By Gagandeep Nagpal & Thomas Chan Yeu Wai

In a stride towards aligning the local transfer pricing regulations with the global common approach, Malaysia released revised Transfer Pricing Rules last year (TPR23). The TPR23 includes a departure from the contentious reliance on a median-based approach for comparability analysis, which had long been a matter of dispute during audits. Instead, the TPR23 embraces the widely recognised “range” concept. As the dust settles on this revision, it would be interesting to assess the implications of this change.

Why statistical measures are relevant in transfer pricing comparability analysis?

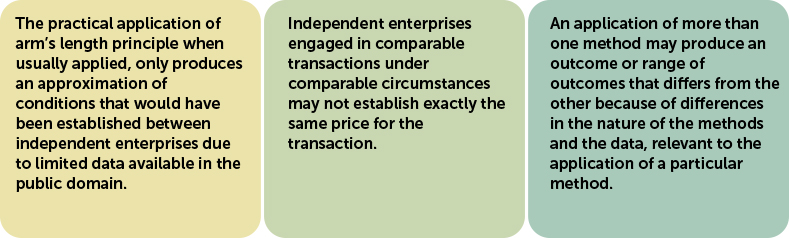

To set the context, the integration of statistical measures such as range and median adds a crucial layer of objectivity to the entire comparability process and transforms transfer pricing into more of a science than an art. These statistical measures are of assistance when the application of the most appropriate method(s) produces a range of potential arm’s length outcomes instead of single figure (e.g., price or margin). These statistical measures that take account of central tendency to narrow the range (e.g. interquartile range or other percentiles) are relevant in the comparability analysis primarily due to the following reasons:

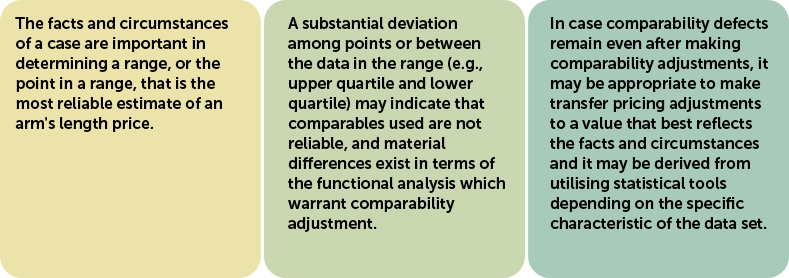

While it could be argued that any point in the full range satisfies the arm’s length principle, there may still be some comparability defects. Therefore, sometimes, it may make more economic sense to apply further measures of central tendency to pinpoint a precise point within the range (e.g. median, arithmetic mean) to conclude the comparability analysis instead of comparison with a range of figures.

The aforesaid theory finds support in the OECD TP Guidelines Chapter III. Now, after understanding the theoretical background and rationale for the use of these statistical measures in transfer pricing comparability analysis, let us explore the practical implications of these principles in Malaysia.

How has this concept evolved in Malaysia?

Historically, and due to the absence of clarity in the Transfer Pricing Rules 2012 (TPR12) on this subject, reliance was placed on the Malaysia TP Guidelines 2017 (TPGL) which prescribe the following:

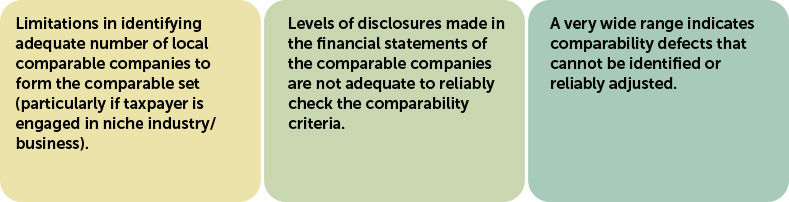

In the past, the Inland Revenue Board of Malaysia (IRB) placed reliance on the above guidelines and preferred the median as the default point of adjustment in transfer pricing audits by citing one or more of the following arguments (non-exhaustive)-

