By Siti Hazirah Hudal Firdaus

Is your organisation ready to comply with the new self-assessment system for stamp duties? Malaysia’s migration from the official assessment system to the self-assessment system is effective from 1 January 2026. Under this new system, duty payers must have a sound knowledge of the Stamp Act 1949 to ensure the furnishing of accurate returns. Errors or omissions may result in penalties in addition to any duty shortfall, thereby increasing both financial and compliance exposure for organisations.

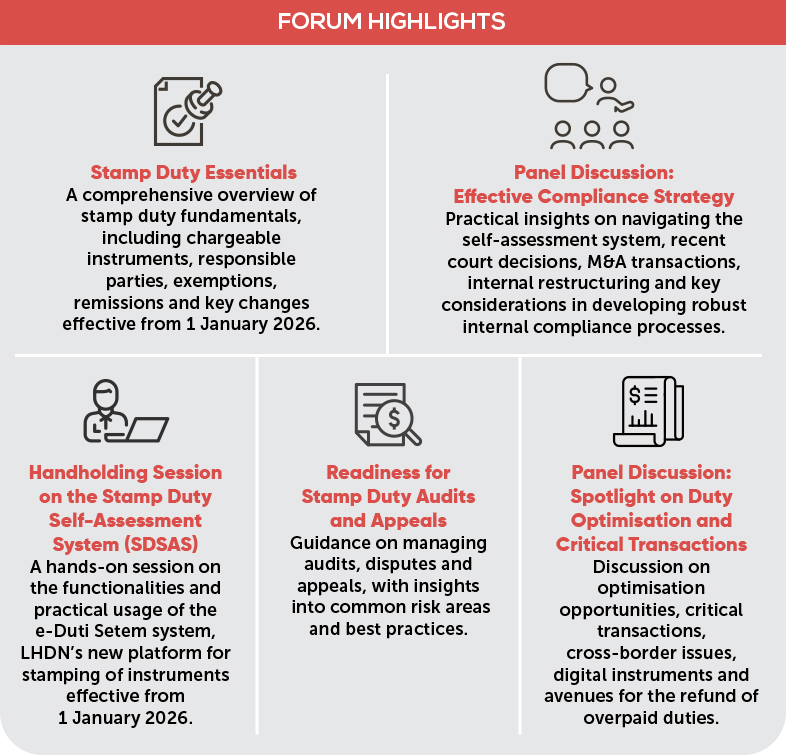

In response to these enhanced compliance requirements, the Malaysian Institute of Accountants (MIA), in partnership with TRATAX Sdn Bhd, is organising the inaugural Stamp Duty Forum: Compliance and Optimisation. Through in-depth technical coverage and practical insights, the Forum equips participants with essential stamp duty knowledge and a comprehensive understanding of relevant provisions. This, in turn, enables organisations to strengthen their compliance frameworks and make informed commercial decisions amid the tax authority’s increasing scrutiny of stamp duty matters relating to service, rental, lease and financing agreements, both for intragroup transactions and transactions between independent parties.

Although stamp duty matters have historically been managed within the legal function, corporate leaders across finance, operations, sales, procurement, compliance and human resources must now be alert to stamp duty implications. Signing of documents made without sufficient awareness of stamp duty consequences may expose organisations to unforeseen risks and costs across business operations and transactions.

Sessions will feature professionals with expertise in tax and M&A law, with discussions led by a tax accountant. The Stamp Duty Forum will be held on Tuesday, 10 February 2026 at the Connexion Conference & Event Centre @ Nexus, Bangsar South, Kuala Lumpur.

This Forum is suitable for accounting and finance personnel, C-suite executives, and representatives responsible for stamp duty compliance matters. No prior accounting, finance or legal knowledge is required, making the programme accessible to a broad range of professionals with decision-making or compliance responsibilities.

Don’t miss this opportunity to prepare for the stamp duty self-assessment system and gain practical, implementation-focused insights from tax and legal professionals. By attending, participants will be better equipped to manage compliance risks and identify optimisation opportunities with confidence.

Group discounts are available for three or more participants from the same organisation.

Click here for more information and registration.