By the Handshakes Team

In light of the updated Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA), Designated Non-Financial Business and Professions (DNFBPs) now face tighter regulatory compliance requirements with effect from February 2024.

Customer Due Diligence (CDD) has become one of the most crucial aspects of the compliance process, which involves the validation of client profiles and assessing their business activities.

The Challenge of Traditional CDD

Traditional CDD processes rely heavily on manual verification of client data, involving physical documentation, government database checks, and manual cross-referencing. This method is not only labour-intensive and prone to errors but also poses compliance risks and potential delays. Additionally, the growing emphasis on international sanctions and politically exposed persons (PEPs) has made manual risk assessment even more complicated and demanding.

The Role of Technology in Streamlining CDD

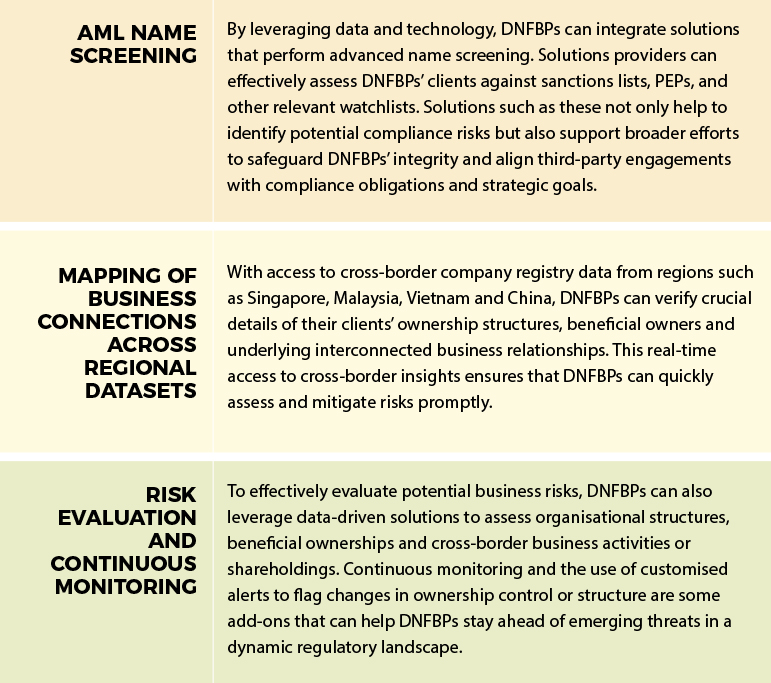

Technology plays a pivotal role in streamlining the CDD process. It not only removes human errors or biases, but also helps DNFBPs achieve greater accuracy and efficiency in their workflow. DNFBPs can now enhance their CDD process through a suite of AI and technology solutions. Here’s how:

Benefits of Integrating Technology in CDD

With businesses adopting technology in their CDD processes, DNFBPs can increase their efficiency whereby automation could speed up the verification process and reduce bottlenecks, ensuring smooth client onboarding. Access to reliable data and risk evaluation also helps DNFBPs proactively identify and mitigate risks, avoiding fines or sanctions.

As the regulatory landscape for DNFBPs continues to evolve, integrating technology in CDD is crucial to ensure compliance with Bank Negara Malaysia’s AML policy. By leveraging cutting-edge tools, client identification, risk evaluation and continuous monitoring could safeguard against money laundering and terrorism financing risks.

In short, technology makes AML compliance more efficient, accurate and robust in today’s fast-paced financial environment. DNFBPs that fail to adapt may face regulatory or reputational setbacks.