By MIA Financial Statements Review Department

Introduction

Goodwill is an intangible asset that typically arises in the context of business combinations. It represents the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognised. As goodwill can be impacted by fluctuation in market conditions or shifts in the business environment, it is subject to periodic impairment testing to ensure its carrying value does not exceed its recoverable amount. To ensure accurate financial reporting, the discount rate used in impairment testing plays a crucial role in determining the fair value of goodwill. In this article, we will delve into the concept of discount rates, their significance in impairment testing, and the various factors influencing their determination.

Scope

This article intends to share the review findings of the Financial Statements Review Committee (FSRC) relating to the disclosures of discount rates used in the goodwill impairment assessment in financial statements.

The comments discussed herein are intended to be applied within the context of the specific facts and circumstances associated with the identified observations. Hence, it is not intended to be exhaustive and does not address all potential issues that may be raised relating to impairment of goodwill.

Additionally, careful consideration and judgement should be applied in each individual fact and circumstance as the Malaysian Financial Reporting Standards (MFRS) are principles-based. Circumstances may appear similar but different in substance.

Impairment Testing on Goodwill

For entities that prepare financial statements in conformity with the MFRS, MFRS 136 Impairment of Assets describes the requirements for impairment testing of all assets except those assets specifically excluded from the standard’s scope.

When an asset is impaired

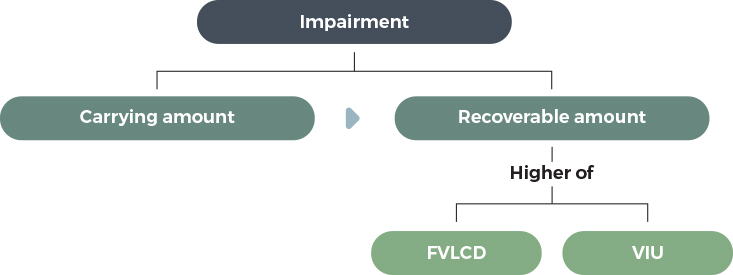

An impairment occurs when the carrying amount of an asset (in this case, goodwill) exceeds its recoverable amount, which is essentially the higher of its fair value less costs of disposal (FVLCD) and its value in use (VIU). In simpler terms, it means the goodwill’s value on the financial statements is higher than the amount at which it is currently recoverable.

For the purpose of impairment testing, goodwill acquired in a business combination shall, from the acquisition date, be allocated to each of the acquirer’s cash-generating unit (CGU), or groups of CGUs, that is expected to benefit from the synergies of the combination. This is irrespective of whether other assets or liabilities of the acquiree are assigned to those units or groups of units. Each unit or group of units to which the goodwill is so allocated shall:

- represent the lowest level within the entity at which the goodwill is monitored for internal management purposes; and

- not be larger than an operating segment as defined by Paragraph 5 of MFRS 8 Operating Segments before aggregation.

A CGU to which goodwill has been allocated is subject to impairment testing at least annually or whenever events suggest a potential impairment.

Estimating recoverable amount using value in use

The recoverable amount of an asset (or a CGU or a group of CGUs) is the higher of its fair value less costs of disposal (FVLCD) and its value in use (VIU). If the carrying amount of the asset exceeds its recoverable amount, an impairment loss is recognised to reduce the carrying amount.

VIU in effect assumes the asset will be recovered through its continuing use and ultimate disposal which reflects the entity’s intentions as to how an asset will be used. Hence, it represents the present value of the future cash flows expected to be derived from an asset or CGU. Estimating the VIU of an asset involves the following steps:

- estimating the future cash inflows and outflows to be derived from continuing use of the asset and from its ultimate disposal; and

- applying the appropriate discount rate to those future cash flows.

