By MIA Sustainability, Digital Economy and Reporting Team

The Malaysian Institute of Accountants (MIA) hosted the inaugural Digital Technology Adoption Awards (DTAA) Presentation Dinner to celebrate and encourage excellence in digital transformation within the accountancy profession. During the awards presentation dinner held at MITEC Kuala Lumpur in May 2024, fourteen outstanding winners were announced.

Launched in 2023, the DTAA is part of MIA’s ongoing efforts to advance digitalisation, in alignment with the MIA Digital Technology Blueprint introduced in 2018. The DTAA is driven by three key objectives:

- Promote the adoption of technology by showcasing success stories from across the accountancy profession.

- Raise awareness of how accountants can drive business and economic growth through digital technology.

- Recognise achievements in digital adoption, inspiring others to follow suit.

In this series of the DTAA Winners in Action, hear from our Top Excellence Award recipient for tax processes: PricewaterhouseCoopers Taxation Services Sdn Bhd (PwC). Read the exclusive interview with Richard Baker, PwC’s Tax Director, and discover how the firm harnessed the power of digital transformation to enhance their tax practices and achieve outstanding success in the DTAA. Learn about their innovative strategies and get an inside look at how PwC is setting new benchmarks in the world of tax practices.

What was the inspiration behind adopting technology in your work?

Our work involved a large amount of data entry and subsequent analysis. This data entry could involve up to 1,000 pages of a document per project, which then had to be entered into Excel and analysed manually. Due to the magnitude of this task, each project took several weeks to complete. With data and analysis being performed by different members of the team, there were also slight inconsistencies in the data entry, analysis and inevitably some mistakes due to human error.

What technologies have you adopted?

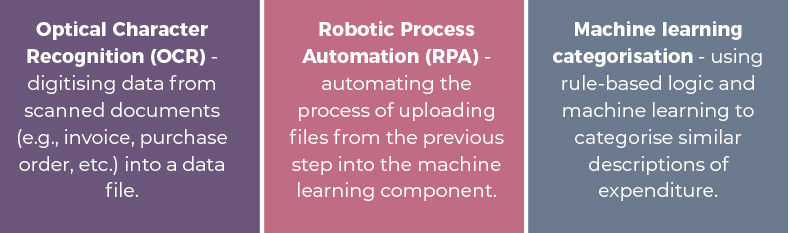

The Capital Allowances Automation Solution (CAAS) is a solution developed in-house by PwC Malaysia, used internally for the analysis of fixed assets for the purpose of capital allowances. The solution was created to bring greater efficiency in data entry, categorisation, and analysis of expenditure. It addresses the key challenge of inconsistencies in the treatment of similar expenditure, which depends on individual reviewers due to the absence of specific definitions or a prescribed list of what is deemed qualifying expenditure. The solution can minimise these inconsistencies by applying logic and machine learning to decide whether an item is a qualifying expenditure or not.

The solution has three main components:

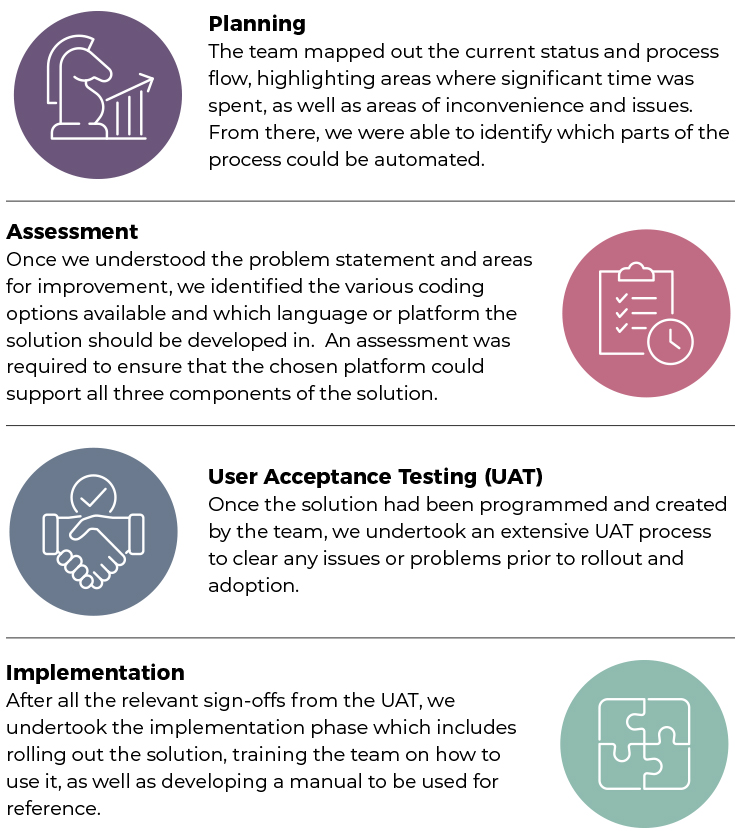

How was your digital technology implementation journey?

What is the impact of your technology adoption?

The use of the solution has allowed us to take on more work with a similar headcount as it automates some parts of the work process such as data entry which requires human effort. Human errors in data entry or mistyping of numerical information have been prevented through the adoption of this solution. It has also enabled us to spend more time and focus on analysis, technical justification and case law interpretation. Additionally, it has freed up our clients’ time by eliminating the need to ‘prepare’ the data or documents as our solution can accept documents in any format (including handwritten or scanned).

The adoption of the solution has resulted in reduced costs for delivering the work and in turn, significantly increased our margins for each project. As an estimate, for each project, we are able to save on average 50 – 75 hours, allowing this time to be spent on more value-adding work, such as detailed analysis of the scenario, case law and legislation by our technical subject matter experts.

In addition to the above, the solution has improved staff morale immensely. The team is no longer required to undertake the mundane and tedious task of data entry. They are now able to engage in more intellectually stimulating tasks by reviewing expenditures and applying logic, using their technical understanding of why items are qualifying, providing justification and reasoned arguments.

What are some of your efforts in implementing technology?

We have already implemented numerous other digital transformation and automation projects subsequent to this. As an example, we have automated the extraction of data from financial statements as well as several internal processes such as timesheet entry, expenses claims and verification.

Do you have any tips to share with the readers?

A key lesson learned during this adoption journey is the importance of identifying the issues and areas for improvement from the outset. As we progressed with the project and gained a deeper understanding of technological advancements, we discovered areas where technology could offer solutions—ones we initially thought were impossible and hadn’t considered. This experience taught us the value of listing all the ‘nice-to-have’ features, rather than dismissing them outright due to a lack of understanding of their technical feasibility.

The UAT is also critical where a significant amount of time should be dedicated to it and not rushed. During the UAT, we were able to identify numerous errors and issues as it was carried out by staff with different levels of experience and knowledge. Some of the key errors and bugs were identified by the most junior members of staff, who had fresh perspectives, allowing them to spot issues that might have been overlooked by more experienced colleagues. Identifying them at the UAT stage has enabled us to rectify the issues, which was significantly easier than amending a fully released version.

Why did you participate in the DTAA?

At PwC, we are committed to driving digital transformation. Our journey has been about evolving the way we work, upskilling our workforce, embracing new technologies and fostering a culture of continuous innovation. The DTAA aligns perfectly with our mission to build trust and deliver sustained outcomes through digital excellence. Participating in the DTAA has provided us with invaluable insights and an opportunity for self-reflection. It has allowed us to benchmark our progress against industry peers and continuously improve our practices.

What is your advice to aspiring participants of the DTAA in the future?

To aspiring participants of the DTAA, my advice is to start preparing early. Familiarise yourself thoroughly with the award criteria, gather measurable outcomes of your digital initiatives, and highlight the tangible impacts of your technology adoption. There are benefits to gaining industry recognition and networking with peers. Use this experience as a platform to showcase your achievements and inspire others.

For more information about the DTAA and the complete list of winners, click the links below: