By MIA Financial Statements Review Department

Introduction

Investing in subsidiaries is a common practice for many businesses aiming to expand their market presence, diversify operations, or acquire new technology. However, evolving economic conditions in tandem with market fluctuations, or changes in the subsidiary’s performance may lead to impairments in the value of these investments. Hence, it is vital for businesses to consistently evaluate the net worth of their investments.

Understanding and accounting for impairment of investment in subsidiaries is crucial for financial reporting, as it reflects the economic substance of the investments and ensures that the financial statements provide a true and fair view of the company’s financial position.

Scope

This article intends to share the review findings of the Financial Statements Review Committee (FSRC or the Committee) relating to disclosures made in the financial statements and their accompanying notes to the financial statements. However, it does not delve into matters related to recognition and measurement of impairment of investment in subsidiaries.

Comments discussed herein are intended to be applied within the context of the specific facts and circumstances associated with the identified observations. It is not intended to be exhaustive and does not address all potential issues that may arise relating to impairment of investment in subsidiaries.

In addition, careful consideration and judgement should be applied in each individual facts and circumstances since the Malaysian Financial Reporting Standards (MFRS) are principles-based. Various circumstances may appear similar but different in substance.

Impairment of Investment in Subsidiaries

Impairment of investment in subsidiaries affects the investing company’s financial statements, leading to a decrease in reported assets and net income. It is crucial to have policies and processes in place to monitor whether there are unfavourable events or circumstances that may cause the investments to be impaired. This is to ensure accurate financial reporting and reflection of the investments’ economic value recoverability. Effective impairment assessment is essential for maintaining transparency and providing stakeholders with reliable insights into the company’s financial health and performance.

Applicable accounting standards

For entities that prepare financial statements in conformity with the MFRS, MFRS 136 Impairment of Assets specifies the requirements for impairment testing of all assets, except those assets specifically excluded from the standard’s scope.

Paragraph 2 to 5 of MFRS 136 defines the scope of this standard. Paragraph 4 states that MFRS 136 applies to financial assets classified as subsidiaries, associates and joint ventures (unless measured at fair value and within the scope of MFRS 9 Financial Instruments as stated in Paragraph 2(e) of MFRS 136).

When an asset is impaired

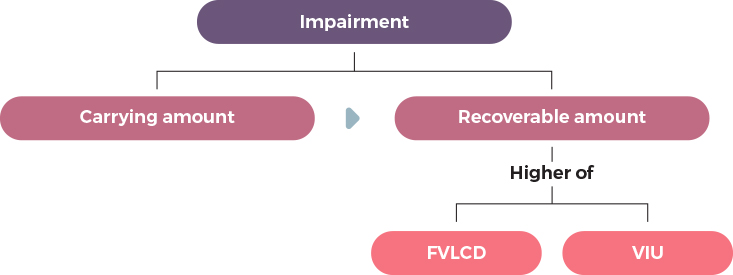

An impairment occurs when the carrying amount of an asset (in this case, investment in a subsidiary) exceeds its recoverable amount, which is essentially defined as the higher of its fair value less costs of disposal (FVLCD) and its value in use (VIU). In simpler terms, it means the investment’s value on the financial statements is higher than the amount at which it is currently recoverable.

Further reference shall be made to Paragraph 6 of MFRS 136 which defines the key terms that are essential in understanding its requirements.

Identifying an asset that may be impaired

At the end of each reporting period, an entity shall assess whether there is any indication that an asset, including investments in subsidiary, joint venture or associate, may be impaired except for certain categories of assets whereby as a minimum, an annual impairment assessment is required (for example, goodwill). If any such indication exists, the entity shall estimate the recoverable amount of the asset.

