By Phang Oy Cheng

On 19 September 2023, the final recommendations for the Taskforce for Nature-related Financial Disclosures (TNFD) were launched. The TNFD comprises 40 members representing financial institutions, corporations, and market service providers with over USD20 trillion in assets. With funding provided by several governments and organisations, the TNFD guidelines are meant to make biodiversity reporting consistent with other financial and sustainability reporting frameworks such as the International Sustainability Standards Board (ISSB) and the Taskforce on Climate-related Financial Disclosures (TCFD) recommendations. This is to ensure that a unified approach is taken in environmental, social and governance (ESG) and financial disclosures.

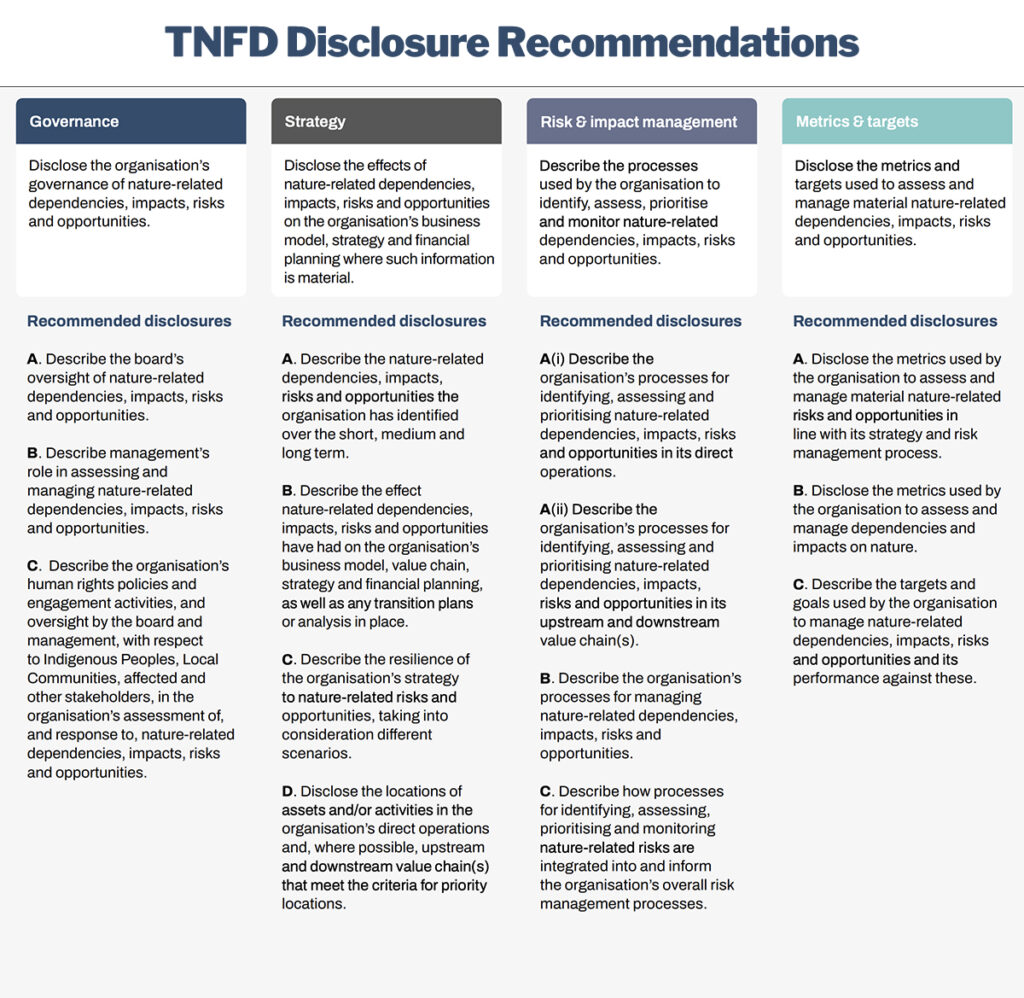

Source: Recommendations of the TNFD

The principles of ensuring good governance include a comprehensive approach towards managing a company’s impact on biodiversity and associated social issues, effecting strategic outcomes over short, medium and long term across the business model and value chain. This approach will also integrate substantively nature-related risks and impacts across the company and value chains, through the adoption of metrics and targets with clearly defined, measurable goals.

TNFD recommendations were crafted as a framework for identifying business risks and dependencies on nature, cross-utilising many other frameworks developed. For example, for companies seeking to develop goals for action, the Science Based Targets Network (SBTN) is referred to, where companies will find a specific process for setting measurable targets for areas like water and land use. However, while these guidance documents provide direction on how a company may identify goals, they do not offer specific initiatives that companies should undertake to protect biodiversity.

