By Diane Wong

In today’s fast-changing business landscape, the role of accountants is evolving faster than ever before. No longer confined to compliance work and number crunching, accountants are increasingly expected to serve as strategic advisors, helping businesses plan for the future, manage risks, and capitalise on growth opportunities.

From automation tools to cloud-based accounting systems, technology is empowering accountants to work smarter, not harder. By eliminating repetitive, manual tasks, accountants can reclaim valuable time and turn it into opportunities for deeper client engagement, better insights, and even new business ventures.

From Data Entry to Decision-Making

Traditional accounting work and processes have always been time intensive. Automation changes that. Studies indicate that 77% of general, everyday accounting processes can now be fully automated and no longer require manual effort.

Cloud platforms can now process transactions, match payments, and generate reports in real-time. Instead of spending hours keying in figures, accountants can shift their focus to higher-value activities such as:

This shift doesn’t just benefit accountants, but also benefits their clients, who get timely advice instead of delayed reporting.

The Dual Role Advantage

Technology also opens up new revenue possibilities. Accountants, especially those in smaller firms, can explore a dual role: combining their accounting expertise with the provision of business software solutions.

This doesn’t mean becoming a full-scale software company. Even smaller practices can integrate cloud tools that enhance efficiency while maintaining compliance without having to become full-scale software companies.

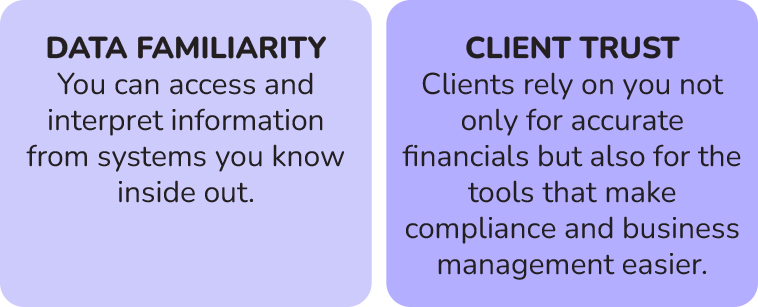

Instead, it’s about offering clients tools that integrate seamlessly with the services you already provide. By supplying solutions you are familiar with, you gain two key advantages:

This approach can strengthen client relationships while creating additional income streams.

Building Stronger Client Relationships

When technology frees up your time, you can invest more in understanding your client’s business beyond the numbers. This deeper engagement positions you as a holistic business advisor rather than just a compliance service provider.

For example, instead of simply filing tax reports, you could help a client identify cost savings, plan investments, or navigate market challenges. Over time, this creates loyalty that’s hard for competitors to match.

Positioning for the Future

The accounting profession is in a period of transition. Those who embrace technology, whether in small practices or large firms, will be better positioned to:

- Deliver faster, more accurate results

- Offer richer business insights

- Build stronger, longer-lasting client relationships

- Expand their service offerings beyond traditional boundaries

Even global bodies like the Institute of Chartered Accountants of India (ICAI) are incorporating AI into their training, emphasising that AI will create new opportunities and enhance, rather than displace, chartered accountants. The choice is clear: technology isn’t replacing accountants, but it’s enabling them to do more, serve better, and grow faster.

Final Thoughts

Efficiency is only the beginning. For the tech-driven accountant, automation and cloud tools are the gateway to new opportunities to advise, innovate, and lead in ways that weren’t possible before. Whether you’re part of a global firm or running your own practice, the tools are here.

The question is: how will you use them?

Diane Wong is Senior Marketing Executive at AutoCount Sdn Bhd.