By Thenesh Kannaa

Until a few years ago, the tax structuring works for investors making inbound investments into Malaysia were mostly focused on the tax considerations in their home country. Malaysian tax implications were almost taken for granted given the absence of dividend withholding tax and Capital Gains Tax (CGT). The focus for most investors has conventionally been centred on obtaining tax incentives to manage the corporate tax exposure and indirect tax exposure (sales tax and Customs duties).

But a lot has changed in recent years with the introduction of CGT in 2024 and Earnings Stripping Rules (ESR) in 2019. The introduction of 2% dividend tax does not have an impact except in cases where the investment is made directly by an individual.

This article details tax considerations of various forms of inbound investment by foreign investors.

Equity Investment

There is no stamp duty when a company issue shares in consideration for funds from its shareholders. Careful investors start with the end goal in mind. If there are plans to divest the Malaysian company at some point, share sale would be subject to both stamp duty and, from 1 March 2024, CGT.

CGT applies, among others, on any gains arising from disposal of shares of a Malaysian company (other than those listed on the stock exchange) by a corporate shareholder (or trust body, limited liability partnerships or co-operative societies).

For such transactions, the general rate of CGT is 10% of the gain. As a transitionary measure, for disposals of shares acquired prior to 1 January 2024, the disposer is given a choice to pay CGT at either 10% of the gain or 2% of disposal value.

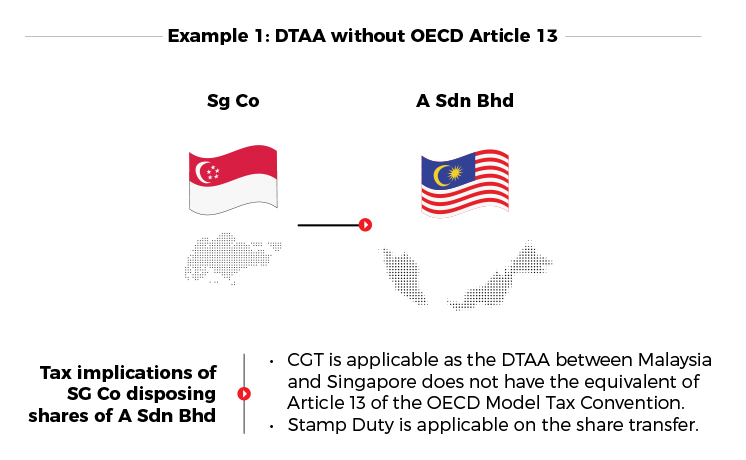

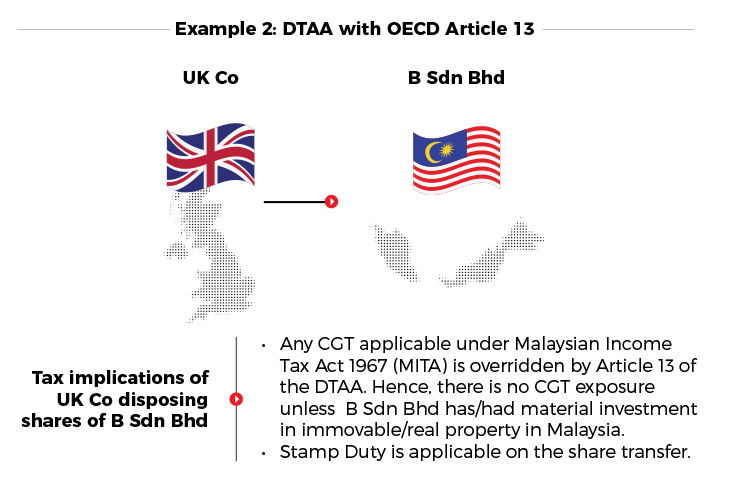

Foreign companies that dispose shares of a Malaysian company are in-scope for Malaysian CGT, but in some cases, treaty protection applies to restrict Malaysia from imposing CGT on such a transaction.

Tax treaty, more formally referred to as Double Tax Avoidance Agreement (DTAA), is an agreement entered into between two (2) jurisdictions to avoid or alleviate (minimise) territorial double taxation of the same income by both jurisdictions. Malaysia has entered into over 70 of such DTAAs. Each DTAA is unique, but the bilateral negotiation takes place based on certain ‘templates’ such as the OECD Model Tax Convention.