Discount Rate in Goodwill Impairment Testing

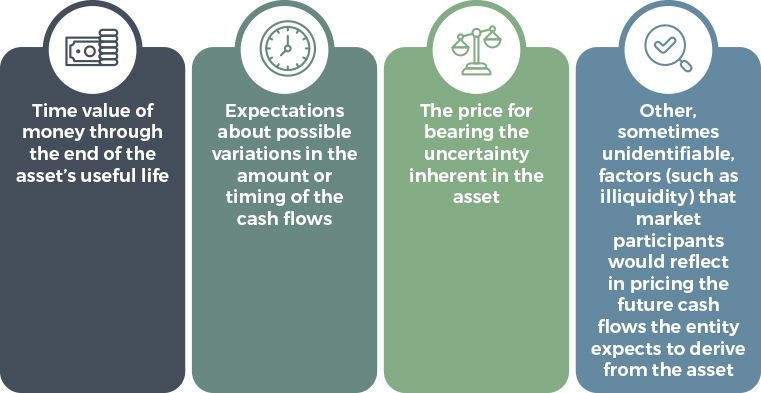

The discount rate applied in impairment testing is a crucial factor in assessing the present value of future cash flows generated by the acquired assets. This rate reflects the time value of money and the risks specific to the asset for which the future cash flow estimates have not been adjusted. It is used to discount future cash flows to their present value, determining the fair value of the CGUs to which goodwill is allocated. The higher the discount rate, the lower the present value of future cash flows, which may increase the likelihood of impairment.

Determining the appropriate discount rate

The discount rate shall be a pre-tax rate that reflects current market assessments of the time value of money and the risks specific to the asset or the CGU being tested for which the future cash flow estimates have not been adjusted.

The discount rate applied to the future cash flows estimates should reflect the return that investors would require, if they were to choose an investment that would generate cash flows of amounts, timing and risk profile equivalent to those that the entity expects to derive from the asset.

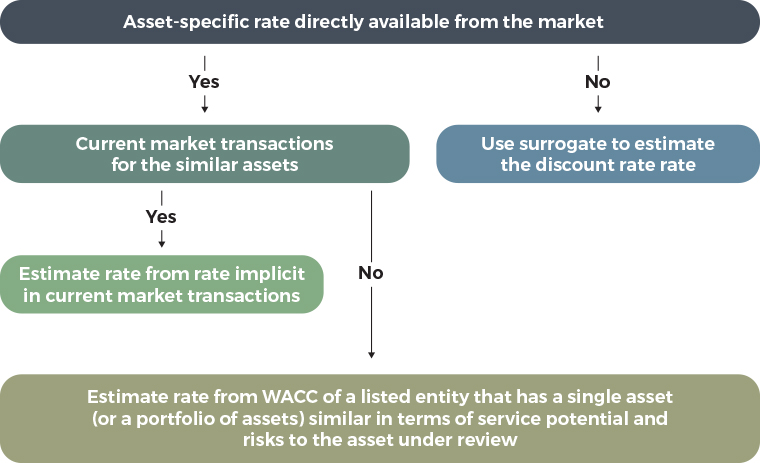

This rate is estimated from:

- the rate implicit in current market transactions for similar assets; or

- the weighted average cost of capital (WACC) of a listed entity that has a single asset (or a portfolio of assets) similar in terms of service potential and risks to the asset under review.

However, the discount rate used to measure an asset’s value in use shall not reflect risks for which the future cash flow estimates have been adjusted. Otherwise, the effect of some assumptions will be double-counted.

For example, considering there is a risk of economic instability, if the future cash flow estimates were adjusted to account for potential economic downturns, incorporating this same risk into the discount rate would essentially be double counting because the effect of economic uncertainty has already been factored into the cash flow projections.

When an asset-specific rate is not directly available from the market, an entity uses surrogates to estimate the discount rate. Appendix A of MFRS 136 provides additional guidance on estimating the discount rate in such circumstances.

The guidance to determine an appropriate discount rate as required by MFRS 136 is illustrated as follows:

It is important to note that determining the discount rate involves judgement, and changes in the discount rate can have a significant impact on the results of the impairment test. Companies typically use market-based data and financial models to estimate the appropriate discount rate for their CGUs.

Further reference shall be made to Appendix A of MFRS 136 on the use of present value techniques to measure VIU as well as determining the appropriate discount rate.

Observations

Below are the observations noted by the FSRC from the review of financial statements of public-listed companies/entities (PLC) relating to the use of discount rate in the assessment of impairment of goodwill.

Observation 1

Impairment losses were recognised on goodwill allocated to one of the PLC’s subsidiaries. The pre-tax discount rate used in determining the VIU was based on the WACC of the CGU.

Response from PLC

The PLC clarified that the discount rates used in assessment of goodwill on consolidation was based on the WACC rate of the PLC extracted from Bloomberg.

The PLC stated that Bloomberg had taken into consideration the country risk and the market risk premium by considering the beta rate, risk free rate and market risk premium in deriving the cost of equity. The management believed that the discount rate applied had been adjusted to reflect the way that the market would assess the specific risks associated with the asset’s estimated cash flows and to exclude risks that are not relevant to the asset’s estimated cash flows or for which the estimated cash flows have been adjusted as per Paragraph A18 of MFRS 136.