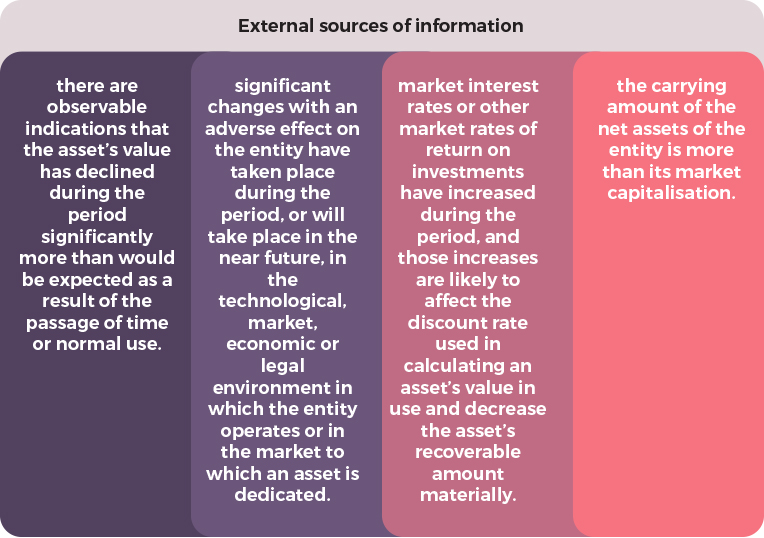

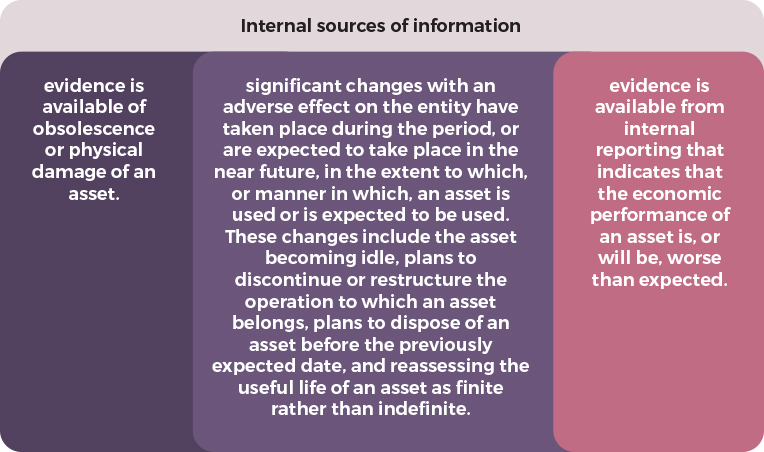

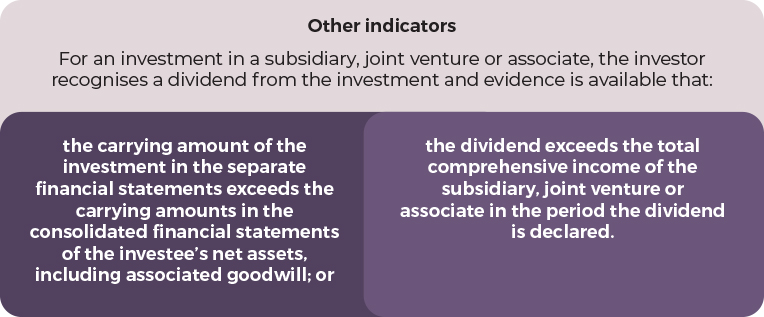

MFRS 136 requires consideration of several indicators that an asset may be impaired, considering both internal and external sources of information. Entities shall consider, as a minimum, the indicators outlined in Paragraph 12 of MFRS 136. However, the list in Paragraph 12 is not exhaustive. An entity may identify other indications that an asset may be impaired.

Disclosure requirements

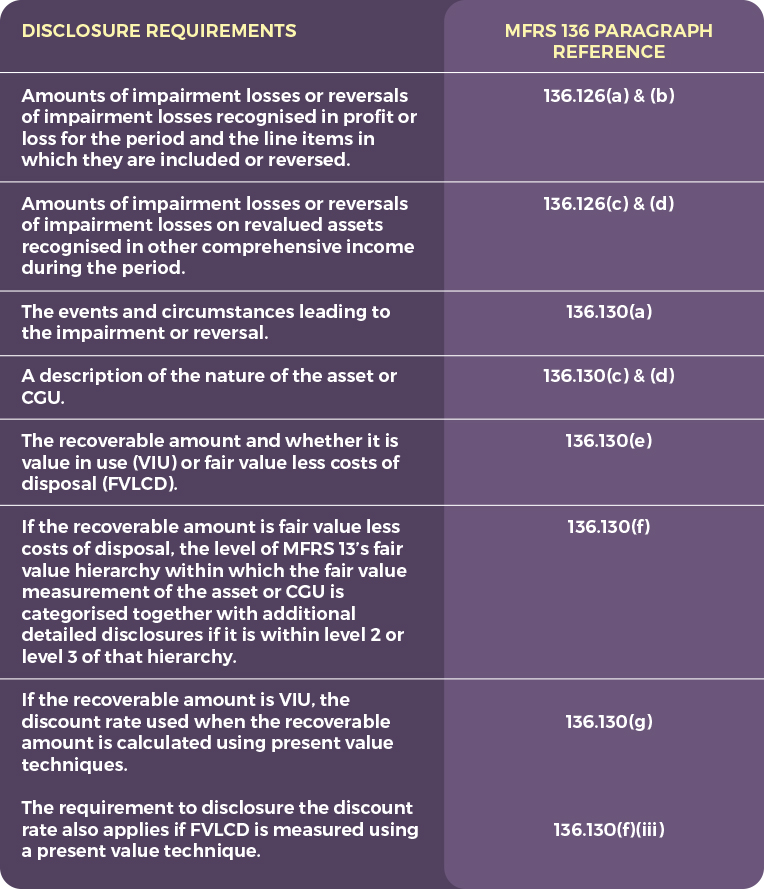

Summarised below are several main disclosure requirements on impairment or reversal of impairment of assets:

Further reference relating to the required disclosure requirements shall be made to Paragraph 126 to 135 of MFRS 136.

Observations

Below are the observations noted by the FSRC relating to the impairment of investment in subsidiaries from the review of financial statements of public-listed companies/entities (PLC).

Observation 1

It was noted that the Company’s total equity is higher than the Group and the Group also recorded a gross loss for the financial year.

There were no additional impairment losses made during the financial year. Instead, a reversal of impairment loss was recognised during the financial year.

There were no other disclosures of whether the Group and Company had considered the impairment indicators and whether any impairment assessment on investment in subsidiaries was performed during the financial year.

Response from PLC

The PLC explained that they have considered the impairment indicator for the investment in subsidiaries, tested the impairment of the investment in subsidiaries and have concluded that the amount of impairment of investment in subsidiaries shall remain as it is (i.e. no further impairment is required for the financial year).

As for the reversal of impairment loss, the PLC clarified that the amount arose from advances previously granted to one of the subsidiaries, which is accounted for in accordance with MFRS 127 Consolidated and Separate Financial Statements and had been fully repaid during the financial year. Following this, the impairment loss previously recognised was reversed during the financial year.

FSRC’s comments

The Committee acknowledged that the PLC have carried out impairment assessment on the investment in subsidiaries. However, there were no disclosures regarding the events and circumstances that led to recognition or reversal of the material impairments.

Paragraph 130 of MFRS 136 clearly outlines the disclosure requirements for each material impairment loss recognised or reversed during the period for an individual asset, including goodwill, or a cash-generating unit. These include a description of events and circumstances that led to the recognition or reversal of the material impairment loss. As such, it was highlighted that necessary disclosures in the financial statements are required to be made in accordance with MFRS 136.

Observation 2

The PLC recognised material impairment loss on its investment in subsidiaries, as the affected subsidiaries reported continued losses.

As disclosed in the notes to the financial statements, the recoverable amounts were determined based on the net assets of the respective subsidiary companies.

