By Rashmi Ravindran

“Digital adoption is no longer optional. It’s an expectation that Malaysian accountants are rising to meet with clarity, confidence, and competence.”

The Rise of MBRS: A New Chapter in Malaysian Corporate Reporting

In recent years, Malaysia’s regulatory landscape has evolved significantly, with the Mandatory Submission Requirements under the Malaysian Business Reporting System (MBRS) gaining momentum. As regulatory bodies move towards digital reporting—structured formats aligned with international trends—accountants are expected to do more than just “file reports.” They are now stewards of digital transformation, data integrity and transparency.

The shift to MBRS is more than a compliance obligation. It represents a broader call to action for the accounting profession to modernise its approach and leverage technology to enhance reporting quality, efficiency, and trust.

Beyond Filing: The Real Challenges Accountants Face

While the technical aspect of generating digital-format compliant files (XBRL, iXBRL, XML, etc.) is well documented, the true complexity lies elsewhere:

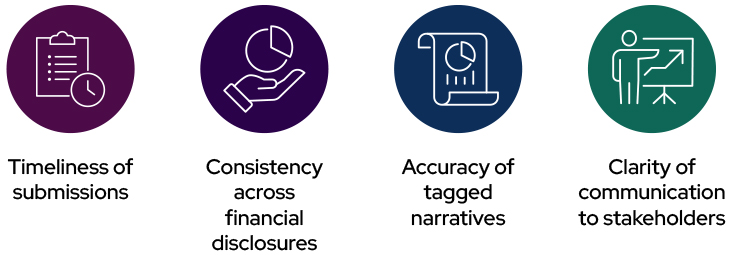

These challenges demand more than just compliance tools—they require professional insight, enhanced by intelligent systems.

The Accountant’s Role in Digital Transformation

As MBRS evolves, so does the role of the accountant. Today’s finance professionals are no longer passive preparers of reports—they are navigators of complexity and advocates for automation.

Technology is not replacing the accountant but amplifying their expertise. With AI-assisted platforms and intelligent validation engines, accountants can:

- Spend less time on repetitive tasks and more on judgment-led decisions

- Detect discrepancies early through real-time validations

- Maintain control over the digital reporting process while streamlining internal collaboration

- Strengthen audit readiness with traceable, transparent reporting workflows

Technology as an Enabler of Trust and Efficiency

At its core, MBRS is about data-driven accountability. Regulators want structured, machine-readable data—not just for enforcement, but to foster greater transparency, comparability, and confidence in capital markets.

In this context, accountants play a vital role in ensuring that data reflects the true picture. When armed with the right digital tools, they are uniquely positioned to improve:

The Path Forward: From Compliance to Leadership

Accountants in Malaysia—especially those who are a part of the Malaysian Institute of Accountants (MIA) —are already taking decisive steps toward digital empowerment. With structured filing becoming the new normal, the profession must continue:

- Investing in digital literacy and upskilling

- Collaborating with technology providers to shape better solutions

- Championing best practices in XBRL-based reporting

- Advising clients and organisations on smarter, scalable compliance processes

Conclusion: A Profession Poised for Progress

The transition to MBRS is not just a policy shift—it’s a defining moment for accounting in Malaysia. As guardians of financial truth, accountants are perfectly positioned to lead this transformation—not just to meet regulatory expectations, but to raise the bar for quality, credibility, and insight in corporate reporting.

Complexity will always exist. But with clarity, collaboration, and confidence, accountants can turn this into a catalyst for change.

Article written by Rashmi Ravindran, VP Sales APAC, DataTracks