By Rasmimi Ramli

What are the different accounting treatments for impairment of assets under the Malaysian Public Sector Accounting Standard (MPSAS) 21 non-cash-generating assets and MPSAS 26 on cash-generating assets, Malaysian Financial Reporting Standard (MFRS) 136 and Section 27 of the Malaysian Private Entities Reporting Standard (MPERS)

This analysis focuses on the significant requirements in MPSAS that are similar and different from the requirements in MFRS and MPERS in relation to (i) identification; (ii) recognition and measurement; (iii) disclosures and (iv) first-time adoption. This comparison does not discuss the requirements in MFRS or MPERS that are not available in MPSAS.

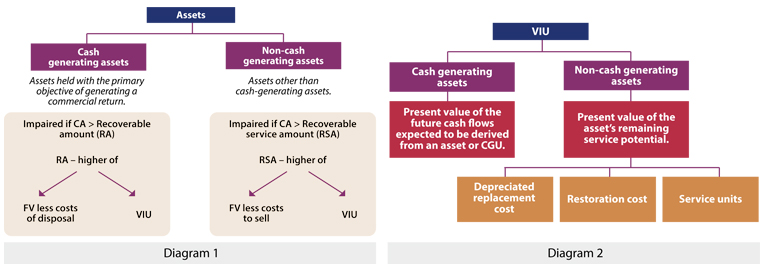

Non-Cash Generating and Cash Generating Assets

Cash generating assets are assets held with the primary objective of generating a commercial return, while non-cash generating assets are assets other than cash generating assets.

MPSAS has two separate standards i.e. MPSAS 21 and MPSAS 26 that provide guidance for each group of assets. In each standard, an entity needs to assess whether its assets are non-cash generating assets or otherwise.

Identification

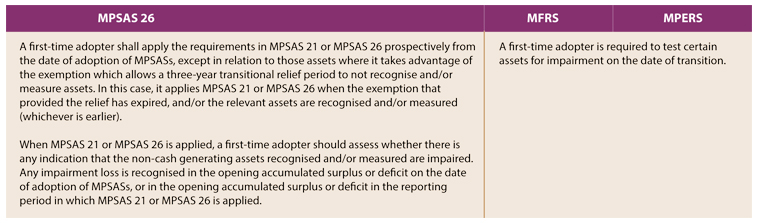

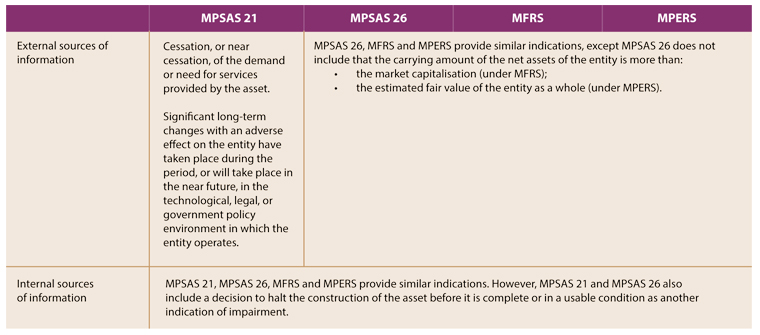

All three frameworks require an entity to assess, at each reporting date, whether there are any indications that an asset may be impaired. As a minimum, an entity should consider the following indications:

Intangible assets

MPSASs, MFRS and MPERS require that intangible assets with indefinite useful lives or not yet available for use be tested for impairment annually. Both MFRS and MPERS also require that goodwill acquired in a business combination be tested for impairment on annual basis. The MPSAS framework does not deal with such items or transactions.