There were no other disclosures noted in the financial statements other than the above.

Response from PLC

The PLC clarified that they had calculated the recoverable amount and compared it to the carrying amount of the assets. These subsidiaries are currently in semi-active and inactive status, and they are mainly from property investment and logistics segments which are not the core business of the Group, and highly dependent on the advances from related or holding companies. The PLC was of the opinion that the value-in-use method was not appropriate in determining the recoverable amount and instead, fair value less costs of disposal was deemed to be a more appropriate basis for measuring recoverable amount.

The PLC further added that there are three methods suggested under MFRS 13 Fair Value Measurement in deriving at the fair value, namely market approach, cost approach and income approach and fair value can also be measured using the net assets approach.

The PLC felt that the net assets approach is the most appropriate approach in measuring the fair value of the subsidiaries. By applying the net assets approach, if the Group would like to sell the subsidiaries at cost, it will be assessing the values of assets and liabilities of the subsidiaries. The net assets of the subsidiaries will represent the fair value of the Company and the recoverable amount of the subsidiaries.

FSRC’s comments

Paragraph 6 of MFRS 136 defined recoverable amount as the higher of its fair value less costs of disposal and its value in use, accordingly both amounts should be estimated when an impairment loss is anticipated. Further, “carrying amount of the net assets of the entity is more than its market capitalisation” was cited in Paragraph 12(d) of MFRS 136 as an example of impairment indicator. However, MFRS 136 did not specify net assets as being an appropriate basis for measuring recoverable amount.

Paragraph 18 of MFRS 136 states that recoverable amount is defined as the higher of an asset’s or cash generating unit’s fair value less costs of disposal and its value in use. Paragraphs 19–57 set out the requirements for measuring recoverable amount. These requirements use the term ‘an asset’ but apply equally to an individual asset or a cash-generating unit, and accordingly should be applied when determining the recoverable amount of an investment in subsidiary.

Based on the PLC’s response, it appears that the Group had carried out the impairment assessment whereby the recoverable amount of the subsidiaries was estimated based on the fair value less costs of disposal (instead of “net asset approach”). The disclosure needs to be more concise, stating whether the recoverable amount of the asset is its fair value less costs of disposal or its value in use.

The Committee emphasised that when using the adjusted net asset method to determine the fair value less costs of disposal of an investee’s equity instruments (for e.g. the FVLCD of an investment in subsidiary), the assets and liabilities of the investee recognised in the statement of financial position need to be adjusted to reflect their respective individual fair values, as well as adjusted for the fair value of any unrecognised assets and liabilities at the measurement date. Consequently, the resulting fair values of both recognised and unrecognised assets and liabilities should represent the fair value of the investee’s equity (rather than simply relying on the carrying amount of the net assets in the investee’s financial statements which may not be at fair value). Where applicable, the existence of other factors might result in the need for additional adjustments such as for lack of liquidity on unquoted equity instruments.

The Committee wishes to highlight the disclosure requirement in accordance with Paragraph 130 (e) of MFRS 136 which states that for an impairment loss which has been recognised or reversed during the period, an entity shall disclose the recoverable amount of the asset (cash-generating unit) and whether the recoverable amount of the asset (cash-generating unit) is its fair value less costs of disposal or its value in use.

Conclusion

The impairment of investment in subsidiaries holds significant importance in financial management for companies. Recognising and accounting for impairments accurately is vital for transparency in financial reporting and to facilitate informed decision-making. Regular assessments and monitoring of events or circumstances that may indicate impairment, adherence to accounting standards, and MFRS 136-compliant disclosures ensure that stakeholders are informed about the true financial health of a company in relation to its subsidiary investments.

By understanding and proper accounting for impairment of investment in subsidiaries, entities can proactively manage and mitigate risks and navigate challenges in their investment portfolios. This would also enable entities to maintain transparency and adherence to accounting standards, thereby fostering trust and confidence in financial markets.