As the global voice of the accountancy profession, the International Federation of Accountants (IFAC) has 180 members representing more than three million professional accountants in over 135 countries. IFAC’s role essentially is to speak out as the global voice of the profession, to lead and develop a large and ready profession, and to support the development, adoption and implementation of high-quality international standards.

As an IFAC member since the global body was founded in 1977, the Malaysian Institute of Accountants (MIA) has been a strategic collaborator with IFAC for decades. IFAC and MIA partner together to drive the profession’s advocacy on developments relevant to the profession, including future-proofing of accountants, the sustainability agenda and the growth of the global Islamic finance sector.

Continuing a long tradition of thought leadership and shared discourse by the IFAC at the flagship MIA International Accountants Conference (MIAC), IFAC President Alan Johnson spoke at MIAC 2022 on the profession’s role in driving ESG for sustainability.

The following are some key excerpts from his speech at MIAC Plenary 7 – Professional Accountants – Driving ESG for Sustainability which emphasised IFAC’s global perspective on why, “there are very good reasons to believe that professional accountants will save the world.”

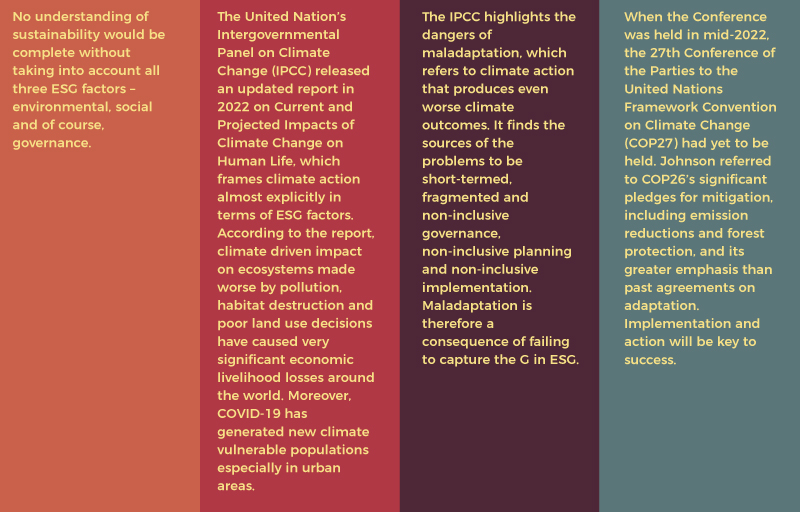

ESG is the Crux of the Climate Crisis

Leading from Commitment to Implementation

If adaptations of mitigation are to succeed, then the accountancy profession needs to lead the world from commitments to implementation. Specific plans need to be made to cover every step of the process, from the first tree to be saved to the last tree to be planted. These plans need to have clear measures and targets that should be reported on regularly and transparently with independent verification. This must happen throughout society – in government as well as in private organisations, especially where public sector capacity is relatively low or where comparative public-private advantages can be leveraged for the common goal of sustainability.

Why Professional Accountants will Save the World

Alan Johnson

- Professional accountants are the centre of information flows and decision making, and so are uniquely positioned to capture, analyse, report on, and assure sustainability information.

- Professional accountants have skills and competencies that are critical for connecting financial and sustainability information, including a grasp of business models, risk management, understanding of systems and processes, and performance management and measurement, along with the growing specific knowledge of ESG factors and the ability to collaborate with experts.

- Professional accountants have global reach like no other profession.

- Professional accountants are able to meet the needs of global capital markets, of global clients and of global supply chains for high quality sustainability assurance, which enhances credibility and trust in disclosures. Our assurance services are based on the International Auditing and Assurance Standards Board’s (IAASB) ISAE 3000, which has recently been revised, and applied by professional accountants in compliance with high quality management standards and an ethical framework.

- Professional accountants have our public interest mandate. As a regulated profession, we are subject to an ethical code and public oversight. We are charged with acting in the public interest with professional judgement, scepticism, and most important of all, independence.

According to Johnson, “There will be more that we need to learn, new competencies to acquire and new roles to fill as ESG factors increasingly guide the decisions of our organisations and of our clients.” He advised professional accountants to be ready to seize the opportunities that come with climate action and broader sustainability efforts, especially through advisor roles and in assuring sustainability information.

How Professional Accountants Can Save the World

IFAC has laid out four calls to action for the accountancy profession to help drive sustainability.

- We should work to enhance corporate reporting through the regulatory framework, to promote vigour and define the scope of reporting. This approach will discourage compliance-based behaviours.

- We can foster trust and confidence in the sustainability of information that companies and government report by supporting regulatory requirements for high quality assurance, conducted in accordance with the standards set by the IAASB and performed by professional accountants.

- We should advocate for sustainability disclosure requirements, with a proportional approach that is right-sized for the smaller enterprises.

- In our engagement with our stakeholders, we should position professional accountants as best placed to meet sustainability-related needs of reporting entities including assurance services.

- We should integrate new ESG subject matter with foundational skills and competencies with our professional judgements and the integrity of professional accountants.

- We should support and provide education and technical guidance that promotes high quality reporting assurance of sustainability information. This is a path to promoting the role of professional accountants as valued partners and advisors.

- We must, as always, comply with financial statement reporting requirements without material emissions or misstatements, to reflect climate matters of materiality to the performance of organisations, and how they create value both in the short, and most importantly, in the longer term.

- Our goal within organisations must be to align and integrate climate-related reporting and financial disclosures with a reporting entity’s climate commitments and targets and strategic decisions to be made.

- We should apply our existing skills to quantify climate related risks and build robust data capture and reporting systems for sustainability information.

- Those charged with governance should provide effective oversight of all reporting, including sustainability-related disclosures.

- We need to work hard to eliminate information silos within organisation. This will better integrate sustainability disclosures with the work of CFOs and their finance teams and facilitate holistic decision making and communications with stakeholders.

- In every organisation, we need to consider ESG factors carefully and when appropriate, integrate them into strategic decision making, the development of business models and our assessment of risks right across the organisation.

“The bottom line is that the future prosperity in Malaysia and around the world depends on how effectively the world’s public and private organisations can adopt and integrate ESG factors into their planning, into their strategies, their processes, their operations, their decisions and, of course, ultimately their disclosures.”

“Our profession must innovate, advise and lead wherever and whenever we can. Our job is to ensure that our professionals can create a better world for all people. Our role relates to the resilience of society as whole, through sustainable value-creation, trust and fairness in institutions,” Johnson emphasised.

“There’s an incredibly important need for our profession to play a critical role in identifying and then addressing the risks to society, from not just addressing the issues we are facing today, but also considering the issues that we may face tomorrow.”

“This is why we are professional accountants. This is why we are proud about what we do, and this is our public-interest mandate. There is an incredible opportunity for us to help address the tough choices facing every organisation and indeed every government,” concluded Johnson.

FAQs

Johnson’s session incorporated a lively Q&A session following his remarks.

Asked how to balance the three elements of ESG, he replied that all three are equally important and they cannot be divided. He stressed the importance of governance. “If we don’t get the governance right, we won’t address the environmental changes that we need to make, and we won’t address the social injustices that we face in society today.”

“It’s not one, two and three, E is first, S is second. Maybe that’s the order in which the ESG is written, but I can assure you that G is as important as the other two. And if we don’t get that right, we will not be able to address the other two.

He was also asked how to shift the focus from profitability to other ESG areas, which is a key concern for the accountancy fraternity.

“Profitability is important because we cannot operate unviable and non-profitable businesses, because you won’t get the capital you need to invest and to grow. However, the purpose alone is not profitability.”

He noted that an entity would only be viable and profitable if it addresses its public interest duties and ensures that the company or organisation is serving the needs of the whole society, not just one aspect of stakeholders, encompassing shareholders, employees, customers, suppliers, business partners, governments, society, local communities.

Stakeholders give organisations the right to operate and the freedom to operate. By addressing their needs, in time, there will be no issue with profitability, said Johnson, who advised accountants not to think only about the short-term but to also take into consideration their longer term impacts.

Replying to concerns that accountants are overwhelmed by ESG roles and that Boards need to assign ESG responsibilities to everybody, Johnson replied that he focused on the roles of accountants because “in most organisations, accountants are at the centre of everything organisations do, we have a critical role as finance professionals in any organisation to connect the dots and make sense, and then communicate both internally and externally.”

He fully agreed that everybody is involved in ESG. “The Board has to take complete responsibility individually as Board Members and collectively as the Board to support everyone in the organisation, particularly the professional accountants to make sure that this is delivered appropriately.” The organisation must also practise an integrated thinking mindset to make sure that decisions are made for the long term in addition to addressing short-term needs, in order to deliver on its 2050 climate commitments.

Responding to concerns that ESG reports might just be an avenue for greenwashing,Johnson noted that integrating ESG reporting into the reporting framework will be the way to go. Currently, financial statements capture maybe an estimated 10% of the value of any organisation, and the other 90% lies outside the financial statements and is not captured in the balance sheet. Therefore, the integration of non-financial reporting, or what is termed ESG reporting, is going to become increasingly important.

Integration of ESG information will be relevant to users of reports to understand what, why and how the organisation is acting and its impacts. “Please don’t think of them as two separate reporting streams. They’ve got to come together and ESG reporting will become the most relevant change that we can make to help make the world a better place.”

Asked whether sustainability reporting should be voluntary or mandatory, he suggested that both should be supported, although he prefers voluntary reporting. To get the momentum going, this could entail starting with the mandatory frameworks that organisations should report against to avoid the challenge of applying different reporting frameworks. He added that standards should be developed, and referred to the new International Sustainability Standards Board (ISSB) established under the IFRS Foundation to establish coherent, consistent and international standards for sustainability reporting. “I hope that we can just rely on voluntary reporting, but I suspect we may have to use a little bit of mandatory pressure to get the adoption of ESG reporting… into mainstream reporting, and not as a separate strand of reporting.”

This article captures the insights of Alan Johnson, Immediate Past President, International Federation of Accountants (IFAC) at the MIA International Accountants Conference (MIAC) 2022. Join us at the MIA International Accountants Conference 2023 to be held on 13-14 June, specially designed to equip you for the “Future Fit Profession – Charting a Better Tomorrow”.