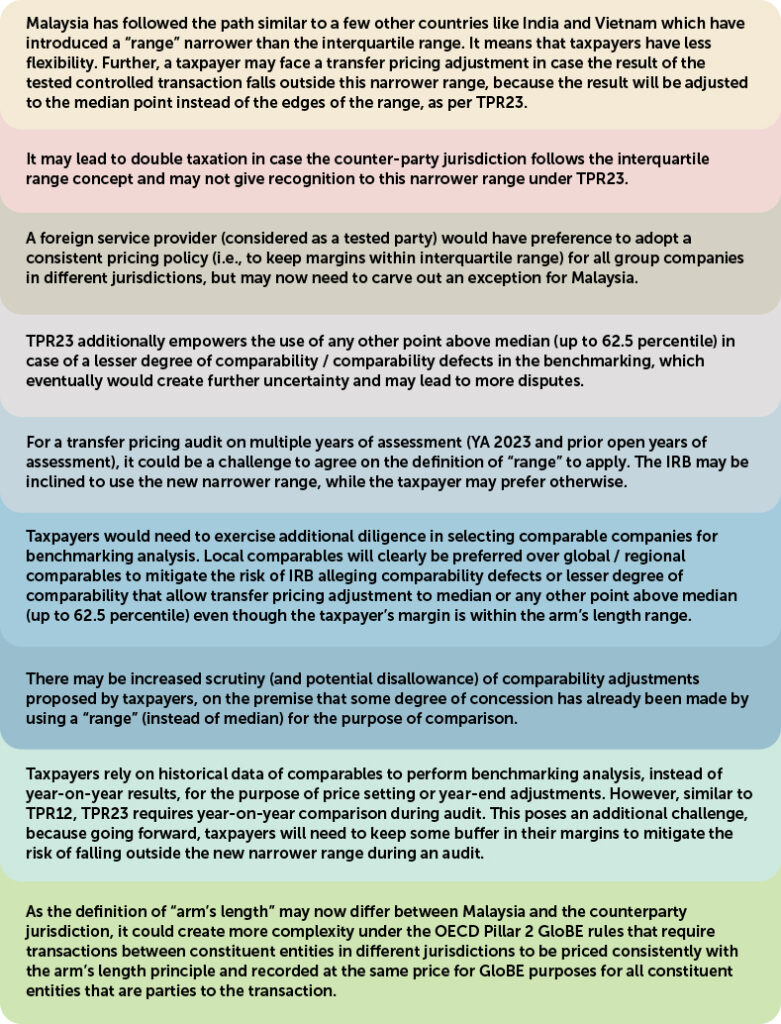

Some taxpayers successfully contested this approach in the Courts¹. However, these disputes were more factual than legal, and the uncertainty persists until a final decision is reached by the Courts, enticing some taxpayers to seek out-of-court settlements as well. Recognising these challenges and the need for alignment with international standards, the IRB embraced the concept of “range” in TPR23, albeit with a narrower definition (37.5 percentile to 62.5 percentile) compared to the customary interquartile range (25th percentile to 75th percentile).

What are the practical implications of the newly introduced range?

It is a welcome move that the IRB has finally given recognition to the “range” concept, albeit with its own flavour. The key features of the newly introduced range are –

- Arm’s length range is considered as a range of figures or a single figure falling between the value of 37.5 percentile to 62.5 percentile of the data set accepted by the IRB during audit.

- Where the price at which a controlled transaction entered by a person is—

- within the arm’s length range, such price may be regarded to be the arm’s length price; or

- outside the arm’s length range, the arm’s length price shall be taken to be the median.

- The Director General may adjust the price of the controlled transaction to the median or any other point above median within the arm’s length range—

- where the uncontrolled transaction is the kind which has a lesser degree of comparability; or

- where any of the comparability defects cannot be quantified, identified, or adjusted.

- Median has been defined as the value at the mid-point of the arm’s length range.

TPR23 is effective for Year of Assessment (YA) 2023, and currently, it is a kind of wait and watch situation to see how the IRB would regulate and implement these during audit. However, it is worthwhile anticipating some potential implications of these changes, as outlined below:

With the anticipated challenges outlined above, it is imperative for taxpayers to closely monitor their transfer pricing results and ensure compliance with the arm’s length principle in both counterparty jurisdictions. Exploring alternative dispute prevention mechanisms, such as bilateral advance pricing arrangements, can provide much needed certainty. Robust operational transfer pricing tools will also be key to sustainable tax transformation.

¹ Director General of the Inland Revenue Board of Malaysia (“DGIR”) v Sandakan Edible Oils Sdn Bhd; DGIR v Procter & Gamble (Malaysia) Sdn Bhd.

Gagandeep Nagpal is Partner | Tax- Transfer Pricing, Deloitte Tax Services Sdn. Bhd.

Thomas Chan Yeu Wai is Director | Tax – Transfer Pricing, Deloitte Tax Services Sdd. Bhd.

The content in this article is the personal view of the author and does not purport to reflect the views of Deloitte Malaysia.