The MIA Sustainability, Digital Economy & Reporting Insights provides quarterly updates on the areas of sustainability, digital economy, tax and reporting. The Insight highlights contents and initiatives that are of high value to members.

MIA Sustainability Agenda

As a regulator and developer of the accounting profession in Malaysia, MIA strives to advocate sustainability for the profession to ensure it stays relevant and continue to add value to organisations. This resonates well with the International Federation of Accountants’ notion to have accountants champion climate reporting and other material disclosures on environmental, social and governance (ESG) matters together with their assurance. In response, MIA sets out its sustainability agenda which is a two-pronged approach that advocates sustainability for the Institute and for the accountancy profession in order to be future relevant, by enhancing the profession’s competency, protecting public interest and supporting sustainable nation building. Visit here to know more on MIA Sustainability Agenda.

Digital Advocacy, Trends and Guidance

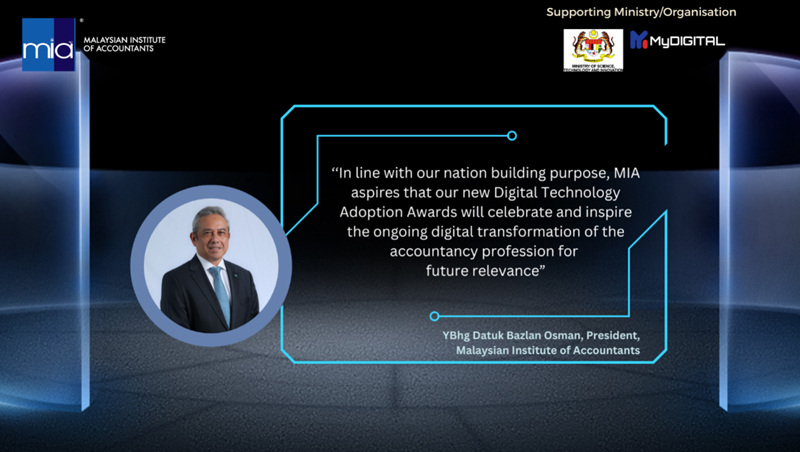

Digital Technology Adoptions Awards

Launched in March 2023, the Digital Technology Adoption Awards (DTAA) is accepting applications until 30 August 2023. The DTAA aims to recognise remarkable achievements of technology application by the accounting profession in commerce and industry, public practice, and public sector. Participating in the DTAA will provide an opportunity to showcase your remarkable digitalisation and gain market exposure. Join the growing list of notable names who are on their way to lead the digitalisation in the accounting profession by participating in the DTAA now.

Watch this video and visit here to learn more about DTAA and how you can participate.

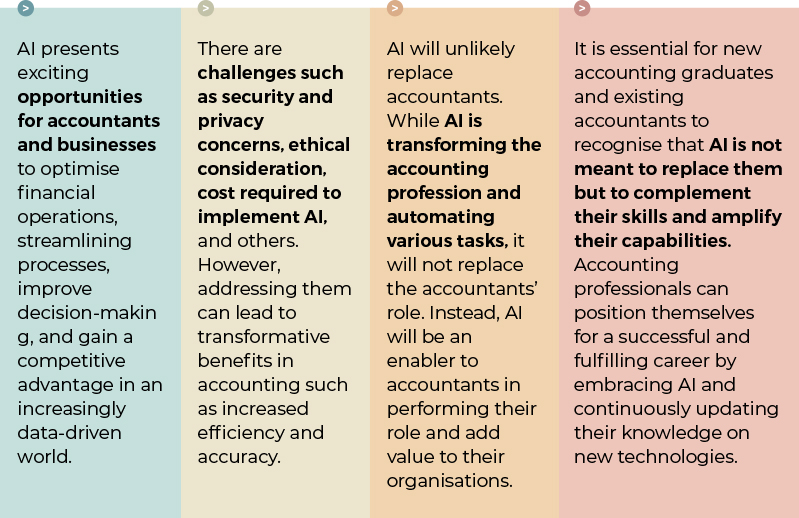

AI in Accounting: Threat or Opportunity

A forum on ‘AI and its impact on the accounting profession’ which provided a comprehensive examination of the challenges and opportunities presented by artificial intelligence (AI) was held on 11 April 2023. Moderated by Rasmimi Ramli, Executive Director, Sustainability, Digital Economy and Reporting, MIA had the pleasure of hosting prominent minds from diverse backgrounds who shared their views during the forum attended by more than 300 accountants and accounting students.

The discussion focused on the potential job displacement of accountants and the need for re-skilling, as well as the benefits that AI can bring to the profession. Among the key highlights of the forum were:

Ethical Leadership in a Digital Era

In the digital era, ethical leadership plays a critical role in guiding organisations and individuals to navigate the complexities and challenges of technology. The first complimentary webinar during the MIA Digital Month 2023 in February explored the importance of ethical leadership in the digital age, addressing its key challenges and opportunities.

Key takeaways from the panel session moderated by the Chair of MIA Digital Technology Implementation Committee (DTIC) Lim Fen Nee and joined by Justin Ong, Executive Director, Deloitte Malaysia Risk Advisory; Ravindran Navaratnam, Former chair and current member of MIA Ethics Standards Board (ESB); and Josephine Phan, member of the MIA DTIC can be found here.

Ethical Guidelines on Technology Usage for Public Practitioners

Adoption of technology is inevitable. The pandemic has been a great teacher in showing us how technology usage has at least ensured that businesses do not stand still. But, for many, there is an ethical dimension which is rarely discussed or even considered.

Dr Veerinderjeet Singh, Chair of MIA Ethics Standard Board

MIA published the Ethical Guidelines on Technology Usage for Public Practitioners on 30 June 2023 to assist practitioners in their preparation to comply with the final revisions to the International Code of Ethics for Professional Accountants issued by the International Ethics Standards Board for Accountants (IESBA). If adopted in the MIA By-Laws, the revisions will guide the ethical mindset and behaviour of professional accountants in both business and public practice as they take advantage of the opportunities created by technology and adapt to new technology. The guidelines, which are principles-based, focus on six potential risks of using technology and the ethical principles that should be applied when dealing with the associated risks. Public practitioners as well as non-practitioners would be able to benefit from this guideline to serve clients ethically in this digital era.

Visit here to read the full guideline.

Data Driven Decisions – Transforming Public Sector Financial Management

MIA recently organised a webinar titled Data Driven Decisions – Transforming Public Sector Financial Management, attended by 77 participants from the public sector.

The session highlighted the importance of data in enhancing public sector financial management, current initiatives implemented in the Government to facilitate data and data analytics, and further discussed how professional accountants in public sector can utilise data in ensuring the effectiveness and efficiency of public sector financial management.

The discussion was moderated by Ting Choo Wai, MIA Public Sector Accounting Committee Member and joined by Muhammad Syarizal Abdul Rahim, Partner, Ernst & Young, Saadiah Yaacob from the Accountant General’s Department and Dzulhusni Anjang Ab. Rahman from MAMPU. The webinar also featured a special presentation on the DTAA by Dr Nurmazilah Dato’ Mahzan, Chair of MIA DTAA Task Force.

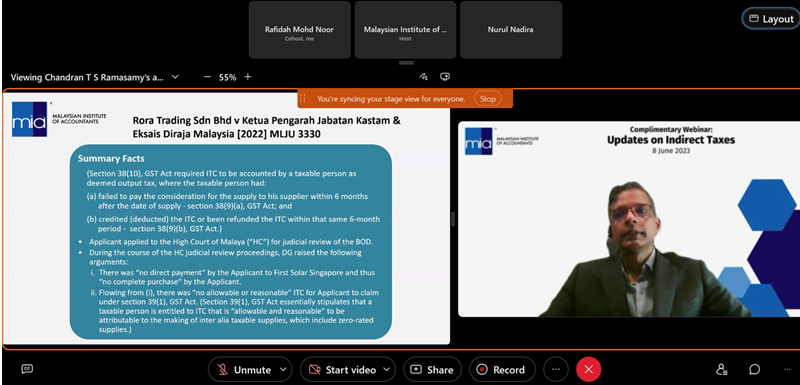

Updates on Indirect Taxes

The subject matter expert on indirect taxes of the Taxation Practice Committee, Mr Chandran T S Ramasamy shared the latest indirect tax updates with 236 members at a webinar held on 8 June 2023. Amongst the updates are Customs forms (as determined by Director General of Customs and announced in public ruling), sales tax exemption on materials for registered-manufacturers i.e. amendments to C1 & C3, penalty/surcharge reduction program vs Voluntary Disclosure Program (VDP) 2.0, excise duty compliance for e-cigarette/vape liquids/gels whether or not containing nicotine, case law updates and change in payee for cheque/bank draft payments to Customs.

Advocacy on taxation and public sector

Engagement on Budget 2023

The Institute, together with CTIM, MICPA and MAICSA had a dialogue session with the IRB on 21 June 2023 to discuss on the Joint Memorandum on Issues Arising from 2023 Budget Speech & Finance Bill 2023 that was submitted to the IRB in April 2023.

During the said dialogue, both parties discussed issues pertaining to the proposed changes to corporate tax, personal tax stamp duty and others. The Institutes also indicated the need to engage with the MOF and the IRB (Tax Authorities) on luxury goods tax, capital gains tax, restructuring of investment incentives towards tiered tax rates based on outcomes, voluntary disclosure programme and implementation of e-invoicing. Members have been informed via Circular No 36/2023 dated 17 July 2023 on the minutes of dialogue and responses from the Tax Authorities.

Engagement on Other Tax Issues

In April and May 2023, MIA engaged with the Tax Authorities to provide constructive design inputs on capital gains tax and e-invoicing. MIA also provided feedback on guidance materials in relation to the voluntary disclosure programme.

Circular No 27/2023 was circulated to members on 21 June 2023 to update members on the guidelines and Frequently Asked Questions on voluntary disclosure programmes administered by IRB and RMCD.

Concessionary Leases and Right-of-Use Assets in Kind

The International Public Sector Accounting Standards Board (IPSASB) issued Exposure Draft 84 (ED 84), Concessionary Leases and Right-Of-Use Assets in Kind in January 2023. It forms part of phase two of the IPSASB’s Leases project. It proposes amendments to IPSAS 43, Leases on accounting for concessionary leases, as well as new guidance on right-of-use assets in-kind and consequential amendments to IPSAS 23, Revenue from Non-Exchange Transactions (Taxes and Transfers). MIA has submitted comments on the ED which can be viewed here.

Elevating Public Sector Financial Management

The Malaysian accountancy profession enjoys excellent representation at global level. Advocating for Malaysia at the global level is Deputy Accountant General of Malaysia, Puan Nor Yati Ahmad, who became a member of the International Public Sector Accounting Standards Board (IPSASB) in January 2023. She was nominated by the Accountant General’s Department of Malaysia under the Ministry of Finance, Malaysia. Her involvement in IPSASB is beneficial in developing our Malaysian Public Sector Accounting Standards (MPSAS) and assists public sector financial statements preparers in Malaysia preparing high quality financial statements. Kindly click here for an exclusive interview with Puan Nor Yati.