By Auto Count Team

As an accountancy professional in Malaysia, you are likely feeling the weight of growing regulatory demands—especially with the mandatory e-Invoicing rollout being phased in according to turnover thresholds, and slated to impact smaller companies as well.

Many of the businesses you support — especially small and medium enterprises (SMEs) — are still managing invoices manually, recording transactions only monthly or annually, or even maintaining handwritten records. These outdated practices slow business processes, and also make it more difficult to comply with LHDN’s new requirements and increase the risk of human error. That’s why embracing technology is no longer optional—it’s essential.

Why Business Owners Struggle with Digitalisation

Encouraging clients to digitalise is easier said than done. Concerns about cost, complexity, or simply the belief that “we don’t need it” are still very common. For many businesses, there is a real fear of technology and resistance to change. This is where your role becomes crucial — not only as a compliance expert, but as a trusted guide in their digital transformation journey.

How Technology Helps You and Your Clients Work Smarter

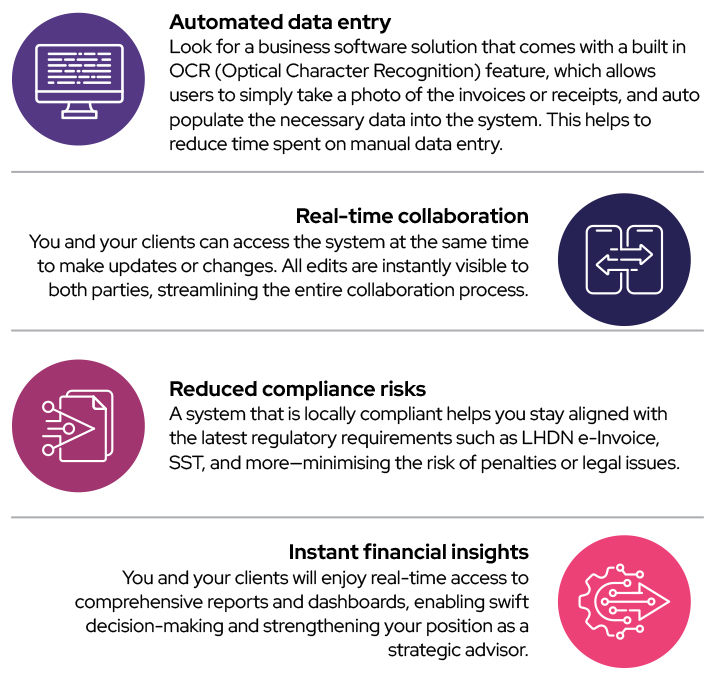

With the right tools, you can ease your clients into the e-Invoicing era—and make your own job easier in the process. Here’s how embracing technology can change the game:

As a result, digitalisation enables accountancy professionals to significantly reduce time spent on manual tasks, allowing them to focus on strategic advisory and build stronger client relationships — ultimately delivering greater value.

Redefine Your Role in the e-Invoicing Era

The e-Invoicing rollout is more than a regulatory shift — it is an opportunity to evolve your practice, deliver greater value, and support clients as true partners in their growth.

Start exploring digital tools today to future-proof both your practice and your clients’ businesses. The sooner you make the shift, the more confident and prepared you’ll be — not only for e-Invoicing, but for the future of the accounting profession.