When analysing environmental, social, and governance (ESG) factors, the “Governance” aspect is often overlooked as climate risk, societal implications, and other “Environmental” and “Social” matters take priority.

However, it is critical for boards to understand the Governance risks and opportunities in decision-making as poor corporate governance practices are often at the root of mismanagement and reputational risk.

In addition, the business case for “Governance” shows that values-driven good behaviour ultimately yields better corporate returns and attracts high quality investors.

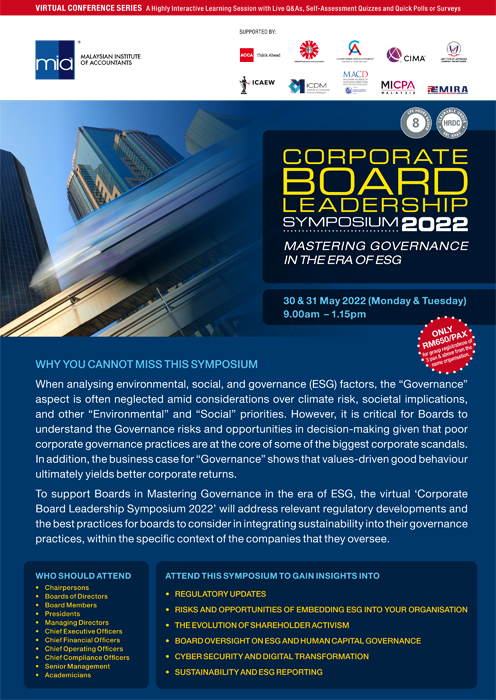

To better support boards, the virtual Corporate Board Leadership Symposium 2022 will focus on relevant regulatory developments and the best practices that boards should consider in integrating sustainability into governance mechanisms, within the specific context of the companies that they oversee.

The following are some highlights of the Symposium, geared to helping boards master governance as the ESG agenda evolves and gains prominence:

Corporate Governance Strategic Priorities 2021-2023

This session lays the foundation for the five thrusts of Corporate Governance, facilitating listed companies in responding to rising stakeholder activism and exercising conscious consideration for a wider spectrum of stakeholders, towards better sustainability.

Lessons From the Pandemic: Mastering Governance in the Era of ESG

Gain an overview of the ‘G’ in ESG and its linkages to value creation. The panellists will also focus on how companies can communicate the ‘G’ in ESG to stakeholders and the value of linking executive remuneration to climate-related KPIs.

ESG: Risks and Opportunities for Businesses

ESG: Risks and Opportunities for Businesses

Evaluate the risks and opportunities of climate change for your organisation and the mitigation steps available for long-term sustainability. Areas of emphasis will include risk-based decision-making on climate issues in business, investment, and financing decisions (strategy & practical tips), guidance on conducting risk-based corporate due diligence on climatological risks and understanding the regulatory framework, namely BNM’s Climate Change and Principle-based Taxonomy’s Guiding Principles.

The Evolution of Shareholder Activism

Review aggressive activist techniques and best practices for effective corporate defence, including how boards can pre-empt activist campaigns and strengthen stakeholder relations to protect the company’s reputation.

Board’s Oversight in ESG and Human Capital Governance

Discusses the “S” or social element in ESG pertaining to human capital issues such as inclusion and diversity (I&D), pay equitability and culture, and inclusion of ESG metrics in executive incentive plans.

Bringing Digitalisation to the Boardroom

Looks at how boards can become more digitally conversant and provide informed oversight as companies accelerate technology adoption.

Board’s Role in Managing Cyber Risk

Builds on the earlier topic of boardroom digital transformation and asserts that boards should view each major new digital transformation initiative through the lens of cyber risk oversight, where cybersecurity issues are treated as critical elements of strategy and enterprise risk.

Sustainability & ESG Reporting: Why Is It Important?

As ESG reporting has become a key priority for many businesses due to increased regulatory and public scrutiny, this session will address boardroom-level issues relating to application of frameworks and standards, implementation of data and metrics, the embedding of new ESG-integrated strategic models and understanding the multi-standard reporting landscape.

For more information, please click here