Para 5 of Article 13 of the OECD’s model tax convention allows CGT to be imposed only by the jurisdiction in which the disposer is a tax resident. Hence, the source state’s (in this case, Malaysia’s) taxing right would be eliminated – and this applies regardless of whether the resident state actually imposes tax on the gains arising from the disposal.

A notable exception to para 5 is provided in para 4 of the same Article. The exception applies when more than 50% of the value of the company whose shares are being disposed is derived from immovable property (a.k.a. real property) in the source state (Malaysia). In such a case, the source state has unrestricted taxing right (as does the resident state, subject to the relief mechanism provided in Article 23 of the OECD Model Tax Convention).

A crucial practical point is that not all DTAAs entered by Malaysia adopt Article 13 of the OECD Model Tax Convention. In such a case, Malaysia is likely to have the unrestricted right to impose CGT regardless of whether the Malaysian company (whose shares are being disposed) owns real property.

Here are some examples to illustrate the application of the a forestated principles.

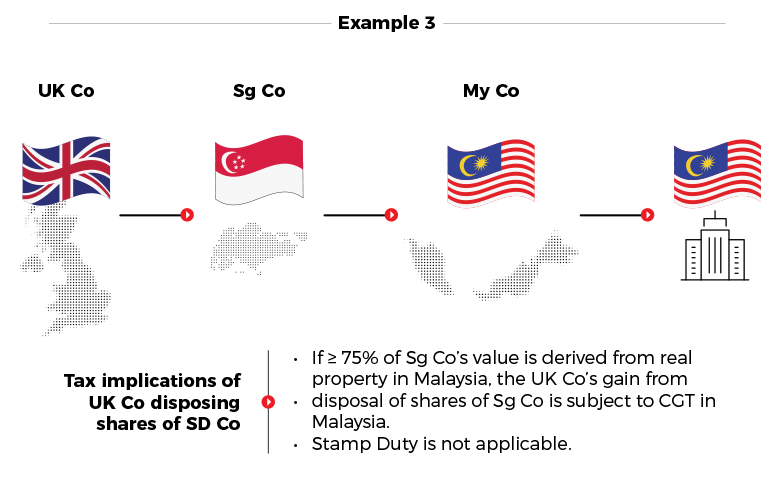

Indirect transfer rules

Let’s say a United Kingdom company (UK Co) sells shares of a Singapore company (Sg Co), therefore one might not ordinarily think of tax exposure in Malaysia. However, if Sg Co derives (directly/indirectly) at least 75% of its value from Malaysian real property, the UK Co is required to pay CGT in Malaysia on any gain arising from disposal of shares of Sg Co. This is provided for in Section 15C of the MITA and is usually not disturbed by DTAA provisions (due to para 4 of Article 13).

Application of Section 15C is a fairly sophisticated process as the determination of whether the 75% threshold is met is not necessarily based only on the value on the date of disposal of the foreign shares. Hence, taxpayers should seek professional support for a thorough assessment.

Capital Reduction/Liquidation

CGT exposure is not limited to sale of shares. Transactions such as capital reduction or even liquidation of a company also have potential CGT implications.

Concluding thoughts in relation to equity investment

CGT implications upon future exit are not dependent on the jurisdiction of the ultimate parent entity, but the immediate holding company which makes the investment into the

Malaysian company. In that regard, multinationals with multiple group entities which are in a position to make the investment must make a conscious decision weighing all relevant factors including CGT and stamp duty implications upon future exit.

Investment via Intragroup Debt Financing

Equity is not the only form of investment in Malaysia for multinationals. Investments may also be made by way of debt financing.

Unlike equity financing, debt financing allows repayment to be made without much hassle. However, in line with transfer pricing principles, the debt financing must be subject to arm’s length interest.

Outbound interest payments are subject to 15% withholding tax, but many DTAAs allow lower withholding tax rates to be applied.

