By Sustainability, Digital Economy and Reporting Team

Introduced in 2023 by the Malaysian Institute of Accountants (MIA), the Digital Technology Adoption Awards (DTAA) aim to continue advancing the digitalisation efforts of the accountancy profession in Malaysia. The DTAA sets out three main objectives:

- Promoting technology adoption

- Raising awareness of digital adoption impact

- Recognising digital adoption

In this third edition, the DTAA Winners in Action proudly spotlights CCL & Partners PLT, the recipient of the prestigious ‘Top Excellence Award’ in the Audit Software category for practices with 10 to 49 employees. Discover the strategies that propelled them to this well-deserved recognition in an insightful interview with Yap Yau Loong, Audit Partner of CCL & Partners PLT!

Why did you adopt technology?

Before adopting digital technology, we faced several significant challenges that impacted efficiency, accuracy, and client service. The firm’s audit processes were largely manual (such as using spreadsheets as the main audit working paper), making audits time-consuming and prone to human errors.

Data management was another major challenge where information stored in scattered locations led to security risk. The lack of integrated systems made it difficult to provide real-time insights or perform in-depth data analysis, limiting the firm’s efficiency in performing analytical review and spotting unusual transactions.

Collaboration within teams was inefficient due to the absence of centralised tools, and inconsistent audit methodologies led to variations in the quality of audit results.

Client expectations for faster audits, real-time reporting, and value-added insights were hard to meet with outdated processes. Additionally, we were also facing increased competition from more digitally advanced firms.

What technologies have you adopted?

To address the challenges above, we have adopted several key digital technologies aimed at improving efficiency, accuracy, and client service which includes the implementation of audit software. This has led to streamlined workflows, automated compliance tracking, and reduced manual errors.

A cloud-based document management system is embedded in the audit software, enabling real-time access to data and enhancing client communication. Meanwhile, automated reporting tools within the audit software allow us to generate real-time, customised audit reports, reduces repetitive tasks and manual work as well as minimises errors. This facilitates teamwork and consistency across audits, even with remote teams.

How was your digital technology implementation journey?

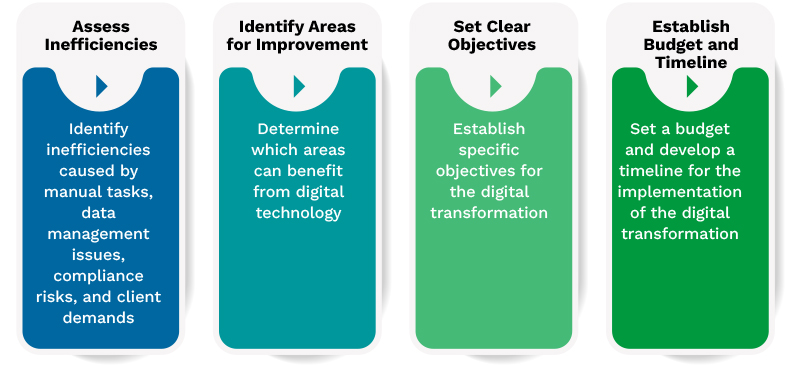

The journey of implementing digital technology involves several key steps and milestones, from initial assessment to full adoption and optimisation.

Initial Assessment and Planning

Vendor Selection and Technology Evaluation

We conducted evaluation of audit software, data analytics platforms, cloud storage providers, and cybersecurity solutions. Vendors were assessed based on their ability to meet the firm’s specific needs.

Training

Training programmes were organised to familiarise the staffs with the software and its capabilities.

Pilot Testing

A pilot project was launched to test the technology in a controlled environment. We started with a selected group of clients to ensure that the software is functioning properly.

Full Implementation

After successful training and testing, the audit software was fully implemented. The firm now has access to real-time data and automated workflows to handle audits more efficiently.

What is the impact of your technology adoption?

The adoption of digital technology has transformed the firm into a more agile, efficient, and client-focused organisation and the impacts are as follow:

Increased Efficiency

Automated workflows reduce the need for manual tasks, such as data entry and sample selection, allowing us to focus more on the high risks or material misstatement of financial statements.

Reduced Errors

The implementation of audit software has a direct impact on the accuracy of audits. Automation reduces human error, and advanced data analytics allow auditors to identify anomalies and unusual transactions with greater precision.

Improved Client Satisfaction

With digital technology enabling real-time reporting and faster audits, clients experience quicker service delivery and enhanced responsiveness from the firm.

Greater Compliance

The ability to stay compliant with evolving regulations, such as International Standard on Quality Management (ISQM), International Standards on Auditing (ISA) and the Companies Act 2016 in Malaysia improves dramatically.

Cost Reduction

The reduction in labour-intensive tasks means that fewer resources are needed to complete audits, allowing the firm to allocate staff to other areas. This leads to lower operational costs without compromising the quality of service.

Real-time Insights and Decision-Making

The firm now has access to real-time data, dashboards, and advanced reporting tools that provide instant insights into ongoing audit engagements.

Competitive Advantage

The ability to provide faster, more accurate, and data-driven audits differentiates the firm from others in the market. This helps attract new clients and retain existing ones, particularly those looking for more technologically advanced audit services.

What is your future digital technology plan?

After achieving digital transformation in audit processes, we may explore enhancing several other key areas such as:

Client Relationship Management (CRM)

Implementing a digital CRM system will better manage and track client interactions, communication history, and engagement details.

Human Resources (HR) and Talent Management

Enhancing HR processes with digital tools could streamline employee recruitment and enrolment, performance management, and training.

Do you have any tips to share with the readers?

Here are some key pieces of advice and best practices:

Start with a Clear Digital Strategy

Assess your organisation’s current challenges, processes, and goals. Identify specific areas where technology can drive improvement, such as reducing manual labour, enhancing client service, or improving compliance.

Conduct a Thorough Needs Assessment

Take the time to understand your organisation’s specific pain points and areas where technology can bring the most value. Avoid adopting technology for the sake of it.

Choose Scalable and Flexible Technologies

Opt for technologies that can scale with your business. As your organisation grows, so should your digital solutions.

Engage and Train Employees

Resistance to change is common, therefore invest in training programmes to equip employees with the skills needed.

Prioritise Client Experience

Ensure that any new technology you adopt enhances the client experience.

Plan for Continuous Improvement

Digital transformation is not a one-time event but an ongoing process. Technology evolves rapidly, and so should your organisation’s use of it. Stay informed about new tools, updates, and innovations.

Why did you participate in the DTAA?

We decided to participate in the DTAA to enhance our digital capabilities and align with industry best practices. One of the primary motivations for participating is to assess our current digital maturity level compared to industry standards. The assessment provides valuable insights into strengths and weaknesses, helping to identify areas that require improvement and guiding future digital initiatives.

We learnt from the participation process that the adoption emphasises the need for a comprehensive approach to digital transformation. It is not just about adopting new technologies; it also involves culture, processes, and people. We learned to focus on enhancing our digital culture and ensuring that employees are equipped with the necessary skills.

What is your advice to aspiring participants of the DTAA in the future?

We would advise future participants that, to gain the most value from technology adoption, they should be candid about their current digital capabilities and challenges. Acknowledging areas for improvement will provide a more accurate assessment and lead to actionable insights.

Before participating, define clear goals and objectives for your digital transformation efforts. Having specific targets will help guide the assessment process and ensure that the outcomes are aligned with your organisation’s strategic vision.

For more information about the DTAA and the complete list of winners, click the links below: