As Malaysia embarks on the National Sustainability Reporting Framework (NSRF), organisations are facing rising expectations to deliver high-quality, decision-useful sustainability disclosures in line with global standards—IFRS S1 and IFRS S2 issued by the International Sustainability Standards Board (ISSB). The standards establish the foundation to report not only on sustainability-related risks and opportunities, but also on how these are integrated into governance, strategy and risk management.

In conjunction with this, the NSRF Symposium organised by the Malaysian Institute of Accountants (MIA) on 28 October 2025 was designed to help accountants understand the objectives of the NSRF and the requirements of IFRS S1 and IFRS S2, while providing guidance on implementation and practical insights on how to prepare for effective adoption of the standards.

At the Symposium, a panel session on “Identifying Sustainability Risks and Opportunities” focused on how to identify these risks and opportunities, with panellists sharing real-world insights on evaluating those that could reasonably be expected to affect entities’ prospects.

Moderated by Rasmimi Ramli, Executive Director of MIA, and featuring panellists Amanah Aboobucker, Chief Sustainability Officer of AmBank Group; Jarod Ho, Head of Sustainability of Pos Malaysia; and Rejina Rahim, Advisor of Institutional Investors Council Malaysia; the discussion focused on embedding sustainability into strategy, reporting, and enterprise-wide risk management, while delving into the following matters:

Investor Focus of IFRS S1

Rejina explained that from an investor’s perspective, “the question is not whether companies are exposed to sustainability issues, but how well they understand, prioritise and manage them”. She further explained how investors interpret the requirements of IFRS S1, how they expect companies to apply its underlying concepts in practice, and what good implementation looks like beyond technical compliance.

IFRS S1 requires entities to disclose sustainability-related risks and opportunities that could reasonably be expected to affect cash flows, access to finance or cost of capital over the short, medium and long term. For investors, this information is fundamental.

“The focus is not on exhaustive lists, but on decision-useful insights. Investors want to understand:

- Which sustainability factors are financially material to the business model;

- How these factors could change the company’s future performance or risk profile; and

- Whether management has credible strategies to manage downside risks and capture upside opportunities,” noted both Jarod and Amanah.

Translating Concepts into Practice: Value Chain, Dependencies and Impacts

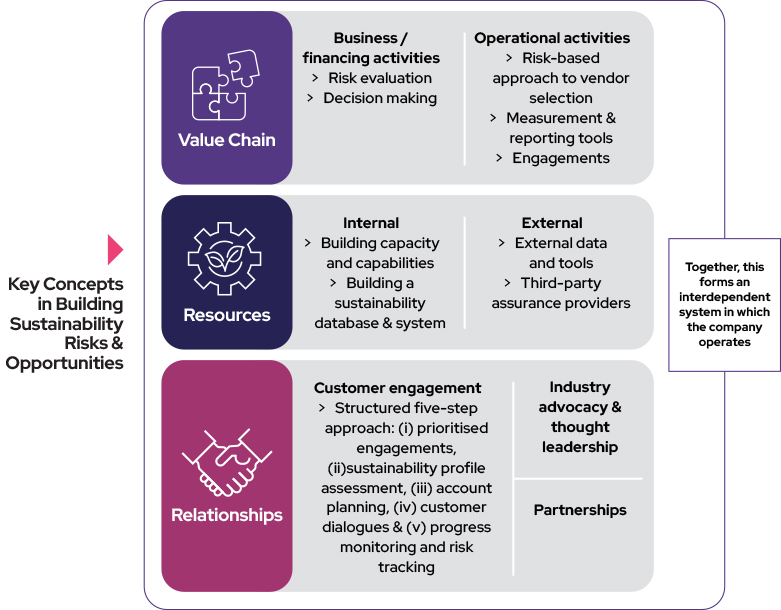

Amanah explained: “IFRS S1 introduces important conceptual building blocks — value chain, resources and relationships, and dependencies and impacts. While these may sound abstract, investors see them as practical lenses for understanding business reality.”

In practice, these concepts help companies move beyond a narrow internal focus:

- Value chain analysis highlights where key risks and opportunities are — whether upstream (suppliers, raw materials), within operations, or downstream (customers, product use).

- Dependencies reveal what the business relies on to operate successfully — such as energy, labour, ecosystems or critical infrastructure.

- Impacts help explain how the company’s activities may, over time, create financial feedback loops through regulation, reputation or market demand.

When applied well, these concepts allow companies to articulate why certain sustainability issues matter financially — not just that they exist.

Industry-based guidance such as the Sustainability Accounting Standards Board (SASB) Standards and Climate Disclosure Standards Board (CDSB) Framework helps organisations to focus on relevant metrics for their sector. IFRS S1 and S2 also emphasise “reasonable and supportable information,” promoting practicality and transparency while allowing smaller entities to begin with readily available tools and get started on their baseline data.

Enterprise-Wide Integration

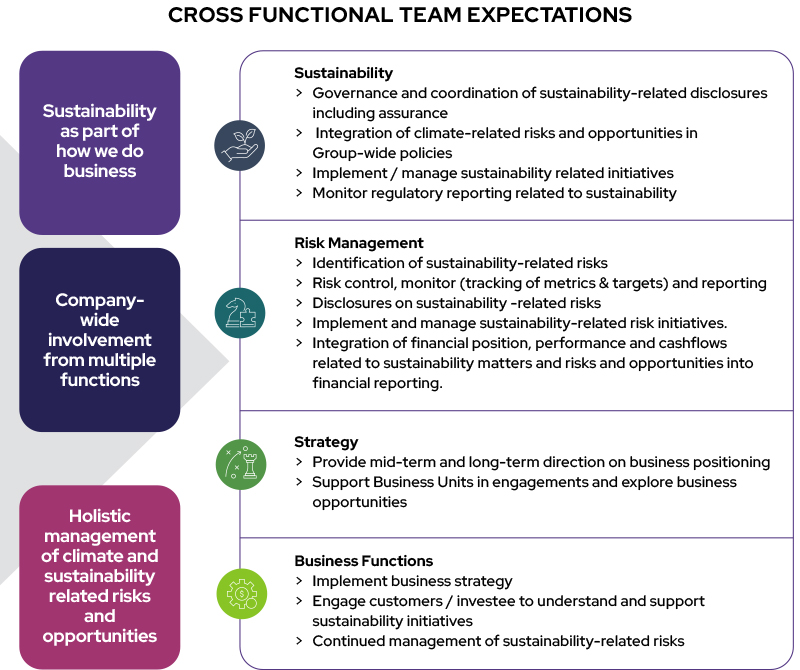

Jarod explained that sustainability reporting cannot be managed in isolation. An enterprise-wide approach—integrating governance, strategy, finance, risk, and operations—is vital.

Organisations often start with challenges in gathering data and qualitative information. Over time, organisations progressively enhance their data collection, measurement, and reporting. Integration across finance, sustainability, and risk teams is essential, with accountants playing a key role in ensuring accuracy, verification, and credible disclosures.

The three panellists agreed that strong board oversight, cross-functional collaboration, and accountability structures support high-quality, decision-useful disclosures that meet both regulatory and stakeholder expectations.

Under IFRS S1, companies are required to refer to the following sources of guidance when identifying sustainability-related risks and opportunities:

- IFRS Sustainability Disclosure Standards, including IFRS S2 (where applicable)

- SASB Standards (industry-based sustainability topics and metrics)

- Climate Disclosure Standards Board (CDSB) Framework (for environmental-related disclosures)

- TCFD recommendations (particularly for governance, strategy, risk management, and metrics)

- Other industry practice and relevant frameworks, to the extent they are consistent with IFRS S1

While IFRS S1 does not prescribe a single method for identifying sustainability-related risks and opportunities, it does require companies to refer to specific sources of guidance as set out above.

Companies are expected to:

- Use the guidance to inform their assessment, not replace judgment;

- Leverage existing risk management, strategy and governance processes; and

- Ensure consistency between sustainability disclosures and other public information.

Reasonable and Supportable Information — Investor’s Expectations

From an investor’s standpoint, the requirement to use all reasonable and supportable information available without undue cost or effort is about credibility and proportionality.

The panel session highlighted that investors do not expect perfection, but they do expect:

- Clear explanation of how risks and opportunities are identified;

- Evidence that management has considered both internal and external information; and

- Transparency around assumptions, limitations and areas of uncertainty.

In practice, this means using information that management already relies on — internal data, industry benchmarks, regulatory developments and credible external research — while avoiding excessive modelling or speculative analysis that adds to informed decision making.

Challenges in Applying the Guidance and How to Overcome Them

The panellist addressed a few questions covering common challenges including data gaps, uncertainty over value chain boundaries, and internal capability constraints. From an investor’s perspective, these challenges are understandable — but silence or boilerplate disclosure is not.

Besides the challenges mentioned above, companies should be transparent about limitations that they have, demonstrate progress over time, and consider sustainability in governance and decision-making.

Incremental improvement, supported by clear governance and accountability, often builds more investor confidence than overly polished but superficial disclosures.

Starting the Journey: Practical Advice for Companies

The panel session concluded with closing remarks reiterating that companies commencing their reporting journey should start with what matters most. The focus should be on understanding the business model and where sustainability realistically affects financial and climate-related outcomes, alongside early engagement with internal stakeholders across finance, risk, operations and strategy. It is about communicating how the organisation creates value — and how sustainability shapes that story over time.

The adoption of IFRS S1 and S2 under the NSRF represents a milestone for sustainability reporting in Malaysia. These standards provide a globally consistent framework for disclosing what truly matters to investors and stakeholders. With expertise in reporting, assurance, and governance, accountants are uniquely positioned to bridge financial and sustainability information, helping Malaysian businesses to not only comply with sustainability reporting requirements but thrive in a sustainable and resilient economy.