Good governance is becoming an increasingly important priority as organisations contend with higher enterprise risks and expectations for reporting transparency, driven by sustainability, climate change and COVID-19 concerns.

As those charged with governance, audit committees are in the frontline of risk management. The onus is on audit committees to enhance audit quality, corporate governance practices, and financial reporting accuracy to improve organisational reputation and thereby build public confidence and trust.

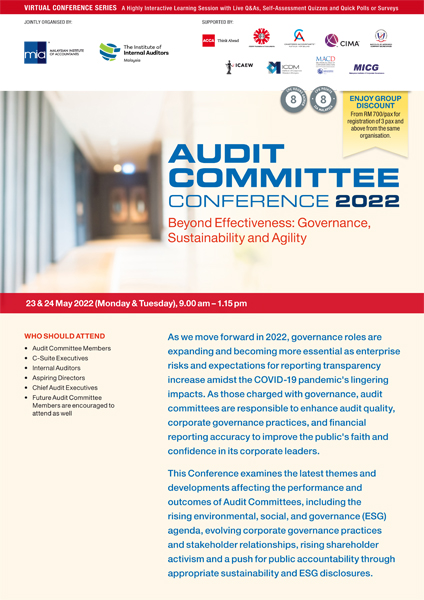

With the theme of Beyond Effectiveness: Governance, Sustainability and Agility, the Virtual Audit Committee Conference 2022 jointly organised by the Malaysian Institute of Accountants (MIA) and The Institute of Internal Auditors Malaysia (IIAM) focuses on the latest developments affecting the performance and outcomes of Audit Committees.

Over the course of two half-days, delegates can expect to hear from top subject matter experts on the following highlights:

* Beyond Effectiveness: Governance, Sustainability and Agility – Review the fundamental importance and optimisation of the governance structure which ultimately determines how the firm conducts everyday operations, its perception in the marketplace, and the value it provides to stakeholders.

* The Future of Governance: Agility & Accountability – Discuss the current and prospective issues affecting good governance and how organisations can move forward to enhance the agility and accountability of their governance mechanism.

* The Future of Governance: Agility & Accountability – Discuss the current and prospective issues affecting good governance and how organisations can move forward to enhance the agility and accountability of their governance mechanism.

* Tax Governance: The Oversight Strategy – In addition to their usual remit, audit committees must be able to provide competent oversight of tax policy and developments in the dynamic global tax landscape. This session recommends that audit committees enhance their Tax Governance by complying with regulatory developments, building strong tax leader relationships, and relying on tools such as Key Performance Indicators, Resourcing and Reporting Structures, Risk Assessment & Risk Appetite.

* Pandemic Proof Sustainability: The AC Perspective – Supply chain disruption is a major challenge for companies post-COVID-19. This session looks at how the audit committee can engage with their board, other committees, and management to understand and manage the comprehensive and material risks affecting their supply chains and business outcomes.

* Strategic Alignment: Internal Audit Reformation – Discusses how the internal audit function can instil reforms to improve the relevance and value add of audit, in response to evolving expectations by the Audit Committee and Management. Key to transformation and driving customer satisfaction is for internal auditors to elevate their thinking from a pure micro level (focussing on individual risks, compliance obligations, and governance requirements) to a macro level (assessing impacts on the holistic frameworks for compliance, risk, and governance).

* Enhancing ESG Oversight – Assesses the role and responsibilities of Audit Committees in addressing ESG concerns and issues. Demonstrates how the internal audit function can step up as ESG advisors, by identifying and mitigating diverse ESG risks which range from climate change to diversity, equity, and inclusion (DEI) issues, enhancing continuous monitoring processes and internal controls, and providing the assurance needed for trustworthy ESG disclosures.

* Championing Risk Oversight in Challenging Times – Addresses the need to ensure that the risk oversight function is sufficiently defined and effective, and that regular review is being conducted to keep up with new challenges such as ESG and COVID-19 impacts. It is critical that the board understands and influences management’s risk identification, risk assessment, and risk monitoring methods for robust risk oversight. The board should also clearly define which risks should be frequently considered by the whole board and which risks should be delegated to a board committee, such as the Audit Committee.

* Annual Transparency Report: Enhancing Governance through Rigorous Auditor Engagement – Looks at the role and relevance of the Annual Transparency Report (ATR) prepared by audit firms, which provides information on legal and governance structures of firms, measures taken to uphold audit quality and manage risks, and measures of audit quality indicators. This session looks at how audit committees can leverage on the ATR to evaluate the appointment and reappointment of external auditors while identifying and addressing related audit risks.

Click here to learn more about the Virtual Audit Committee Conference 2022.