By Leonard Woo & Daniel Tan

With the proliferation of sustainable and responsible investing (SRI) in recent years, Environmental, Social and Governance (ESG) considerations and factors have become one of the central tenets of investment and capital allocation, corporate finance and the stewardship and management of corporations.

There is a trending influx of funds and capital to support sustainable practices globally. According to the 2020 Global Sustainable Investment Review (GSIR), sustainable investing assets reached USD35.3 trillion in five major markets – Europe, US, Japan, Canada and New Zealand, a 15% increase from 2018 to 2020¹.

Individual companies which incorporate ESG into their business models are rewarded – a multinational power generation company which repositioned its portfolio from coal to renewable resources, appeared to be able to attract talent and increase workforce productivity². By investing in less carbon intensive operations, it commanded a valuation premium, with its price-to-earnings multiple increasing from 9 times in January 2018 to 14 times by March 2019, outpacing industry indexes.

The opposite is also true – a lack of ESG consideration could potentially jeopardise the long-term sustainability of companies. An example of this is a Japanese conglomerate whose competitive position has eroded materially over the past decade, with its price-to-book lagging the Tokyo Stock Price Index Universe resulting from its weak corporate governance practices³. In addition to being negatively affected by the Asian financial crisis in 1997 and exacerbated by negative cyclical earning factors, it faced a major defect cover-up scandal in Japan in 2016, resulting in a necessity for recapitalisation by its parent company. Since then, it has taken steps to remain competitive by changing its production footprint and model range. This underscores the importance of ESG considerations in decision making.

ESG as drivers of business value

In view of its increased importance, it is imperative to explore the fundamental question – how does ESG drive and create business performance and value?

Briefly, the individual components of ESG are defined as follows⁴,⁵:

ESG can therefore be viewed as a set of intertwined, qualitative, and non-financial factors which are used by the markets to understand the impact and sustainability of a company’s actions.

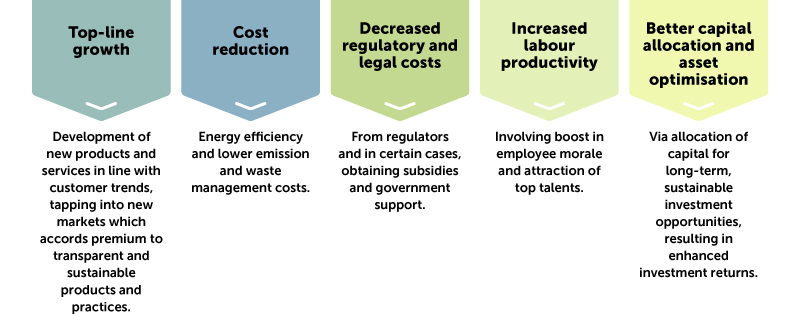

Based on various publicly available sources, there are five (5) principal ways in which good ESG practices, in aggregate, affect economic performance and valuation:

Incorporating ESG Framework into Business Valuation

Despite the growing essentiality of ESG, the progress of reaching a globally accepted set of standards to incorporate ESG considerations into the valuation of a business is still in its infancy stage. There are varying opinions and publications surrounding this topic. Notably, the International Valuation Standards Council (IVSC) released a Perspective Paper “ESG and Business Valuation”⁶, as part of its effort to initiate and foster debate, as well as address challenges pertaining to the incorporation of ESG factors into valuation analysis.

According to the IVSC, there is a common misconception that ESG disclosures are typically non-financial by nature and hence, do not have a financial impact. It added that this ignores the fact that ESG represents a myriad of factors which evaluates the long-term financial viability and sustainability of an enterprise. When assessing such factors, analysis will therefore need to shift away from the traditional detailed “price x quantity” into an examination of how it allows enterprises to create value in the medium to long-term.

In recognising ESG factors into valuation, the IVSC laid out that it should be a matter of embedding them into the current valuation methods and procedures. We explore the considerations put forth by the IVSC while offering our views of key benefits and challenges on each of them.

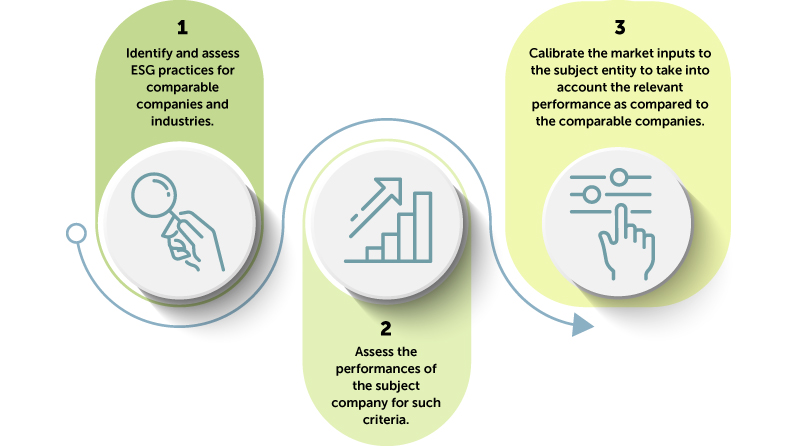

The Market Approach – To account for ESG considerations, valuation under the market approach should:

A main drawback of this approach would be that ESG data, disclosures and rating systems are still in their infancy stages, and subject entities are typically private companies. Scoring would therefore be judgemental, with different practitioners potentially assigning different weightings/scorings to different ESG factors and practices by companies.

The income approach – To account for ESG considerations, valuation under the income approach should consider its impact on the discount rate or cash flows itself. These are explored further below.

The IVSC highlighted that care should be exercised not to double count certain ESG factors which have already been implicitly incorporated into the valuation. For example, criteria cited as rationale for incorporation of size premium in discount rate derivation overlaps with what many would consider ESG factors (namely, smaller, private companies are typically associated with relatively weaker governance, concentrated shareholding, non-existence of independent oversight from board of directors etc. which can be viewed as ESG factors).

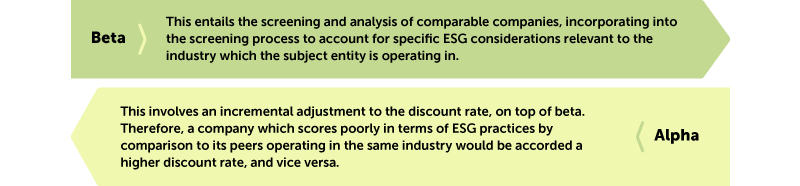

1) Incorporation into the discount rate:

A main challenge would be the determination of the magnitude of adjustment to be applied, in view of the limited research and data points available in this context. When determining alpha in this context, attention must also be given not to double-count the risk of poor ESG practices which has already been incorporated by the market.

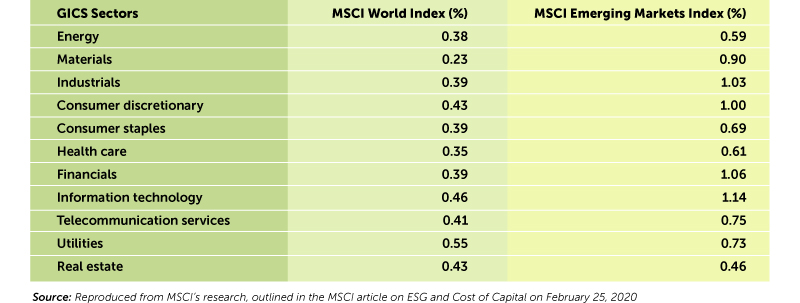

Despite the inherent subjectivity present, there is encouraging evidence that high-ESG-rated companies have lower cost of capital. A research done by Morgan Stanley Capital International Inc. (MSCI), cataloguing companies in their indices by their ESG scores showed that the average cost of capital of companies from 2015 – 2019 in the highest-ESG-scored quintile is lower than the lowest-ESG-scored quintile. Similarly, they found that the average cost-of-debt of high-ESG-rated companies is lower than those of low-ESG-rated companies through decreased default risk due to good corporate governance practices. This is prevalent across all sectors in both developed and emerging markets, and not just those which are traditionally viewed as more exposed to environmental risks (energy and utilities) or governance risks (financials).

The difference in cost of capital between high and low scoring ESG companies by Global Industry Classification Standard (GICS) sector is outlined below:

2) Direct adjustment to cash flows:

Cash flow projections – this involves an explicit consideration of value created by specific ESG practices of an entity in the cash flows of a company, including the entity’s long-term growth rate.

This encourages practitioners to attempt to quantify ESG factors into future cash flows. This offers a clearer starting point for discussion as assumptions made are clearer and less arbitrary than those made to the discount rate. Given the strong correlation of ESG criteria to long-term survivorship likelihoods, the IVSC in their discussion paper acknowledged that a blanket reliance on standard long-term growth rates is likely to be insufficient. As valuation is sensitive to long-term growth rate assumptions, an attempt must be made to consider ESG when deciding the growth rates.

Notwithstanding, there are contrary views on the impact of ESG on cash flows. Bardford and Damodaran, in their article⁷ concluded that while there is weak empirical evidence of good ESG practices enhancing a company’s cashflows, there is more substantial support for the premise that having poor ESG practices can make funding more expensive (higher cost of equity and debt). They also stated that actions taken to improve ESG can potentially result in lower value for some firms through higher costs.

Another challenge concerns the multitude of ESG factors which needs to be considered, and certain high-impact and low-probability events may be difficult to incorporate into cash flow projections. Robust sensitivity analyses should hence be conducted, considering sensitivities of each ESG factor to the value of the companies, under different scenarios.

Conclusion

ESG is likely to have increasing significance in the years to come. Continuous efforts are required to achieve consensus on a standardised approach to incorporate ESG into valuation. Effort is already underway – regulations are rapidly evolving towards a more homogenous ESG measurement and reporting framework which would aid practitioners to better capture and quantify ESG considerations into the valuation process. The benefits are multifaceted: alignment of financial incentives through higher business valuation would result in capital allocation towards companies pioneering sustainability initiatives. Correspondingly, it would also induce companies to behave in a socially responsible manner as it is in their best financial interest to do so. Given the implications of ESG factors on the long-term sustainability and financial viability of a company, there should be a paradigm shift among practitioners to take into account the long-term benefits of having businesses operate in a sustainable manner, while simultaneously balancing the need to achieve short-term financial goals. Valuation has a pivotal role to play in quantifying and realising the benefits of sustainable practices.

¹ GSIR-20201.pdf (gsi-alliance.org)

² The Business Case for ESG (harvard.edu)

³ Guidance-case-studies-esg-integration.pdf (cfainstitute.org)

⁴ https://www2.deloitte.com/hu/en/pages/energy-and-resources/articles/esg-explained-1-what-is-esg.html

⁵ Introduction to ESG (harvard.edu)

⁶ Perspectivespaper-ESGinBusinessValuation.pdf (ivsc.org)

⁷ https://www.researchgate.net/publication/346519376_Valuing_ESG_Doing_Good_or_Sounding_Good

Leonard Woo is a member of the Valuation Committee of Malaysian Institute of Accountants. He is a partner with Financial Advisory, Deloitte Southeast Asia.

Daniel Tan is a manager with Financial Advisory, Deloitte Southeast Asia.