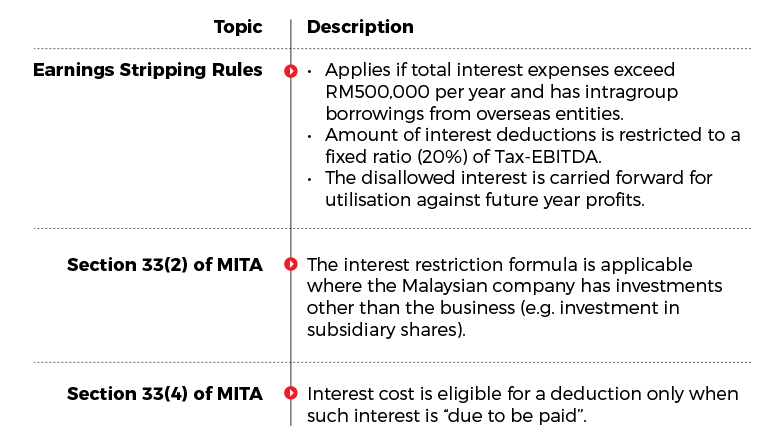

Interest cost is qualified for tax deduction, subject to the following limitations:

While in many cases intercompany debt could be commercially apt and tax-efficient due to corporate tax savings that outweigh withholding tax exposure, careful consideration is needed on the various limitations that apply for deduction (in particular ESR) and compliance to transfer pricing requirements.

Hybrid Instruments

There is a host of instruments that neither meet the ‘classic features’ of equity instruments nor debt instrument. This includes, but is not limited to, preference shares.

Preference share is a popular form of intragroup financing given the non-application of interest and ease of capital repayment.

IRBM issued Guidelines on Hybrid Instruments dated 19 June 2024, whereby the following factors have been outlined to determine whether a hybrid instrument is equity or debt for tax purposes:

- The source from which the principal will be repaid, and the distributions or profits will be paid, as well as the order in which they will be repaid in case of liquidation or dissolution.

- Right to enforce payment of distributions or profits and repayment of principal by the instrument holder.

- Right of recovery in the event of default.

- Maturity date of instrument.

- The ability of the issuer to obtain loans and make payment on an arms’ length transaction.

- Involvement of the instrument holder in the management of the issuer’s business/operations.

- Benefit to the instrument holder.

The redemption of equity instruments is potentially subject to CGT implications. For example, redemption of preference shares is likely subject to CGT. Even in cases where the redemption price is the same as the issue price, there are concerns arising from the requirement to use market value for transactions between connected persons. For investors who plan ahead, treaty protection may preclude application of CGT or redemption of preference shares.

Other Considerations

As always, a tax incentive is a key (not sole) consideration for choice of investment destination. Malaysia has a host of tax incentives which are offered in the form of preferential tax rate, income-based exemption or capital expenditure (CAPEX)-based exemption. Often, investors are in a position to choose between CAPEX-based exemption or income-based exemption (or preferential tax rate). Depending on the projected financials, each investor’s preference may vary.

Regardless, companies which are part of a group with more than EUR750 million in consolidated revenue must take into account the Pillar Two top-up tax implications.

Amid the United States of America’s recent decision to withdraw from this initiative, the GloBE rules are part of the Malaysian tax law and hence must be complied with.

The Government has announced that the New Investment Incentive Framework (NIIF) will be rolled out in the third quarter of the year. It should incorporate a scorecard approach to evaluate investments to ascertain if these qualify for incentives.

Investors should consider appealing for longer incentive periods with partial exemption in order to meet the global minimum tax rate of 15% while also realising the intended benefits of any existing or newly sought tax incentive.

Some investors may be in the position to pursue the Strategic Investment Tax Credit, which grants an amount which could be offset against tax payable – but the Malaysian Government is likely to be very cautious in granting such credits due to the liability on the government to pay investors the grant amount if not utilised against tax payable within four (4) years (a rule imposed by OECD).

Concluding Thoughts

The Malaysian tax system is now more comprehensive than it used to be. Hence, more careful thought is needed with regards to structuring an investment in Malaysia. What used to work well three to five years ago may not be the best strategy today. It is vital to not assume a ‘business as usual’ mindset and continue applying investment and intragroup financing/investment strategies from the past. It is now more important than ever for investors to make conscious choices in determining every aspect of an investment structure.

Thenesh Kannaa is Executive Director of TRATAX Sdn Bhd and Asia-Pacific International Tax Leader of WTS Global. The views expressed above are his own. This article has deliberately simplified matters in the interest of brevity.