By Rasmimi Ramli and Mohd Lukman Mahmud

Does the offering of waqf shares present an appropriate mechanism of collecting funds for waqf projects such as Larkin Sentral in Johor? In hindsight, this pioneering waqf share exercise fell short of hitting its targeted proceeds. Alternatively, a simple mechanism such as donation may have attracted more people to contribute their cash to the development of Larkin Sentral.

About Waqaf Saham Larkin Sentral (WSLS)

In June 2017, Larkin Sentral Property Berhad (LSPB), a wholly owned-subsidiary of Waqaf An-Nur Corporation Berhad (WANCorp) made an offering of waqf shares of up to 850 million ordinary shares to institutions and individuals at RM0.10 per share which will be subsequently endowed (via waqf) to WANCorp. This is the first public offering of waqf shares in the world which has been approved as Shariah-compliant by the Shariah Advisory Council of the Securities Commission Malaysia.

The offering aims to:

- Create awareness on the concept of waqf among the public;

- Raise proceeds primarily for the upgrading and refurbishment of Larkin Sentral and the acquisition and development of the surrounding land for the benefit of the public.

- Provide an opportunity to the public regardless of race or religion to participate in the noble effort to contribute to society.

This offering is considered as a public waqf. Both Muslims and non-Muslims can participate in the offering of WSLS and can benefit from the proceeds raised from the offering, which is primarily to fund the upgrading and refurbishment of Larkin Sentral as well as to fund the acquisition of land for the proposed development of a seven-storey car park. Individual and institutional subscribers will enjoy tax deductions of up to 7% and 10% of aggregate income respectively.

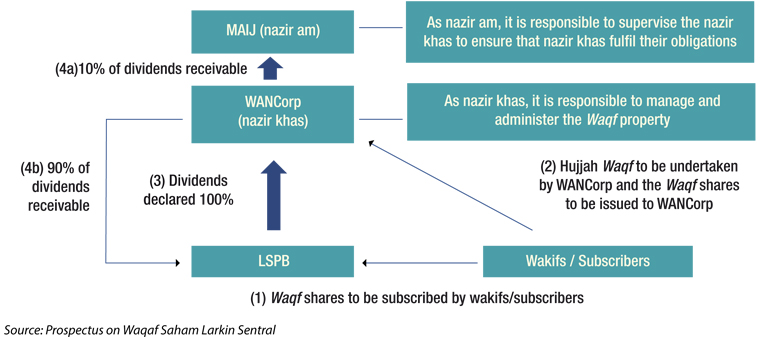

In addition, WANCorp has been appointed by Majlis Agama Islam Johor as nazir khas to manage and fulfil the objectives of the waqf for religious and charitable purposes in accordance with Shariah as instructed by the wakifs.

The arrangement of the waqf is illustrated below.

The dividends receivable by WANCorp from the issuance of the ordinary shares will be used as follows:

A. 90% of the dividends receivable will be used to:

- provide reasonable rental rates (i.e. lower rental rates compared to normal market rental rates) for selected tenants of Larkin Sentral; and

- charge minimal rental rates for small shop lots created in Larkin Sentral for single mothers and lower income group (i.e. approximately half of the market rate per square foot).

B. the remaining 10% of the dividends receivable will be channelled to MAIJ where;

- 5% will be retained by MAIJ as its entitlement, being the sole trustee of waqf in the State of Johor; and

- remaining 5% will be distributed for charitable purposes involving education, entrepreneurship and healthcare sectors (Prospectus, 2017).

Less than Successful?

The amount of proceeds raised as at July 2018 was less than the targeted proceeds of RM85 million since its offering in June 2017 and the offering has been extended to May 2019.

In addition to the extension of the subscription period, the Supplementary Prospectus dated 17 May 2018 includes the following:

- inclusion of non-Malaysian citizens, foreign companies and institutions to participate in the offering;

- addition of debit cards as a payment method; and

- additional subscription method which is directly through WSLS’s website.

As the offering is still ongoing until May 2019, the offerors could take certain extra initiatives to increase the subscription by addressing the possible issues, such as lack of awareness and difficulty of subscription.

Some of the recommendations to enhance the success of the WSLS include:

- increasing awareness on waqf and WSLS such as utilising social media platforms to create and develop a good content on waqf shares to disseminate information to the masses;

- collaborating with mosques in Johor to collect donations; the mosques could then recommend that the donors of “tabung waqf” subscribe to the WSLS waqf shares;

- leveraging on digital technology.

This is the executive summary of a case study written by Rasmimi Ramli and Mohd Lukman Mahmud, as a requirement for the MIA Islamic Finance Mini Pupillage Programme.

You might also be interested in these articles on Waqf: Reviving Takaful-Waqf Product In Malaysia: Issues and Challenges by Nurul Hidayah Zailani and Professionalising Waqf in Malaysia – Issues and Challenges by Zharif Agil.