By Dr Shyamala Dhoraisingam, Dr Ravichandran K. Subramaniam and Prof Dr Ravindran Ramasamy

Rachel Grimes, former International Federation of Accountants (IFAC) President said that “technology will go on helping to burnish (enhance) the profession’s credentials as a trusted adviser.” She called for the profession to continue adopting and implementing emerging technologies or otherwise being left stranded on the sidelines. Malaysian Institute of Accountants (MIA) has appropriately prepared for this emerging era of the fourth industrial revolution (IR 4.0) and has moved in tandem with the global call by the IFAC.

MIA has developed the MIA Digital Technology Blueprint, which aims to guide accountants in developing appropriate action plans for their environment to respond to digital technology. The survey on Preparing the Malaysian Accountancy Profession for the Digital World was undertaken in 2019, a follow-up to a similar survey carried out in 2017. Interestingly, the survey results found that approximately 52 per cent and 36 per cent of survey respondents propose to adopt data analytics tools and artificial intelligence (AI) respectively in the next three years, signaling the effectiveness of MIA’s advocacy for the profession’s digital transformation. Furthermore, 93 per cent of survey respondents ranked technology as either very important or essential, and 92 per cent of respondents said they were either very interested or interested in knowing more about technologies affecting the accountancy profession. This article looks at how AI is used in auditing to increase the degree of confidence of the intended users of the financial statements by providing reasonable assurance (i.e., true and fair opinion) on the audited financial reports (IFAC, 2018).

Adaptation of AI to Auditing

Computerised accounting makes auditing very challenging. Millions of transactions are not entered manually by individuals but scanned by the cashiers at the point of sale. Hence, when a risk-based audit approach is utilised (audit risk model), it influences the audit planning and gathering of audit evidence to arrive at an audit opinion on the financial statements. Income statement and balance sheet accounts such as revenue and inventory have inherent and control risk. The use of AI provides a starting point to analyse the data for any unusual transactions or patterns documented in the audit plan for further audit testing and gathering of audit evidence. The adoption of AI aids in identifying red flags where potential misstatements (errors or fraud) may occur. One such example is that relating to a client’s closing procedures. The closing procedures are considered a high-risk audit area. The use of machine language aids in identifying any unusual transactions, for example, when in the closing process in the sales cycle, it is noted that there are increases in the sales invoices just prior to the year-end. Therefore, using AI involves pattern matching and identifying deviations or variations. The reduction of audit risk to an acceptably low level is essential from the perspective of detection risk, i.e., the risk the auditor will give the inappropriate audit opinion on the financial statements¹.

Traditional auditing uses sampling techniques to select and examine samples from a homogeneous population randomly. The sampling results based on tolerable error allow an auditor to make inferences about the attributes of the population. According to the International Standard on Auditing (ISA) 315¹, sampling increases audit efficiency but, on the other hand, creates a sampling risk. ISA 530² defines sampling risk as the risk that the auditor’s conclusion built on a sample may differ if the auditor examined the entire population.

AI-enabled Technology

The use of AI enables examining the entire population of accounting transactions, which can considerably improve audit quality and obtain more audit evidence on a larger scale. AI provides audit evidence obtained from examining 100 per cent of the transactions, therefore eliminating sampling risk. It also allows auditors to better perform their audits by focusing on unusual/suspicious transactions. The use of AI is targeted explicitly for data acquisition, which means that the use of AI-enabled technology can extract information that will enable the auditor to devote more time to areas requiring higher-level judgment. For example, AI enables full automation of time-consuming tasks such as payment transaction testing, including extracting any supporting data for further substantive testing. The AI software undertakes a complete population analysis to investigate transactions at risk of material misstatement or deviation from planned materiality.

This article was motivated by the results of MIA surveys, hence further research is conducted on the application of machine learning. We observe that there was a rising interest in technology among its members where one of the main concerns was on which technologies relate to them and which one they should take up first.

This article was motivated by the results of MIA surveys, hence further research is conducted on the application of machine learning. We observe that there was a rising interest in technology among its members where one of the main concerns was on which technologies relate to them and which one they should take up first.

Application of Machine Learning (ML)

Machine learning can theoretically influence all stages of the audit processes, from planning to the reporting stage of an audit. We explored the use of ML to predict frauds. In our approach, we examine whether any internal control risks arising from the complexity and nature of a firm’s operations and issues of accounting measurement application may cause variations in the patterns relating to transactions and balances in the draft trial balance. This article examines the practices indicated in the closing procedures between the general ledger accounts and the supporting accounting records, including cash/bank transactions. We chose the use of AI in closing procedures as closing procedures complete the accounting cycle to prepare draft financial statements.

Using MathLab

Within the subgroup of AI, our study focuses on machine learning (ML) language, using MathLab. The MathLab is used as an AI software to execute cognitive tasks. The study examines whether the use of AI reduces audit risks (misstatements). We carried out interviews to better understand the use of AI in the financial statements closing procedures. The discussion commenced with general questions (e.g., job title and responsibility) to make respondents feel at ease. The interviewer explained the primary purpose of the research. We collected actual data from an audit firm and analysed it through a boxplot.