The PLC was of the view that the discount rate applied is independent of the entity’s capital structure and the way the entity financed the purchase of the asset.

FSRC’s comments

Paragraph 55 of MFRS 136 states that the discount rate (rates) shall be a pre-tax rate (rates) that reflect(s) current market assessments of: (a) the time value of money; and (b) the risks specific to the asset for which the future cash flow estimates have not been adjusted.

Paragraph 56 of MFRS 136 states that a rate that reflects current market assessments of the time value of money and the risks specific to the asset is the return that investors would require if they were to choose an investment that would generate cash flows of amounts, timing and risk profile equivalent to those that the entity expects to derive from the asset. This rate is estimated from the rate implicit in current market transactions for similar assets or from the weighted average cost of capital of a listed entity that has a single asset (or a portfolio of assets) similar in terms of service potential and risks to the asset under review. However, the discount rate(s) used to measure an asset’s value in use shall not reflect risks for which the future cash flow estimates have been adjusted. Otherwise, the effect of some assumptions will be double-counted. When an asset specific-rate is not directly available from the market, an entity uses surrogates to estimate the discount rate.

Accordingly, the PLC should first assess whether the asset-specific rate for the CGU is directly available from the market by applying the principles in the paragraphs above, in the absence of which the PLC estimates the discount rate using surrogates.

Paragraph A17 of MFRS 136 on the determination of discount rate states that as a starting point in making such an estimate, the entity might take into account the following rates:

- the entity’s weighted average cost of capital determined using techniques such as the Capital Asset Pricing Model;

- the entity’s incremental borrowing rate; and

- other market borrowing rates.

Further, paragraph A18 of MFRS 136 states that these rates must be adjusted:

- to reflect the way that the market would assess the specific risks associated with the asset’s estimated cash flows; and

- to exclude risks that are not relevant to the asset’s estimated cash flows or for which the estimated cash flows have been adjusted.

Consideration should be given to risks such as country risk, currency risk and price risk.

Paragraph A19 of MFRS 136 states that the discount rate is independent of the entity’s capital structure and the way the entity financed the purchase of the asset, because the future cash flows expected to arise from an asset do not depend on the way in which the entity financed the purchase of the asset.

It appears that the discount rate applied by the PLC for impairment testing of the CGU represents the WACC of the PLC itself and not the respective CGUs and does not reflect necessary adjustment taking into consideration the relevant information of other market participants. As guided by MFRS 136, when an asset-specific rate is not directly available in the market, the entity should use a surrogate to estimate the discount rate. The purpose is to derive a market assessment reflecting factor such as:

Hence, if the asset-specific discount rate is not directly available from the market, the management should determine a market consistent discount rate and adjust this rate to take into account factors specific to the asset/ CGU being tested. Adjustments need to be made taking into consideration the market participants’ information. The WACC of the company should be adjusted to reflect the market participant’s view of specific risks associated with the asset/ CGU estimated cash flow. Adjustments might also be necessary to exclude risks that are not relevant to the asset’s estimated cash flows.

Disclosure Requirements

When an entity performs goodwill impairment testing, it is important to provide transparent and comprehensive disclosures regarding the key assumptions and methodologies used in the impairment assessment. These disclosures help stakeholders, including investors and analysts, understand the basis for the impairment test results and the inherent uncertainties involved.

Guidance on the disclosure requirements relating to impairment of assets are stated in Paragraphs 126 to 135 of MFRS 136.

Specifically, in accordance with Paragraph 130(g) of MFRS 136, an entity is required to disclose the discount rate(s) used in the current estimate and previous estimate (if any) of value in use, if the recoverable amount is based on value in use.

In addition, Paragraph 130(f)(iii) requires an entity to also disclose the discount rate(s) used in the current measurement and previous measurement if fair value less costs of disposal is measured using a present value technique.

Conclusion

The discount rate used in impairment testing for goodwill is a crucial element that directly influences the recoverable amount of intangible assets. As a complex interaction of various factors, the determination of the discount rate requires careful consideration of both general market conditions and company-specific characteristics. Regular reviews and updates to the discount rate, coupled with a thorough understanding of the underlying assumptions, are essential to maintaining the accuracy and relevance of impairment testing in financial reporting. By grasping the intricacies of the discount rate, companies can enhance their ability to assess and communicate the true value of their goodwill.