By MIA CPE Compliance Team

In a rapidly changing business environment, Continuous Professional Education (CPE) plays a crucial role in ensuring that professional accountants remain competent, current, and compliant with regulatory expectations. Beyond strengthening ethical and technical proficiency, CPE is a mandatory requirement enforced by the Malaysian Institute of Accountants (MIA or the Institute) to uphold the profession’s standards.

Balancing professional demands with annual CPE obligations can be challenging. However, with proactive planning, busy professionals may fulfil their annual CPE requirements smoothly while gaining real value from their learning experiences.

Understanding CPE Requirements

A critical first step is to clearly understand the specific CPE requirements set by the Institute. These typically include a minimum number of CPE hours per year, as well as guidance on what types of learning activities qualify.

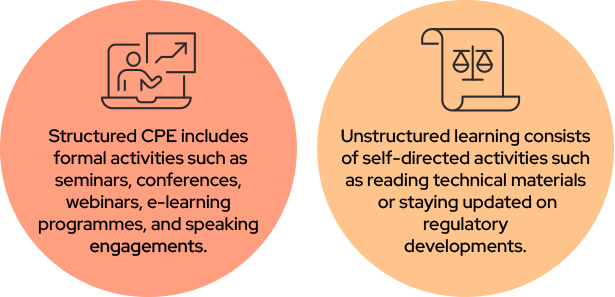

Professional accountants are required to achieve a minimum of 20 structured CPE credit hours annually and participate in CPE learning activities that are relevant to their professional role. It is also important to distinguish between structured and unstructured learning.

The structured and unstructured learning activities are outlined in APPENDIX V of the By-Laws (On Professional Ethics, Conduct and Practice) of the Malaysian Institute of Accountants (MIA By-Laws).

New members should be aware of when their CPE obligations begin:

- For members admitted between 1 January and 30 June, CPE requirements commence in the current year.

- For members admitted between 1 July and 31 December, CPE requirements start in the following calendar year.

Additionally, professional accountants should stay informed about upcoming changes, such as the introduction of mandatory ethics training hours starting from 1 January 2026. With this new requirement, while the annual CPE requirement remains at 20 structured and verifiable credit hours, members must now complete at least two (2) structured and verifiable CPE hours dedicated to ethics training. This update underscores the importance of ethical conduct as a cornerstone of professional practice. The revised requirements apply to all members of the Institute, reinforcing the profession’s commitment to uphold standards of integrity and competence. Understanding these guidelines prevents misunderstandings and ensures that all learning efforts are appropriately recorded and contribute toward compliance.

Plan Ahead and Avoid the Year-end Rush

Procrastination is one of the most common reasons professional accountants struggle to fulfil their CPE requirements. Planning your CPE activities early in the year can prevent unnecessary stress. Leaving CPE activities until the last quarter often results in rushed decisions and sub-optimal learning experiences.

To avoid this, professional accountants are encouraged to set annual learning goals and spread out the CPE hours across quarterly or monthly targets. Integrating CPE into one’s professional development plan can also yield additional benefits. By aligning CPE activities with current responsibilities and career goals, individuals can choose training that not only fulfils a regulatory obligation but also supports their long-term growth. Tools such as digital calendars, reminders, or professional development trackers can further support consistency and accountability throughout the year.

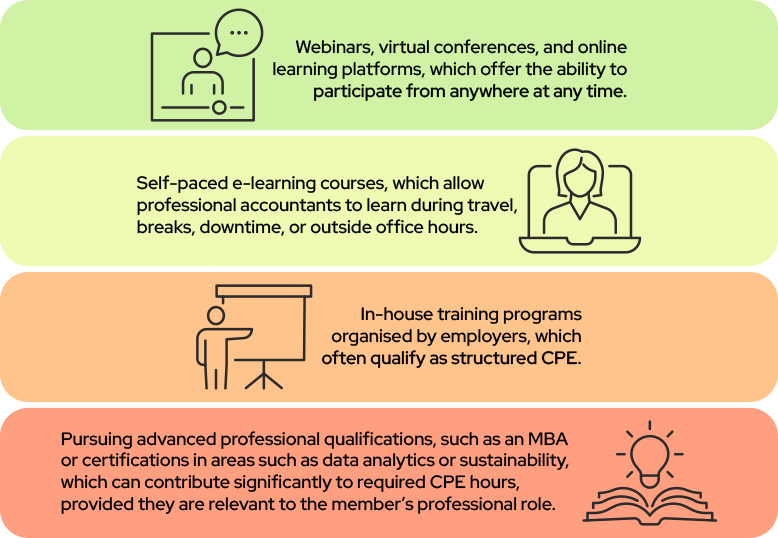

Leverage Flexible Learning Options

The shift toward digital learning has made CPE more accessible than ever. The increasing availability of flexible learning options has transformed the way professionals can meet their obligations. Busy professionals can benefit from:

These flexible options enable professional accountants to balance work, personal commitments, and ongoing professional development effectively.

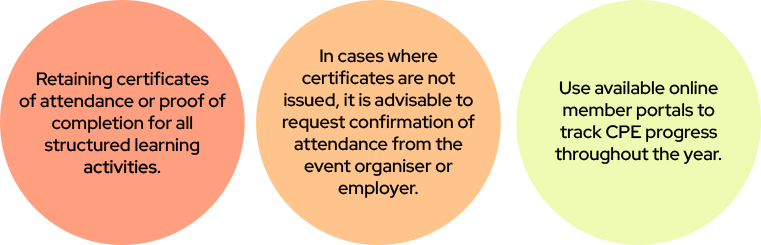

Keep Accurate Records

CPE compliance goes beyond completing the CPE hours. Maintaining proper documentation and accurate records of CPE activities is equally vital, as members’ CPE records may be subject to audit by the Institute. Best practices include:

Staying organized and consistently recording completed CPE activities throughout the year helps avoid the stress of last-minute documentation and ensures compliance with audit requirements.

Recognise Everyday Opportunities for CPE

Not all CPE must come from formal learning settings. Many routine work-related activities may qualify as structured CPE if criteria are met. For example, delivering or presenting at a formal and structured professional training, and writing technical articles or research papers related to one’s professional role, may qualify as structured learning.

These activities not only contribute to CPE hours but also allow professional accountants to share knowledge and add value to the profession. Recognising and leveraging these impactful learning experiences can make CPE more engaging and rewarding.

Balance Learning with Practical Value

While meeting the minimum number of hours is essential, professional accountants should aim to select high-impact learning opportunities that deliver real, practical value. The goal should not simply be to “tick the box”, but to pursue learning that enhances professional competency. High-impact CPE activities can improve technical competence, boost ethical decision-making, strengthen communication and leadership skills, and increase familiarity with regulatory changes and best practices.

When chosen thoughtfully, CPE goes beyond a compliance exercise to become a strategic investment in long-term professional excellence.

Final Thoughts

In conclusion, meeting annual CPE requirements need not be overwhelming. By understanding the rules, planning early, exploring flexible options, maintaining accurate records, and selecting meaningful learning experiences that align with personal and professional goals, busy professionals can stay compliant while continuously enhancing their expertise.

When viewed as an investment rather than an obligation, CPE becomes a valuable driver of professional growth, relevance, and long-term success in a dynamic professional environment.