and completeness.

If the auditee has no linked facilities at a specific centre of RHB Bank, that particular centre will appropriately reject the request, and this rejection will not result in any bank charges or platform usage fee.

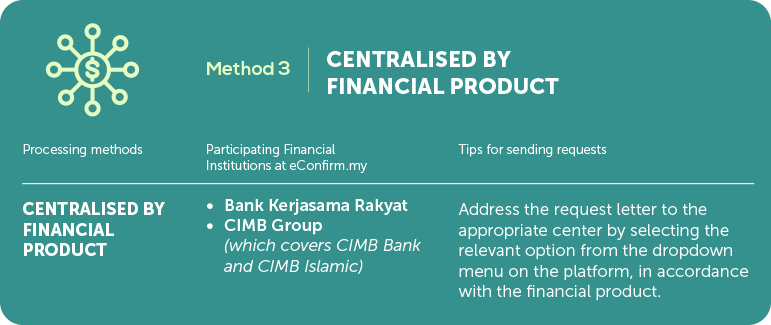

Under this method, the request letter should be directed to separate centres based on the financial products currently held with the responding bank.

It is recommended to send the request letter(s) to all relevant centres to ensure comprehensive coverage and completeness.

If the auditee has no linked facilities at a specific center, that particular centre will appropriately reject the request, and this rejection will not result in any bank charges or platform usage fee.

Example 4: Centralised by financial product

An auditee holds loan, savings and hire purchase accounts with CIMB Bank nationwide.

It is recommended to send the request letter(s) to all relevant centres (borrowing and non-borrowing, hire purchase, private banking, securities services and treasury) to ensure comprehensive coverage and completeness. If the auditee has no linked facilities at a specific centre, that particular centre will appropriately reject the request, and this rejection will not result in any bank charges or platform usage fee.

Other Important Notice

i. Auditee’s consent to use eConfirm.my

In order to ensure the smooth processing of requests submitted through the platform, it is important to note that every submission should include both the auditee’s agreement to obtain bank confirmation via the online bank confirmation platform (refer to page 2 of the MIA request letter template), and the corresponding bank confirmation request letter.

Auditees must grant explicit consent for the audit firm to utilise eConfirm.my and be aware of an additional RM15 platform fee, which is in addition to the existing bank charges. Furthermore, auditees’ financial information will be stored in the platform for six months from the confirmation date.

Should the auditor unintentionally overlook providing the auditee’s consent, the bank officer will be unable to proceed with the request, leading to a rejection of the requests.

ii. Special requests from banks

- CIMB Bank

Account numbers are a compulsory prerequisite for Trustee accounts, professional firms such as solicitors, government agencies, as well as NGOs, non-profit organisations, and associations.

This necessity arises from the fact that these entities may maintain multiple accounts across various CIMB branches nationwide, each managed separately and audited by different audit firms.

To uphold accuracy and adhere to financial regulations, CIMB now mandates the inclusion of account number(s) for the above entities to prevent any unintended confirmation of inaccurate accounts.

- Public Bank

Any asset held as security will not be incorporated in the bank confirmation reply via eConfirm.my. Nevertheless, for auditors who may require this information, Public Bank branches will make the details available at no cost.

Feedback from Audit Firms and Financial Institutions

Ever since the introduction of eConfirm.my on June 26, 2020, MIA has been consistently receiving commendable feedback from both participating audit firms and banks. Auditors have expressed their overall satisfaction with the notably reduced turnaround time (TAT) and the enhanced efficiency of the platform. Notably, the average TAT for bank confirmation responses from the respondent banks since January 2023 stands at 9.5 days, with the quickest TAT recorded at just 2 days.

The positive experiences and responses from audit firms and banks following their adoption of eConfirm.my are detailed in the following articles within e-Accountants Today:

If any firm has yet to participate in eConfirm.my, please register using the registration form and email to [email protected]. Once registered, complimentary training will be provided to audit staff before the audit firm can start creating the firm’s and clients’ profile for submission of bank confirmation requests through the Platform.

Given the widespread participation of audit firms on eConfirm.my, the Institute holds a positive outlook regarding the swift onboarding of other financial institutions to the platform. The Institute anticipates that this momentum will be instrumental in realising the platform’s ambition of becoming a comprehensive ‘industry-wide’ electronic bank confirmation platform.

For more information about eConfirm.my, please visit www.econfirm.my or MIA website.

Should any auditor or member have further enquiries, please contact the Project Management Office at [email protected].