MATLAB Algorithm for Speedy Accounts Verification

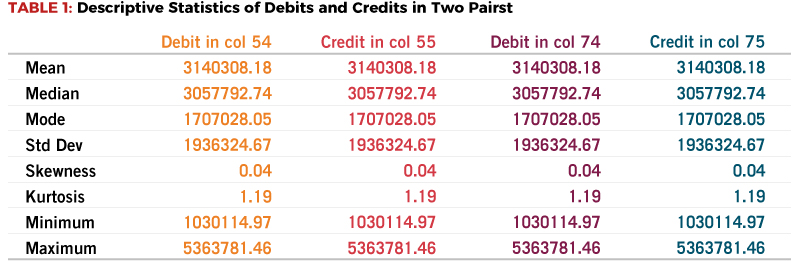

In our study , the client’s chart of accounts consists of 86 columns. Some are numeric, string data, and alphanumeric. The debit and credit balances are in six columns of three pairs, where columns 54 and 55, and columns 74 and 75 provide debit and credit balances in pairs. Data is in time and date-wise. In the ledger, the bookkeeping accounts are retained for all accounts. Finally, the general ledger will have separate entries and balances and bring them to trial balance. The tabular presentation of statements is based on time and date, and there are no ledger-wise classifications. Hence the entries are coded first by account name and then later by transaction number to verify them thoroughly. Though AI is recommended, the auditor’s professional judgment is still needed to identify deviations or patterns in accounts. Identifying the debit credit mismatches is possible only if there is an intelligent software to detect and isolate the questionable items. The artificial intelligence-related software, once applied to data, will trigger the mismatching items to the auditors.

Note: Table 1 shows the descriptive statistics of debits and credits for a sample of transactions. This helps to gauge the outliers and the next course of action to be undertaken by the auditors

The auditors could investigate and elicit more information from clients to satisfy themselves with the authenticity and accuracy of these transactions. In addition, the auditor must finish the work within one or two months. Checking the entire transactions entered throughout the financial year is practically impossible, so AI coding could help auditors to quickly identify and isolate the dubious transactions and raise questions and doubts to the accountant. Hence, this will facilitate finishing the audit on time with high integrity, which will increase the assurance level provided to the stakeholders. If not appropriately investigated, these transactions may cause severe losses to the organizations, and audit firms’ reputations will be in jeopardy. Table 1 above shows the same values for each parameter and concludes that there is no mismatch in debit and credit balances.

MATLAB algorithms can be used in a number of ways which includes (a) matching debits/credits, (b) identifying extreme values, (c) classification of accounts/items etc., (d) use of a large database of built-in algorithms, (e) developing computational codes easily and (f) implementing and test algorithms easily.

Hence, it is salient to identify accounting transactions that are normal and those that need to be investigated due to their abnormality. Under these circumstances, auditors should use their professional experience and judgment to review a random sample of extreme values via the diagrammatic presentation, using boxplots. Furthermore, AI coding could help the auditors to easily identify and isolate transactions and raise questions and doubts to the accountants.

The auditor’s responsibility during the risk assessment phase of the audit is to reduce the audit risk of their assignment. Especially when it relates to Cash at Bank transactions and under such circumstances, large extreme values need to be investigated. Therefore, the auditor would plan to focus on these extreme values by understanding the client’s control environment as well as designing more substantive procedures on the cash and bank transactions and the cash flow statements. If such transactions are not made available to the auditors, this may be overlooked and may pose higher risk of detection to the auditors. Hence, in this instance, the auditor has to note these transactions and thoroughly investigate for any typo error, fraud, misfeasance or misappropriation. If proper investigation is not done, these transactions could cause severe losses to the organisations and the reputation of the audit firms will be in jeopardy.

Conclusion

In this research, we found that there were many significant figures, either extreme values or outliers. Once applied to the accounting data obtained from the client, the artificial intelligence-related software will trigger the outliers to the auditors to investigate and to design audit procedures to obtain sufficient appropriate audit evidence regarding the outliers. Hence, the auditors should investigate these outliers to avoid any suspicious transactions or misstatements to reduce the audit risk to an acceptably low level. Accordingly, this will enhance the audit quality as a whole.

¹ International Standard on Auditing (ISA) 315 (Revised 2019), Identifying and Assessing the Risks of Material Misstatement, should be read in conjunction with ISA 200, Overall Objectives of the Independent Auditor and the Conduct of an Audit in Accordance with International Standards on Auditing.

² International Standard on Auditing (ISA) 530, “Audit Sampling and Other Means of Testing” should be read in the context of the “Preface to the International Standards on Quality Control, Auditing, Review, Other Assurance and Related Services,” which sets out the application and authority of ISAs.

Dr Shyamala Dhoraisingam (Monash University Malaysia); Dr Ravichandran K. Subramaniam (Monash University Malaysia) and Prof Dr Ravindran Ramasamy (Formerly from University Tun Abdul Razak). Acknowledgment to Mr Hari Iyer and Mr Chin Wei Xun from BDO for their assistance.