MIA Sustainability, Digital Economy & Services Team

As sustainability becomes a cornerstone, companies are under increasing pressure to report their environmental, social, and governance (ESG) impacts transparently and effectively. With evolving regulatory requirements such as the National Sustainability Reporting Framework (NSRF) and growing stakeholder expectations, digital tools and technologies are playing a vital role in enhancing the quality and efficiency of sustainability reporting.

As sustainability becomes a cornerstone, companies are under increasing pressure to report their environmental, social, and governance (ESG) impacts transparently and effectively. With evolving regulatory requirements such as the National Sustainability Reporting Framework (NSRF) and growing stakeholder expectations, digital tools and technologies are playing a vital role in enhancing the quality and efficiency of sustainability reporting.

But how equipped are organisations to handle this shift with the necessary tools and technologies?

Recently, experts gathered during the MIA Digital Month 2025 to explore this crucial topic on ‘Tools and Technologies for Sustainability Reporting in Malaysia’. With seasoned professional Steven Chong, Member of MIA Digital Technology Implementation Committee (DTIC) as moderator and an esteemed panel including Adham Fayumi, Founder and CEO, Rymba; Karina Mohammad Nor, Director, Sustainability & Emerging Assurance, Audit & Assurance, Deloitte Business Advisory Sdn Bhd; and Nusaybah Mohamad Sufian, Senior General Manager, Group Financial Management & ESG Compliance, PETRONAS, the discussion shed light on the importance of leveraging effective resources, the role of accountants, and the role of technology in driving sustainability reporting forward.

Leveraging Innovations for Sustainability Reporting in Malaysia

Sustainability reporting has quickly emerged as a strategic imperative in Malaysia, propelled by rising global ESG expectations and evolving regulatory frameworks such as those from Bursa Malaysia. “It’s not just about compliance anymore,” said Adham Fayumi, highlighting a shift in mindset across the industry.

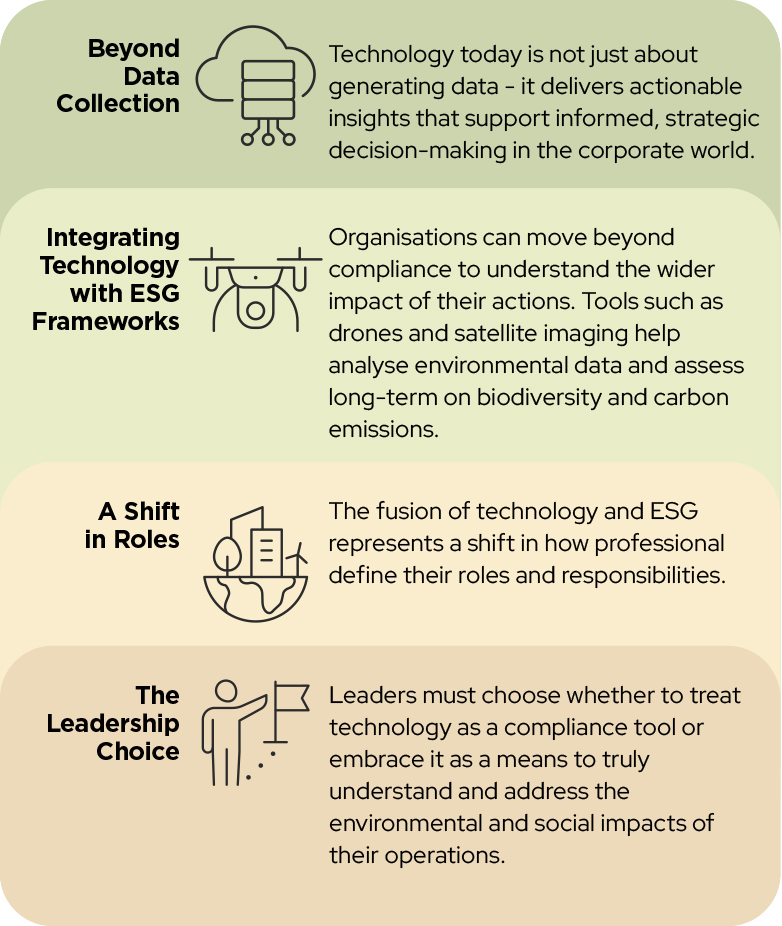

Increasingly, businesses are moving beyond viewing sustainability reporting as a routine obligation and are instead embracing it as a tool for long-term planning value creation, and organisational transparency. This transformation is particularly significant, where organisations must now adopt advanced tools and technologies -such as AI, drones, satellite imaging, and data analytics – to ensure the accuracy, credibility, and relevance of their ESG disclosures. As the demand for robust sustainability practices intensifies, these innovations are becoming essential for accountants to track and manage ESG performance effectively and remain aligned with global standards.

