By the MIA Practice Review Team

Overview

The Practice Review Programme (PRP) is established under Section B250: Quality Assurance and Practice Review of the Malaysian Institute of Accountants (MIA) By-Laws. The practice review framework requires all audit firms to be subjected for inspection by the practice review function of MIA. It serves as a structured mechanism to evaluate whether practitioners’ audit practices adhere to applicable professional standards, as well as legal and regulatory requirements in Malaysia.

A critical yet often underemphasised part of the PRP lies in its final stage, the closing meeting and the subsequent reporting to the Practice Review Committee (PRC). These two stages, which are conducted following the review by the Practice Review Department (PRD), are integral to upholding the integrity and effectiveness of the entire review process.

This article explores the final stage in the PR process in greater depth, highlighting key takeaways, practical insights, and relevant references to the MIA By-Laws to underscore their importance within the PRP framework.

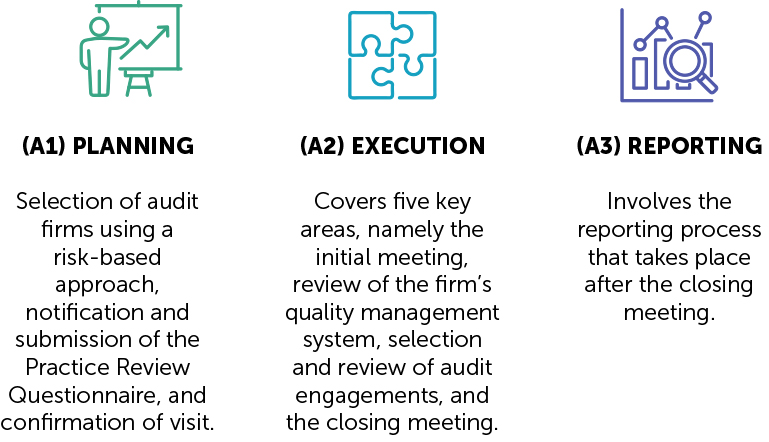

Practice Review Process – A Snapshot of the Three Stages of the Reporting Process

To gain a comprehensive understanding of the Practice Review Programme (PRP), practitioners are encouraged to consult the Summary of Practice Review Process in Appendix VI of the MIA By-Laws.

The review process and procedures can be categorised into three stages:

The focus of this article is on the final stage of the PR process, which encompasses the closing meeting and the reporting process.

Note: For full details of the above three stages, refer to Appendix VI of the MIA By-Laws.

A2.5 – Closing Meeting: Aligning on Findings and Factual Accuracy

Refer to A2.5 of Appendix VI of the MIA By-Laws

At the conclusion of the review, the closing meeting is held to discuss the factual findings with the firm’s sole proprietor or partners. This meeting serves several purposes:

- To communicate key findings and deficiencies (if any);

- To allow the firm to provide clarifications or explanations on the findings raised; and

- To engage proactively if there is any concern regarding the practice review matters and to address the issues constructively.

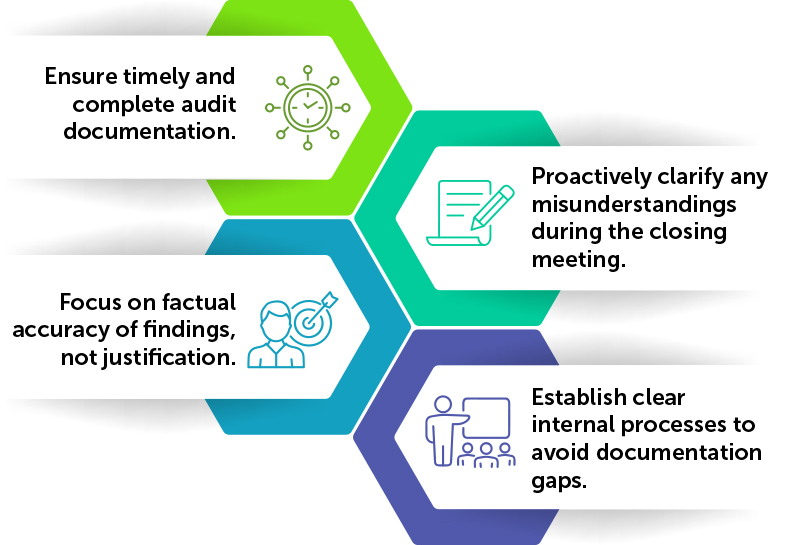

After the closing meeting, the reviewer and sole proprietor or partners are required to sign off on the summary of review findings (SRF) to confirm the accuracy of the factual findings of the review. The firm’s sole proprietor or partners should be mindful of the importance of open dialogue and that any finding raised by the reviewer is based upon the documentation provided by the firm, hence, clear communication should be established and the firm should focus upon confirming the factual accuracy of the findings. In sum, the guiding principle “if it is not documented, it is not done” reinforces the importance of clear communication and thorough verification of each finding.

⚠️ As stipulated in Appendix VI A2.5 of the MIA By-Laws, refusal to sign off on the summary of review findings, without a valid reason, would be considered as non-cooperation and deemed to be unprofessional conduct. A complaint shall be lodged with the Registrar.

It is also important to note that any new submission of documents made after the closing meeting and the date of the certificate of completeness of audit working papers shall not be accepted or considered in the review process. Firms are expected to have submitted all relevant working papers by the time of the commencement of the practice review, reflecting their declaration of completeness and compliance with documentation standards.

Best Practices at this Stage:

A3 – Reporting: Finalising and Submitting the Review Outcome

Refer to A3 of Appendix VI of the MIA By-Laws

Post-closing meeting, the reviewer will prepare the draft report, incorporating the factual findings as discussed with the audit firm, and a draft report will be issued to the audit firm for comments.

Any comments on the draft report must be submitted in writing within 21 days from the date of receipt of the draft report. The reviewer will finalise the draft report upon receipt of the firm’s submission of comments. In finalising the report, the reviewer may make changes to the draft report in light of the comments received from the audit firm. Should the reviewer deem that further clarification is required based on the firm’s comments, the reviewer will include their justification in the report. The final draft report will be presented to the PRC for consideration. All identifying details of the firm and its clients are removed prior to the submission of the final draft report to the PRC to ensure confidentiality and fairness.

The PRC will determine a rating based on the review findings, and the following are the possible ratings:

Once the PRC has issued the final rating, that rating stands as the final outcome for the review cycle.

To ensure a constructive review outcome, firms are encouraged to remain mindful of the review process and timelines, while being responsive and proactive in addressing any findings. In addition, firms are strongly urged to undertake regular self-assessments and/or peer reviews as part of their commitment to continuously monitoring and enhancing audit quality.

Conclusion

The PRP’s ultimate goal is to improve audit quality, thereby strengthening the accountancy profession and protecting public interest. Firms are encouraged to view the PRP not merely as a compliance exercise but as a chance to enhance the firm’s system of quality management, strengthening its documentation standards to enhance overall audit quality. While its primary function is oversight, it also serves as a valuable platform for firms to reflect on their current practices, identify areas for enhancement, and reinforce a culture of quality and accountability.

A taskforce will be established, and MIA will undertake a holistic review of the practice review programme to ascertain its ongoing relevance and operational effectiveness in fulfilling its intended objectives, having regard to the evolving landscape of the audit profession.