Recognition and Measurement

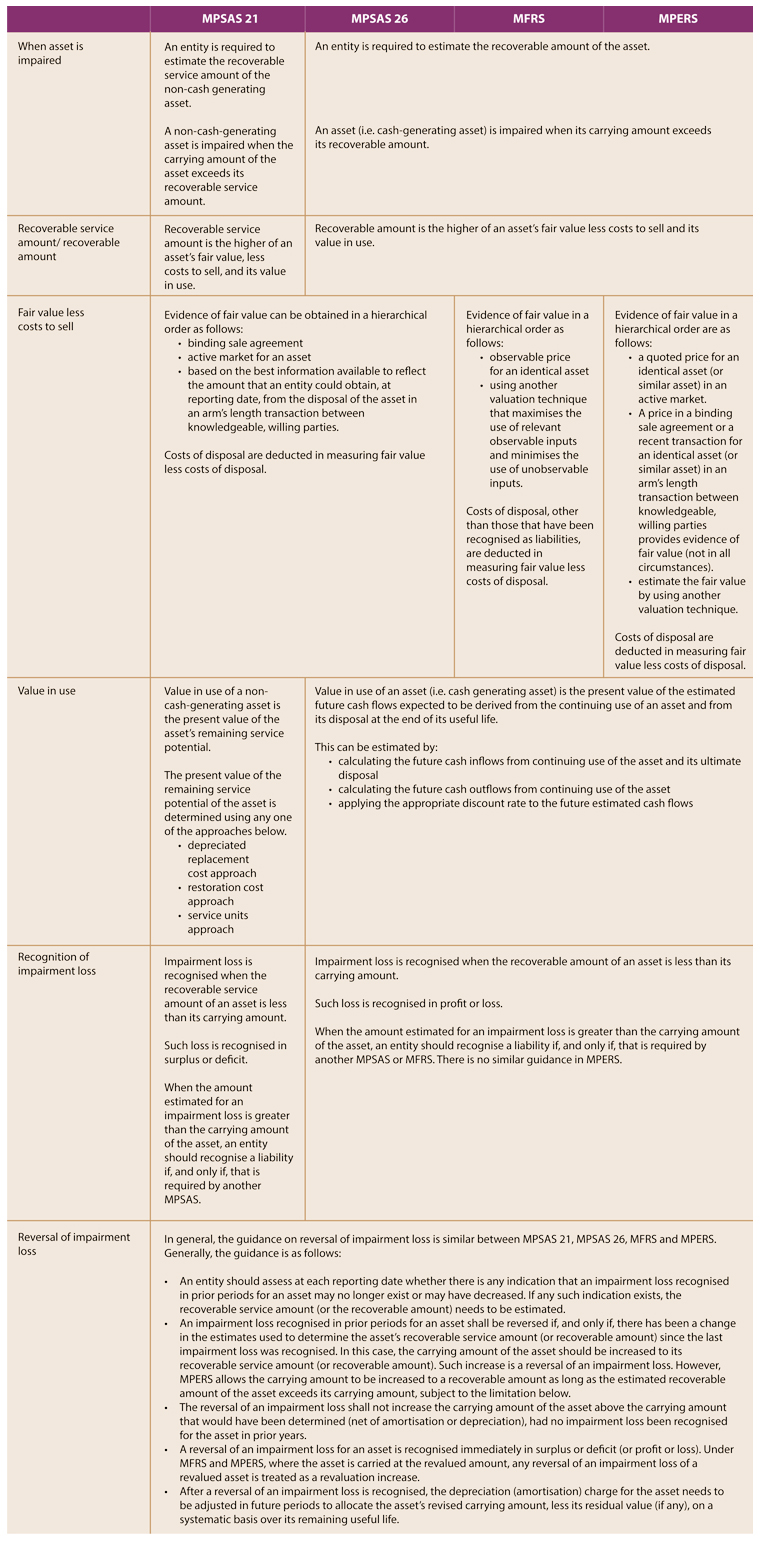

When there are indications of impairment, MPSAS 26, MFRS and MPERS requires the recoverable amount to be estimated, while MPSAS 21 requires entities to measure the recoverable service amount.

The above is summarised in Diagrams 1 and 2 below.

Cash generating unit

Under all three frameworks, the recoverable amount should be estimated for an individual asset. However, MPSAS 26, MFRS 136 and MPERS provide that when it is not possible, an entity should determine the recoverable amount of the cash generating unit to which an asset belongs. These three standards then provide further guidance on dealing with the cash generating unit.

Disclosure

MPSAS 21, MPSAS 26, MFRS 136 and Section 27 of MPERS have some similar requirements in relation to disclosure. MPSAS 21, MPSAS 26 and MFRS 136 have some additional requirements on disclosure compared to Section 27 of MPERS.

First-Time Adoption

General requirements in relation to first-time adoption in relation to impairment of assets are as follow: