By Fauziah Begum

Changes in accounting standards have in turn brought about significant change to the audit of accounting estimates. Recurring audit inspection findings criticising the quality of audits of accounting estimates – where the auditor failed to sufficiently evaluate significant assumptions and data that clients used in developing the estimates – have also contributed towards the revision of ISA 540. Although ISA 540 (Revised) is applicable to all accounting estimates, the extent of audit procedures in relation to an individual estimate varies depending on its estimation uncertainty.

Extensive revisions to continuously improve scalability and address public interest issues have been made to ISA 540 (Revised) which is effective for audits of financial statements for periods beginning on or after 15 December 2019. The most salient changes are encapsulated in the diagram below:

Separate assessment of inherent risk and control risk

ISAs do not ordinarily refer to inherent risk and control risk separately, but rather to a combined assessment of the risks of material misstatement. However, ISA 540 (Revised) requires the auditor to separately assess inherent and control risk in identifying and assessing the risks of material misstatement relating to an accounting estimate and related disclosures at the assertion level.

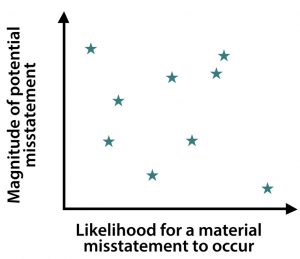

Explicit recognition of spectrum of inherent risk

Inherent risk could be higher or lower depending on the type of assertions and related classes of transactions, account balances and disclosures. Under the spectrum of inherent risk concept, the assessment of inherent risk depends on the degree to which the inherent risk factors affect the likelihood or magnitude of misstatement and varies on the scale as illustrated in the diagram below.

Therefore, the nature, timing and extent of the risk assessment and further audit procedures will vary according to the spectrum of risk. For example, for a straightforward accrual relating to bonus that is paid to employees shortly after the period end, it might be more appropriate for the auditor to obtain sufficient appropriate audit evidence by evaluating events occurring up to the date of the auditor’s report, rather than through other more detailed testing procedures.

Concept of inherent risk factors

Inherent risk factors are characteristics of conditions and events that may affect the likelihood of an assertion to misstatement, before controls are considered. In addition to estimation uncertainty, ISA 540 (Revised) introduces complexity, subjectivity and other inherent risk factors to be considered in identifying the selection and application of the methods, assumptions and data used in making the accounting estimate, and the selection of management’s point estimate and related disclosures for inclusion in the financial statements. These factors would allow the auditors to recognise the potential inherent risk embedded within the accounting estimates. For example, inherent complexity may arise when data used to measure the estimates is difficult to obtain or relates to transactions that are not generally accessible.

Enhanced risk assessment procedures

To foster a more independent and challenging sceptical mindset in auditors, risk assessment procedures relating to obtaining an understanding of the entity and its environment, including the entity’s internal control were enhanced in ISA 540 (Revised). For instance, additional requirements for the auditors to identify control activities (including IT controls, where applicable) relevant to the audit over management’s process for making accounting estimates have been added to the standard.

Objective-based work effort requirements

In the event inherent risk is assessed as not “low”, objectives-based work requirements will be applicable to accounting estimates. More granular work requirements to obtain audit evidence to respond to assessed risks of material misstatement are introduced in the standard. The work requirements are directed to methods, data and assumptions used by management in making the accounting estimate.

Emphasis on professional scepticism

Professional scepticism plays a central role in auditing accounting estimates. The following provisions have been added to ISA 540 (Revised) to enhance the role of professional scepticism:

- Auditors are required to design and perform further audit procedures in a manner that is NOT biased towards obtaining audit evidence that may be corroborative or towards excluding audit evidence that may be contradictory.

- A ‘stand back’ requirement has been included for auditors to consider all audit evidence obtained – whether corroborative or contradictory – when evaluating if the accounting estimates and related disclosures are reasonable in the context of the applicable financial reporting framework.

The evolving business environment featuring increasingly complex information systems and the use of complex modelling systems to record accounting estimates has resulted in significant changes to ISA 540. If we look into the auditing standards that have been issued, they do not dive deep into a particular accounting transaction or items in the financial statements. The extensive revision of ISA 540 prioritises the importance of accounting estimates as one of the fundamental areas of audits. As accounting estimates are virtually found in most financial statements, auditors are advised to be up to date on the key revisions made to this ISA to determine and enhance the requisite audit procedures.

For more information and implementation support on ISA 540 (Revised), please visit the International Auditing and Assurance Standards Board (IAASB) website at www.iaasb.org.

Fauziah Begum is Assistant Manager, Assurance & Digital Transformation Department, MIA