By Zulfa Abdul Rahman, Dana Jensen and Adrian Lim

In its “call to action”, published in August 2022, IFAC asked professional accountancy organizations (PAOs) and stakeholders to identify how Islamic financial instruments have been used to advance Sustainable Development Goals (SDGs). Malaysia, an Islamic finance pioneer, is the first case study in this series reporting on government and regulatory efforts to support the SDGs with Islamic finance principles.

Malaysia is uniquely qualified to lead in the effort to support SDGs. Its government, central bank, Securities Commission, and stock exchange (Bursa Malaysia), as well as the large private sector companies, all want the country to be a leader in Islamic finance. Malaysia continues to expand the narrative for the common principles between the foundation of Islamic finance (maqasid al-Sharia’a), which values socially responsible investment, and the global trends of incorporating environmental, social, and governance (ESG) principles in financing SDGs.

Today, Malaysia boasts a comprehensive end-to-end ecosystem for Islamic finance that harnesses a variety of instruments, mechanisms and innovations to drive the goals linked to the SDGs. These include, but are not limited to, sukuk, waqf, charity crowd-funding, zakat, value-based intermediation and fintech.

In this first part of the Malaysia case study, we take a look at sukuk, which is one of the Islamic financial instruments that can go a long way in supporting the SDGs. In particular, sukuk provides the means to deliver more infrastructure investment to emerging economies.

Sukuk is a bond that generates returns to investors without conflicting with Islamic Sharia’a principles, which prohibit payment of interest. The Malaysian government is offering innovative green sukuk initiatives, which channel sukuk for climate-oriented investments, and subsequently help bridge infrastructure and green finance. Green sukuk can contribute to achieving Good Health and Wellbeing (SDG3), Quality Education (SDG4), Clean Water and Infrastructure (SDG6), Affordable and Clean Energy (SDG7), Decent Work and Economic Growth (SDG8), Industry, Innovation and Infrastructure (SDG9), Sustainable Cities and Communities (SDG11), Responsible Consumption and Production (SDG12) and Climate Action (SDG13).

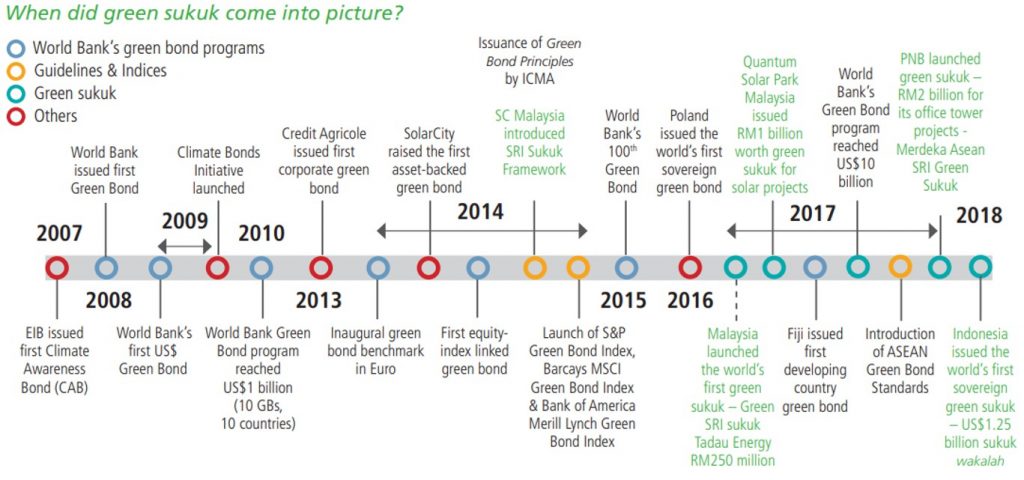

Since 2016, the World Bank Group Knowledge and Research Hub has joined forces with Bank Negara Malaysia and the Securities Commission to support the Malaysia Green Finance Program, which aims to encourage investments in green or sustainable projects through the development of green Islamic finance markets—first in Malaysia, and subsequently in other countries. The Program supported the launch of the world’s first green sukuk in 2017, raising USD 59 million to finance a solar power plant in Malaysia—another sign of the country’s commitment to SDG responsibilities.

