The Malaysian Institute of Accountants (MIA) is proactively advancing its sustainability agenda to enable future-proofing of the profession.

The MIA Sustainability Blueprint for the Accountancy Profession launched in June 2024 sets out four overarching aspirations of the accountancy profession on sustainability. For each sector of the accountancy profession, namely – commerce and industry, public practice, public sector and academia, a set of competencies (referred to as ‘guiding principles’ in the Blueprint) has been identified to help accountants build their skills in sustainability, with three maturity levels – foundation, intermediate and advanced. The competencies include having understanding and knowledge of sustainability concepts and advocating sustainability.

As MIA embarks on its role in advocating sustainability within the profession, it has developed the MIA Sustainability Roadmap to facilitate the implementation of the Blueprint. Based on the aspirations and guiding principles set out in the Blueprint, 169 initiatives were grouped into three themes – capacity building, tools and guidance, as well as advocacy – to be implemented across 3 phases from January 2025 to December 2029.

As part of capacity building efforts set out in the Roadmap, MIA has curated the top sustainability news since January 2025 to enable accountants to stay updated on the latest trends and regulations.

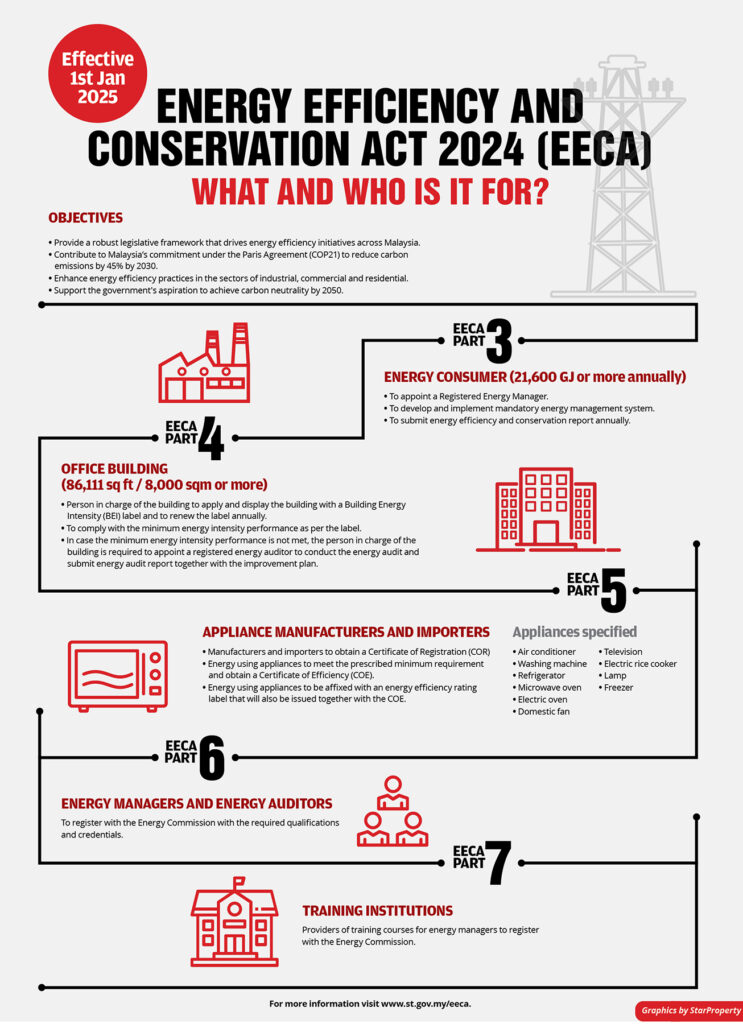

Energy Efficiency Act (EECA) 2024

The Energy Efficiency and Conservation Act (EECA) 2024 was enacted to regulate the efficient consumption and conservation of energy in Malaysia. The Act, effective January 2025, aims to improve energy efficiency across various sectors, reduce energy waste, and support the country’s environmental goals, including carbon neutrality by 2050. The Act applies to large energy consumers, specific buildings, and energy-using products, setting out the roles and responsibilities of stakeholders to ensure compliance with energy efficiency standards.

The Energy Commission is responsible for overseeing the implementation of the EECA 2024. Its functions include advising the Minister on energy efficiency policies, recommending laws and measures, promoting private sector investments, setting energy efficiency targets, and enforcing regulations. The Commission also has the power to conduct studies, audits, and research, as well as to publish information and statistics related to energy efficiency¹.

The Act promotes public awareness and education on energy conservation and calls for active participation from public and private sectors. The Act marks a significant step in Malaysia’s journey toward energy security, emissions reduction, and a more sustainable economy.

The Act can be accessed here.

Guidance for boards in implementing NSRF

The Securities Commission Malaysia (SC) released a new guide under the National Sustainability Reporting Framework (NSRF) to help boards of directors enhance their strategic oversight and governance of sustainability reporting.

The guidance provides boards of directors with simplified and actionable steps on key areas such as governance, sustainability data boundaries, financial impact assessments, and integration with enterprise risk management systems². It has been developed in alignment with the global standards – IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosures, and emphasises the importance of transparency, accurate disclosures, and board accountability.

SC Chairman Dato’ Mohammad Faiz Azmi said, “The NSRF is not a compliance tool, but a blueprint for embedding sustainability in corporate decision-making.”

The guidance is available here.

