By MIA Professional Practices and Technical

Audit exemption is not a new concept for Malaysia; it was introduced nearly a decade ago. The initial thresholds allowed for a gradual transition, with subsequent, phased increases providing a multi-year runway for Small and Medium Practices (SMPs) to diversify and reduce their reliance on statutory audit work.

In Part 1, we presented a strategic response framework for Malaysian SMPs. Now, we turn to our regional peers in Singapore and Brunei, who have already navigated this journey. Their experiences, drawn from a recent panel discussion, offer practical insights for Malaysian practitioners transforming from compliance-focused auditors into trusted business advisors.

The panel, moderated by Mr. Simon Tay, MIA Executive Director of Professional Practices & Technical, featured:

- Ms. Lucy Wong, Practitioner, Lucy Wong and Associates (Brunei)

- Ms. Vivienne Chiang, Managing Director, Reanda Adept PAC (Singapore)

- Mr. Lim Yeong Seng, Managing Partner, KLP LLP (Singapore)

- Puan Saniza Said, Audit Partner, Saniza & Co (Malaysia)

- Mr. Wong Wen Tak, CEO of Grant Thornton Malaysia PLT (Johor Office) (Malaysia)

Brunei: A Case Study in Sudden Adaptation

In Brunei, private companies are exempt from an audit if their annual revenue is up to BND 1 million, they have 20 or fewer shareholders, and no corporate shareholders.

The Key Takeaway: Resilience Through Forced Reinvention

The policy was introduced without a phased timeline or having undergone extensive consultation. This sudden shift created significant uncertainty, forcing firms to adapt quickly or face decline.

Strategic Transformation in Action: Lucy Wong’s Story

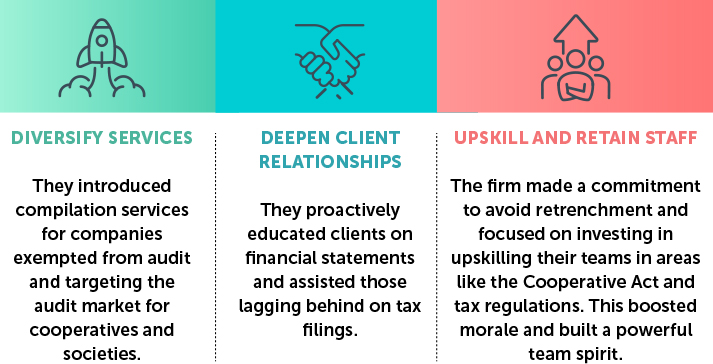

Facing a potential 40% drop in revenue, Lucy Wong and Associates embarked on a client-centric overhaul. Their strategy was threefold:

The result was a stronger, more resilient practice that attracted higher-quality clients, grew its team, and retained almost all clients.

Insights for Malaysia:

Regulatory change can be unpredictable. The ability to pivot quickly is a core survival skill. Bruneian firms that had already begun diversifying were best positioned to weather the storm.

Singapore: A Blueprint for Progressive Transition

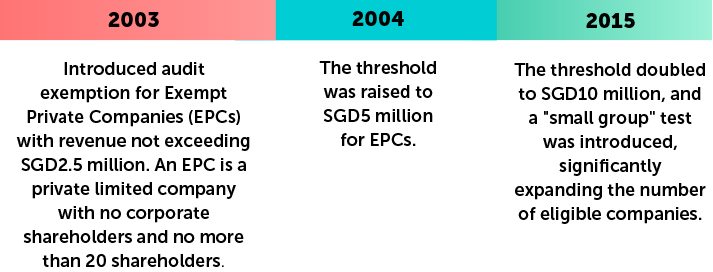

Singapore’s journey with audit exemption provides a more gradual and instructive case study for Malaysia with the following key milestones:

The Phased Impact on SMPs

As Vivienne Chiang highlighted, the impact was phased. The initial introduction was a “disruptive shock,” but subsequent changes were foreseen, allowing firms to build resilience. The most recent increase proved less severe because the peak revenue impact had already occurred.

Strategic Outcomes: Efficiency and Advisory

Mr. Lim Yeong Seng emphasised the strategic benefit: while audit revenue may drop, it allows firms to reallocate resources to higher-margin services.

Vivienne on Strategic Client Management:

“We segment clients into three groups: those who must be audited, those already exempt, and those nearing the threshold. For the latter, we initiate future-planning discussions. A key offering is compilation services, for which firms successfully charge up to 80% of the traditional audit fee. With a lower risk profile, this offers a better return on effort and frees up valuable firm resources.”

Puan Saniza Said concurred, confirming she has implemented a similar client segmentation model in her own practice in Penang. This approach, she noted, has been instrumental in proactively managing her client portfolio, demonstrating the strategy’s applicability in the Malaysian context.

Lim on Business Efficiency:

“The reduction in audit work alleviates recruitment pressure and creates spare capacity. This allows us to pivot to new, non-audit services. Remember, it’s the profit that counts, not the revenue. By applying the 80/20 rule, we achieve better returns for less effort and can expand our service offerings beyond the independence constraints of auditing.”

Insights for Malaysia:

A progressive timeline is a gift. Use it to actively restructure, invest in advisory training, and communicate your evolving value proposition. This transforms a threat into an opportunity for growth and deeper client relationships.

Leadership Perspectives: M&A and Technology

Growth Strategies: Organic vs. Inorganic

The panel revealed two successful growth paths:

- Both Vivienne Chiang and Wong Wen Tak championed an inorganic strategy. Notably, Chiang’s firm executed mergers and acquisitions to rapidly consolidate its position and attract larger clients.

- Lim Yeong Seng, Saniza Said and Lucy Wong advocated for an organic path, focusing on perfecting the firm’s core audit service and profitability rather than pure scale.

Technological Investment: A Universal Imperative

All panellists agreed technology is non-negotiable, but highlighted different benefits:

- Vivienne: “Investing in technology is a strategic necessity to combat the talent shortage, save time, and improve accuracy.”

- Lim: “We use Robotic Process Automation (RPA) and data mining to make audits more efficient and meaningful, freeing staff for value-added analysis.”

- Lucy: “The pandemic accelerated adoption. The key is to balance clear benefits against costs for a strong Return on Investment (ROI).”

- Wong: “Technology allows us to leapfrog, provide data-driven value, and make work more engaging for staff, aiding retention.”

Conclusion: A Regionally Proven Path for Malaysia

The experiences of Singapore and Brunei provide a clear lesson: audit exemption, while disruptive, is a catalyst for positive transformation. SMPs that shifted from a compliance-only model to a proactive, advisory-focused practice emerged stronger.

This path is not just theoretical but proven locally. Mr. Wong Wen Tak, a former Malaysian SMP practitioner, began preparing for this shift in 2017. By diversifying services and focusing on advisory, his firm has since joined the Grant Thornton network and achieved growth beyond initial expectations.

The message is unequivocal: by learning from regional peers and emulating local success stories, Malaysian SMPs can transform this challenge into their greatest opportunity for growth and resilience. The future belongs to those who adapt.