In essence, the TNFD recommendations, SBTN and other related guidelines recognise that context and individual circumstances matter, which reinforces the fact that one-size solutions do not exist. The intent of these guidelines is to enable companies to begin their journey of self-examination while developing appropriate strategic actions suited to their circumstances. However, the flexibility of the framework could also mean savvy reporters could pick and choose easy wins, while masking more difficult issues, as it is not mandatory for companies subscribing to the TNFD recommendations to report on all 14 recommendations. The risk of greenwashing increases when the disclosure of negative impacts is optional.

While the TNFD recommendations have achieved the initial goal of equipping businesses with a framework to assess their nature and biodiversity risks, in actual practice, the types of initiatives to be undertaken by companies to highlight their role in inhibiting biodiversity loss and stimulating ecosystem regeneration remain hazy. Nevertheless, it must be recognised that TNFD recommendations have accelerated a global dialogue among companies about the urgency of protecting the natural world. This, at least, is a step in the right direction.

While this situation remains, companies should not be discouraged from exploring various possibilities. Here are five clear actionable categories that can be leveraged to build robust biodiversity protection plans:

1. Land footprint

Leaving virgin land intact is at the heart of biodiversity conservation. Minimising the use of land for business operations entails a thorough review of existing land utilisation to identify ways to optimise. Consider the option to expand vertically instead of horizontally, which can already be seen in examples set by vertical farming. Companies whose industries are land-based can further consider reducing their land footprint by adopting innovative technologies that increase the productivity and biodiversity features of their working lands.

2. Toxicity

What happens within a value chain matters. Biodiversity conservation becomes real only when companies are able to reduce the volume of toxic chemicals throughout their entire value chains, as soil and water pollution are primary contributors to biodiversity decline. Preventive actions can include a shift towards the use of bio-based materials and investing in sustainable innovations so that biodiversity-friendly practices can be deeply embedded into the corporate blueprint.

3. Ecosystem restoration

This action encourages companies to have deeper situational awareness of how their business impacts the ecosystems within which they operate, both positively and negatively. Companies should note that their commitment towards biodiversity conservation can also be measured by the level of their community engagement. Through collaboration with local communities, including conservation groups and indigenous tribes, companies can develop specific restoration strategies designed to protect ecosystems for the long term.

4. Circular solutions

Incorporating circularity enables the integration of circular practices through the end-to-end stages of product creation, beginning from the product R&D and design process, thereby ensuring that products and systems are inherently sustainable, resource-efficient, and capable of being easily repaired, reused, refurbished, and recycled. These circularity principles can be applied across business units using ubiquitous procedures and processes.

5. Culture

Ultimately, behaviour determines the effectiveness and sustainability of the company’s biodiversity conservation efforts. Instilling the right organisational culture that encourages proactive actions and rewards exploration allows employees to be positive enablers in achieving a shared ambition.

Beyond these five actionable areas, companies seeking to understand how to apply and report on the TNFD can consider the following suggestions:

- Understand the requirements: While the recommended disclosures are very similar to those recommended by the TCFD, and consistent with the IFRS Sustainability Disclosure Standards, the TNFD recommendations have been developed to allow transparency and accountability in business behaviour by allowing companies to identify and incorporate nature-related risks and opportunities within their strategic planning.

- Identify gaps: In understanding key areas for improvements, companies would be able to determine appropriate allocation of resources and effort. Essentially, take the initiative to learn what one knows and what one doesn’t.

- Value-add to nature: Understanding nature-related impacts and risks means companies would be able to put a financial value to these risks and impacts. Methodologies provided in the TNFD include Natural Capital Accounting, amongst others.

- Data, data, data: Data is crucial, and just as important are the metrics of measurement. Most companies will start by reviewing the depth of data being collected within the organisation; once it’s understood what the risks and impacts are, then it will be easier and clearer to draw correlations between daily data collection and nature-based issues.

Choosing the right metric depends on how a business impacts the ecosystems and is also impacted by them. Ergo, this emphasises the importance of good data quality. Thus far, there is no single metric that adequately covers ecosystem-related impacts. - Wholesome reporting: Avoid the tendency to only report or overemphasise the positive aspects in an attempt to gloss over possible transgressions. Being forthright, transparent and accountable are the rules of the game in this instance. It is more important to report a company’s improvement plans to meet niggly investor questions and concerns.

Preserving nature and its capacity to contribute to sustainable economic growth is a consequential challenge, bringing with it significant risks to corporate and financial stability, but also opportunities. Whether an organisation is exploring biodiversity conservation initiatives by choice or mandate, there should be a shared awareness that all companies are standing at a crossroads, and it is past time to make the important decisions that will protect our collective future.

This article is the view of Phang Oy Cheng, a member of the MIA Integrated Reporting Committee. Oy Cheng is also the Head of Sustainability Advisory in KPMG Malaysia.

The views expressed herein are those of the author and do not necessarily represent the views and opinions of KPMG Management & Risk Consulting Sdn. Bhd.