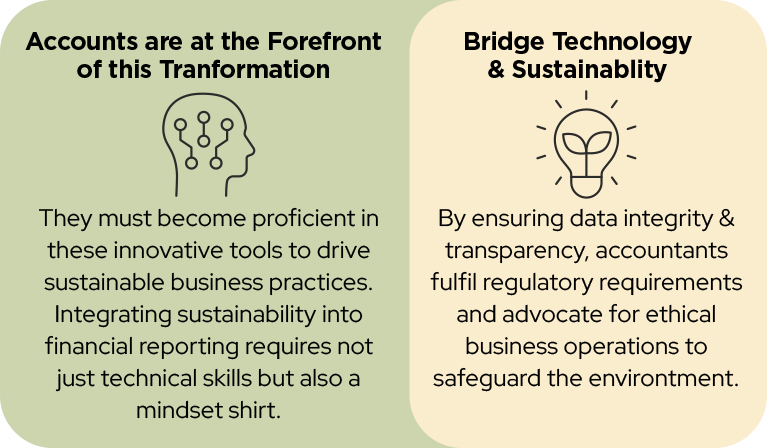

The Role of Accountants in Driving Change

As highlighted by Nusaybah, integrating sustainability into financial reporting requires not just technical skills but also a mindset shift. This shift enhances the value accountants provide to their organisations and contributes to broader societal goals.

“Accountants are trained to measure and disclose, but sustainability demands more – strategic thinking and a shift in mindset. While frameworks like Global Reporting Initiative (GRI) focus on metrics, International Financial Reporting Standards Climate-related Disclosures (IFRS S2) emphasises embedding climate risks and opportunities into decision-making. The journey begins with Enterprise Risk Management (ERM): when sustainability risks are integrated into ERM and the corporate risk profile, reporting gains credibility, and that credibility deepens when insights shape business strategy. Without strategic action, disclosures remain numbers. IFRS S2 links risk, strategy, and metrics, ensuring sustainability data drives decisions. Governance reinforces accountability, not just compliance. Accountants must evolve from measurers to enablers, because true sustainability reporting begins when data informs decisions and drives change,” added Nusaybah.

Technology’s Role in ESG Decision-Making

The panellists also explored how technology is becoming increasingly central to ESG strategies. Below are some of their key perspectives:

Achieving success in the sustainability and technology space requires a firm commitment to leveraging innovation for deeper insight and meaningful action. In doing so, organisations can contribute positively to both society and the planet, ensuring long-term value and ethical integrity.

Finding the Right Mix of Disclosure and Privacy

In response to a question on the main challenges of sustainability reporting and its link to financial performance, Karina noted that companies often face a delicate balancing act between transparency and strategic disclosure.

According to her, companies need to be open enough to build trust with stakeholders—like investors, suppliers, and employees—but they also have to keep certain strategic details under wraps, especially those that might affect their competitive edge. When disclosure is insufficient, stakeholders may doubt the company’s value and its commitment to driving meaningful impact.

“Many studies suggest that companies with robust sustainability reporting tend to experience enhanced financial performance,” said Karina. This is largely because transparency fosters trust. A wide range of stakeholders, including potential business partners, are more likely to trust and engage with companies that are open about their operations. Transparency doesn’t just boost reputation— it boosts efficiency and can attract top talent. The key is to ensure that any qualitative data shared reflects true practices, avoids greenwashing, which can damage trust and credibility, and prioritises the critical elements that must be disclosed in a sustainability report.

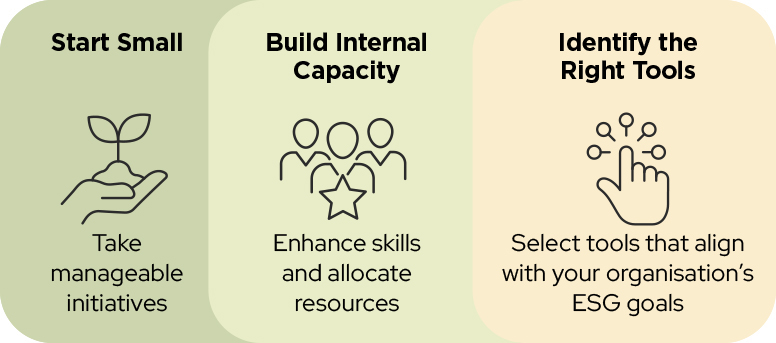

Towards Smarter, Sustainable Reporting

As sustainability reporting evolves, the integration of digital tools is becoming essential—not optional—for companies striving to meet both global expectations and local regulatory standards. Despite the challenges, growing momentum in sustainability reporting, rising stakeholder demand, and advanced technologies signal a promising path forward. As highlighted by the panellists, progress begins with practical steps:

With this approach, businesses in Malaysia can position themselves for long-term impact and credibility in the sustainability landscape.