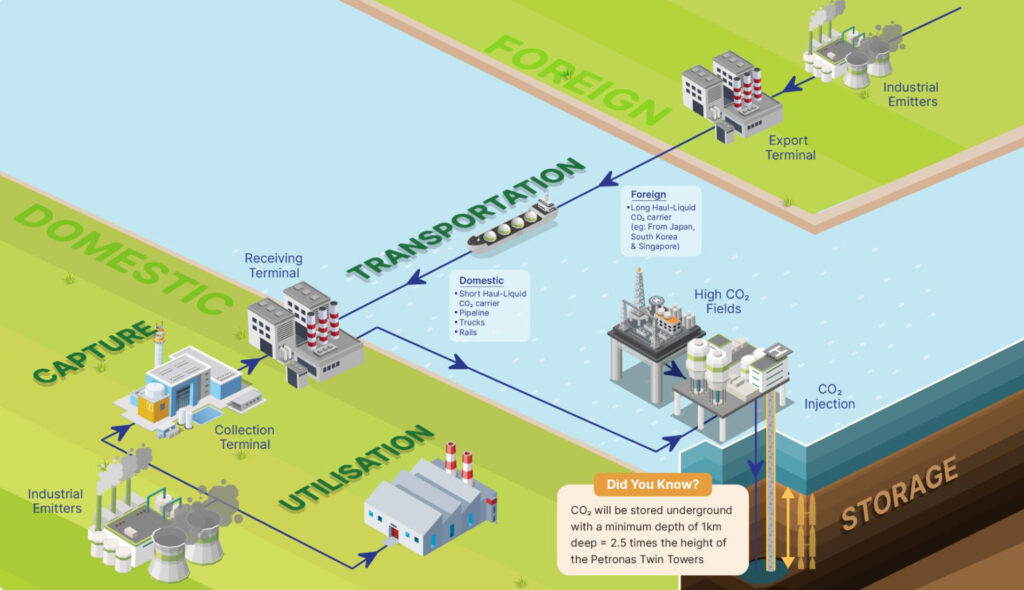

Carbon Capture, Utilisation, and Storage (CCUS) Bill 2025

Dewan Rakyat has approved the Carbon Capture, Utilisation, and Storage (CCUS) Bill 2025 on 6 March 2025, paving the way for a regulated carbon capture industry and reinforcing the nation’s commitment to a low-carbon future.

The Bill provides for the creation of a dedicated CCUS Agency to oversee licensing, regulation, and safety of carbon storage operations, both onshore and offshore in Peninsular Malaysia and Labuan³. It mandates strict environmental monitoring to mitigate risks and aligns national standards with global practices to enhance investor confidence.

Positioning Malaysia as a regional hub for CCUS, the legislation is expected to attract significant foreign and domestic investment in carbon mitigation technologies.

The Bill will proceed to the Dewan Negara for further deliberation before receiving royal assent.

Read more about CCUS here.

ASEAN Simplified ESG Reporting Guide

The ASEAN Simplified ESG Reporting Guide for small and medium enterprises (SMEs) in Supply Chains (ASEDG) was launched on 12 April 2025 by the ASEAN Capital Markets Forum (ACMF) on the sidelines of the ASEAN Finance Ministers and Central Bank Governors Meeting in Kuala Lumpur.

The Guide simplifies environmental, social and governance (ESG) disclosures by focusing on key material topics relevant to SMEs, and includes practical templates, sample key performance indicators, and illustrative examples. It promotes voluntary reporting to encourage early ESG adoption, even in the absence of regulatory mandates⁴.

To further support implementation, the guide is complemented by training resources and toolkits aimed at building SME capacity for sustainable business practices.

It has 38 priority disclosures that SMEs can consider tracking and reporting against, categorised as basic, intermediate and advanced.

Dato’ Mohammed Faiz Azmi, Chairman of the SC said that “they are pleased to initiate the development of this guide as a valuable contribution to ASEAN counterparts.”

The Guide is available here.

ISSB proposes relief for financial institutions on Scope 3 emissions reporting

On 28 April 2025, the International Sustainability Standards Board (ISSB) proposed a relief measure via an Exposure Draft (ED) proposing targeted amendments to IFRS S2 that would provide reliefs to ease application of requirements related to the disclosure of greenhouse gas (GHG) emissions⁵.

Aimed at easing the burden of Scope 3 emissions reporting for financial institutions, in response to widespread challenges in tracking financed emissions, these proposed amendments are to help companies apply the Standard while retaining the decision usefulness of information provided to investors.

The relief targets key financial sectors such as banking, asset management, and insurance, which face complex reporting requirements related to financed emissions. Public consultation is underway to solicit industry feedback and ensure the practicality of the measure.

“As a market-focused standard-setter, we have taken steps to respond in a timely manner by proposing targeted amendments helping preparers where possible, without causing too much disruption and ensuring that our Standards continue to enable the provision of decision-useful information to investors,” said Sue Lloyd, ISSB Vice-Chair.

The ED can be accessed here and is open for public comments until 27 June 2025.

¹ https://www.st.gov.my/eng/microsites/index/19/106

² https://www.sc.com.my/resources/media/media-release/sc-release-nsrf-guidance-to-help-companies-board-of-directors-drive-sustainability-reporting

³ https://theedgemalaysia.com/node/746993

⁴ https://www.businesstoday.com.my/2025/04/12/launch-of-asean-simplified-esg-reporting-guide-for-smes/

⁵ https://esgnews.com/issb-proposes-relief-for-scope-3-reporting-requirements-in-financial-sector/

The views expressed are not the official opinion of MIA, its Council or any of its Boards or Committees. Neither the MIA, its Council or any of its Boards or Committees nor its staff shall be responsible or liable for any claims, losses, damages, costs or expenses arising in any way out of or in connection with any persons relying upon this article.