The World Bank stipulates that green sukuk can help bridge the gap between the conventional and Islamic financial worlds for two main reasons:

- Sukuk would provide environment-focused investors with confidence that their money is being used for a sustainable purpose.

- A larger number of environment-focused investment products are available on the equity side of the capital markets rather than on the fixed-income side. As sukuk is akin to a conventional fixed-income security, it could help fill the fixed-income supply gap for environmental investors when sukuk are allocated for an environmentally friendly purpose.

The World Bank Group, and the Government of Malaysia extended the operation of the Inclusive Growth and Sustainable Finance Hub in Malaysia for a five-year period from 2021-2025, which reflects the development ambitions of Malaysia to achieve inclusive growth, greater shared prosperity, and a global leadership role in sustainable finance. Malaysia’s public and private institutions partnering with the Hub are expected to contribute to new and innovative financial products that can be used throughout the world.

Developing a Conducive Ecosystem

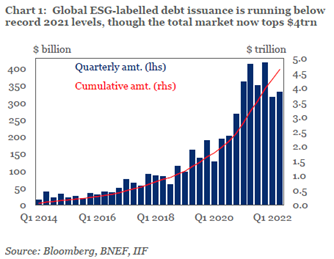

According to the Global Green Bond Market: Size & Forecast with Impact Analysis of COVID-19 (2021-2025) report, demand for green, social, and sustainability bonds is increasing globally due to growing demand for renewable energy, clean drinking water and sanitation, rising concern over CO2 emission, rising awareness about forest conservation, and growth in urban population across the world. According to the Institute of International Finance’s (IIF) Sustainable Debt Monitor, as of July 2022, the total sustainable debt universe surpassed the $4 trillion mark, with the green bond market accounting for more than a third of that, at $1.5 trillion. In parallel, Islamic green financing is on an upward trend as many investors shift to allocating capital toward more sustainable business models. In 2021, the Islamic Financial Services Board (IFSB) reported that USD 162.1 billion of sukuk were issued in 2019 compared to USD 124.8 billion in 2018, representing a market growth of 30% and consistent with growth over the past five years, with Malaysia being among the top three issuers.

To augment the growth, it will be key to focus on building the ecosystem and fueling growth, which Malaysia has been doing since 2014. In 2014, the Securities Commission of Malaysia implemented the Sustainable and Responsible Investment (SRI) sukuk framework to support the green sukuk market development—relating to projects encompassing natural resources, renewable energy and energy efficiency, economic development, waqf properties and assets. Malaysia’s case in facilitating green sukuk issuance through the development of the relevant framework and ecosystem can become a model in bridging Islamic finance with SRI.

It is hoped that more countries will follow suit, and that innovative green financing based on Islamic Finance principles can become the norm, thereby advancing a step closer to attaining sustainable and inclusive growth.

The next installments in the Malaysia case study series will cover:

- Part 2: Value Based Intermediation

- Part 3: Fintech and Digital Banking

- Part 4: MyPac, Sadaqah House and Waqf

Announcement: The Malaysian Institute of Accountants (MIA), together with IFAC, are planning a virtual Global Roundtable event in 2023 with representative stakeholders from various regions to discuss how Islamic Finance tools and concepts can be utilized to achieve SDGs. Stay tuned!

Zulfa Abdul Rahman is Team Lead of the Islamic Finance Unit in the Professional Practices and Technical Division of MIA. Dana Jensen is Regional Manager of the International Federation of Accountants (IFAC) and Adrian Lim is a Senior Manager with IFAC.

This article originally appeared on the IFAC Knowledge Gateway. Copyright ©2022 by the International Federation of Accountants (IFAC). All rights reserved. Used with permission of IFAC. Contact [email protected] for permission to reproduce, store, or transmit this document.